Incheon Int'l Airport raises $300 mn in first global bond sale

By Apr 27, 2021 (Gmt+09:00)

South Korea’s Rznomics inks $1.3 bn out-licensing deal with Eli Lilly

Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Kumho Tire shuts Gwangju plant after fire, derailing record sales run

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

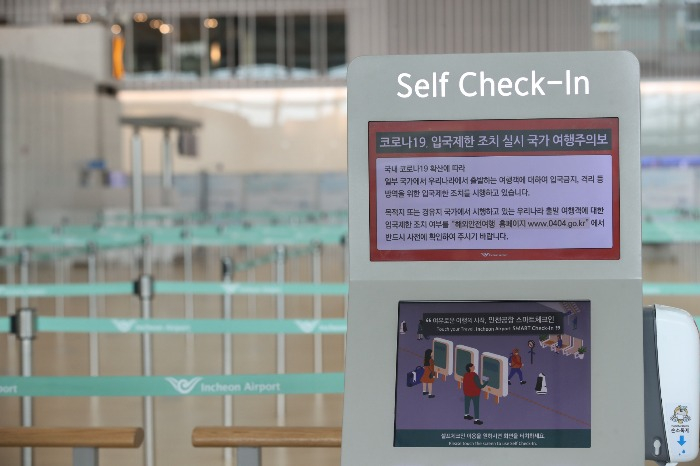

South Korea's government-owned Incheon International Airport Corp. has raised $300 million in its first global bond sale to ease financial difficulties caused by travel restrictions in the prolonged pandemic situation.

Initially, Incheon International had offered a higher spread, or 0.85 percentage points above the benchmark yield, but it was able to cut the yield thanks to robust demand.

The new issuance also marked the institution's first certified green bond, or a bond that meets certain environmental, social and governance (ESG) criteria. Incheon International is rated Aa2 and AA by Moody's and S&P, respectively, on a par with the South Korean government's credit rating.

Bank of America Merill Lynch, Citigroup Global Markets and JPMorgan underwrote the bond sale.

With an asset of around 12 trillion won, Incheon International's revenue is derived from airport service charges and rent from duty-free stores. With the number of daily flights tumbling by 96% year-on-year in 2020, it swung to a loss of 426.8 billion won from a 1.2 trillion won operating profit in 2019. This year, its shortfall is expected to double amid the slow pace of vaccination in the country.

Excluding basic operating expenses, Incheon International needed to raise around 4 trillion won ($3.6 billion) on its own to pay for the ongoing construction to expand its second passenger terminal and to build a fourth runway.

In 2019, the airport operator did not tap the bond market. But since April 2020, it has raised a total of 2.1 trillion won in 19 rounds of bond issues. At the end of last year, its debt-to-equity ratio came to 46.5%.

Write to Hyun-Il Lee at hiuneal@hankyung.com

Yeonhee Kim edited this article.

-

-

-

EnergySK Earthon secures rights to explore 2 offshore oil blocks in Indonesia

EnergySK Earthon secures rights to explore 2 offshore oil blocks in IndonesiaMay 22, 2025 (Gmt+09:00)

-

-

Asset managementMirae Asset Global Investments’ AUM tops $288 bn as global push pays off

Asset managementMirae Asset Global Investments’ AUM tops $288 bn as global push pays offMay 21, 2025 (Gmt+09:00)