Banking & Finance

NPS gobbles up Korea’s top 4 financial holding stocks

Shares are expected to continue rising on bold hareholder-friendly policies

By 7 HOURS AGO

3

Min read

Most Read

South Korea’s Rznomics inks $1.3 bn out-licensing deal with Eli Lilly

Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Kumho Tire shuts Gwangju plant after fire, derailing record sales run

South Korea’s largest institutional investor, the National Pension Service (NPS), remains a strong backer of the country’s top four financial holding firms, encouraged by their strong earnings and shareholder value enhancement programs, such as dividend hikes and stock buybacks.

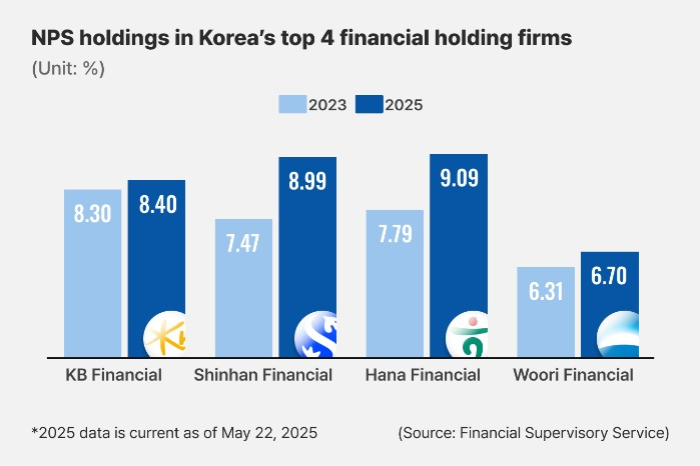

According to the Financial Supervisory Service on Thursday, NPS recently acquired more than 1.05 million shares in Shinhan Financial Group Co., Korea’s leading financial service provider, elevating its holdings to 8.99% from 8.64%.

Its stakes has been on a steady rise from 7.47% in 2023.

Its holdings in runner-up KB Financial Group Inc. have also risen to 8.4% after recently purchasing an additional 144,875 shares.

The state-run pension fund has also raised its stakes in Hana Financial Group and Woori Financial Group Inc. from 7.79% to 9.09% and from 6.31% to 6.70%, respectively, since 2023.

NPS is now the largest shareholder of KB, Shinhan and Hana and the second largest shareholder in Woori.

The top four financial holding firms’ introduction of more generous shareholder-friendly measures is largely owed for the unwavering share purchases by NPS.

Under the guidelines of the Korean government’s corporate value-up program introduced early last year to bolster the distressed valuation of the country’s stock market, the financial service providers have actively adopted a series of shareholder return enhancement policies, such as an increase in dividend payments and an aggressive share buyback and retirement program.

Their stocks also gained further momentum from their strong earnings since last year, with their combined net profit in the January-March period this year hitting 4.93 trillion won ($3.6 billion).

SHARES ON A ROLL

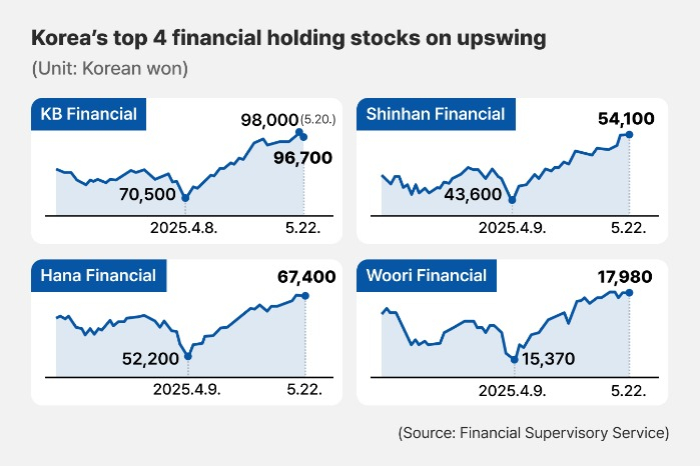

Buoyed by the country’s largest institutional investor’s firm interest in them, the four stocks have steadily climbed since early last year.

Woori Financial jumped 16.9% year-to-date, hitting a record high of 18,060 won on May 15.

Hana Financial has recouped some of its recent losses, flirting with the historic high of 68,800 won, recorded on August 26, 2024.

KB Financial and Shinhan Financial shares also added 16.6% and 13.5% year-to-date.

They all have recovered from the brief fall triggered by the US government’s reciprocal tariff concerns earlier this year.

Following a string of rallies, market analysts keep an eye on whether the country’s financial stocks could improve their valuation, which hovers under 1.

The price-to-book ratio of heavyweight KB Financial, which boasts the fifth-largest market capitalization on the main Kospi market, is at 0.62, while Shinhan, Hana and Woori stay at 0.48, 0.44 and 0.39, respectively.

Investors use PBR to compare a firm’s market value to its book value. A stock with a PBR under 1.0 is considered undervalued, meaning room for a rise.

Market analysts pin high hopes on their shareholder value-up programs for an upgrade in their stock value.

Noting a steady increase in banks’ earnings in recent years despite hefty expenses, Kim Eun-gap, an analyst at Kiwoom Securities Co., expected the financial holding firms’ efforts to improve shareholder return would play a pivotal role in lifting their stock valuation after years of depression.

Write to Jin-Seong Kim at jskim1028@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Shareholder valueKorean financial firms launch global IR blitz to woo foreign capital

Shareholder valueKorean financial firms launch global IR blitz to woo foreign capitalMay 21, 2025 (Gmt+09:00)

3 Min read -

EarningsS.Korea’s top 4 financial holding firms cheer upbeat Q1 results

EarningsS.Korea’s top 4 financial holding firms cheer upbeat Q1 resultsApr 25, 2025 (Gmt+09:00)

3 Min read -

Shareholder valueS.Korea’s top financial regulator pushes tax support for value-up program

Shareholder valueS.Korea’s top financial regulator pushes tax support for value-up programFeb 21, 2025 (Gmt+09:00)

4 Min read -

Korean stock marketKorea announces measures to upvalue local shares

Korean stock marketKorea announces measures to upvalue local sharesFeb 26, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN