Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

Boom in dermatology and cosmetic procedures fuels rise in revenues, exports and company valuations

By 10 HOURS AGO

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Samsung steps up AR race with advanced microdisplay for smart glasses

Mubadala, Goldman Sachs to invest $700 mn in Kakao Mobility

Seoul-backed K-beauty brands set to make global mark

As beauty-conscious tourists continue to flock to Seoul’s clinics, South Korea’s aesthetic medicine sector may be entering a golden era, where culture, commerce and cosmetic innovation align.

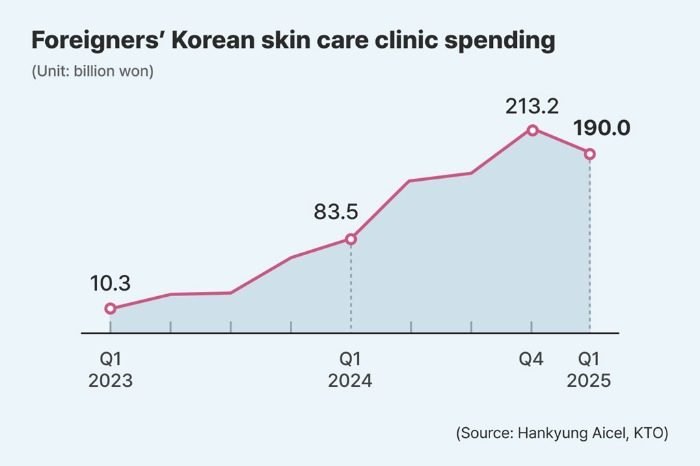

Korea’s aesthetic medical industry is riding an unprecedented wave of demand, powered by a surge in foreign patient spending that hit an all-time high in April, industry data showed on Monday.

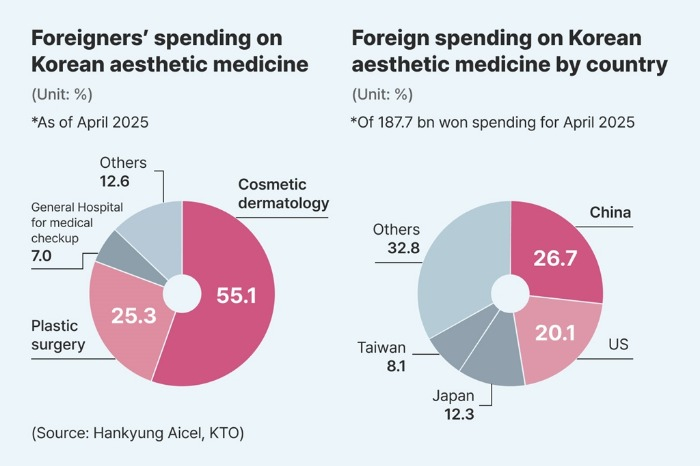

According to data from the Korea Tourism Organization's Tourism Data Lab, foreign visitors spent a record 187.7 billion won ($134 million) on domestic medical services in April, an 83% increase from a year earlier and a 22% rise from the previous month.

April marks the second consecutive month to set a new foreign medical spending record.

Dermatology treatments dominated the boom, with foreign patients spending 108.3 billion won on services such as laser therapy and skin rejuvenation – surpassing 100 billion won in a single month for the first time.

Cosmetic surgery followed with 47.5 billion won, up 46% from the previous year. The average spending per foreign patient reached 1.25 million won for dermatology and 2.14 million won for cosmetic surgery – record figures for both.

CORPORATE WINDFALL FROM BEAUTY TOURISM

The surge in medical tourism, bolstered by the global popularity of K-beauty and K-culture, is reverberating across related sectors, driving growth in the domestic aesthetic device and pharmaceutical industries.

Data showed sales of medical devices and consumables to clinics have surged in tandem.

According to the Korean alternative data platform KED Aicel, credit card payments for aesthetic devices on five medical-exclusive e-commerce platforms doubled to 28.6 billion won in April from the year-earlier period.

Classys Inc., a manufacturer of energy-based aesthetic devices (EBDs), posted 11.3 billion won in estimated transactions last month, up 126% from a year ago.

Korea AbbVie Co.’s Botulinum toxin, or Botox, sales rose 81% on-year to 7 billion won. Jeisys Medical Inc., known for high-frequency facelifting devices, saw transactions climb 194% to 5.5 billion won, while filler and Botox maker Jetema Co.’s sales grew 50% to 1.9 billion won.

Wontech Co., a radiofrequency skincare device maker, posted 2.9 billion won in sales last month, up 26% from a year earlier.

KED Aicel is the alternative data service brand of Hankyung Aicel, renamed from Aicel Technologies Inc. after The Korea Economic Daily acquired the data firm from US-based policy and global intelligence provider FiscalNote Holdings Inc. for $8.5 million last October.

“There has been a sharp uptick in clinic-only platform sales across aesthetic device and Botox providers, driven by a simultaneous rise in demand from foreign and domestic patients,” said Aicel analyst Park I-kyung.

GLOBAL DEMAND PROPELS VALUATION SURGE

K-medicine’s export boom has also added growth momentum.

Korea exported $90 million worth of aesthetic medical devices in April, up 15% from a year earlier and tripling from just five years ago. Botox exports rose 54% on-year to $40.12 million, according to KED Aicel.

The dual engine of domestic and overseas growth has boosted the corporate values of several companies listed on the tech-heavy Kosdaq market.

PharmaResearch Products Co., the leader in regenerative dermatology products, saw its market capitalization triple over the past year to 4.37 trillion won, becoming the seventh-largest stock on the Kosdaq.

Its flagship product, Rejuran, helped drive its first-quarter operating profit to 44.7 billion won.

Hugel Inc., a major Botox supplier, now ranks eighth with a 4.36 trillion market cap, with its share price rising 80% over the past year.

Classys came in ninth place with 3.96 trillion won, with its share price up 20% over the past year.

The sector has also attracted foreign capital.

Last October, French private equity firm Archimed acquired 100% of Jeisys Medical, valuing the Korean company at around 800 billion won.

TOURISM TAILWIND SET TO CONTINUE

Industry officials attributed the K-medicine boom to a confluence of factors, including K-pop’s global influence, competitive pricing and transparent medical services.

Chinese, US and Japanese visitors were the top spenders in April, accounting for 26.7%, 20.1% and 12.3% of foreign medical consumption, respectively.

“The popularity of K-culture and K-beauty, combined with lower, more transparent aesthetic medical costs than in markets such as Japan, has led to a surge in foreign use of Korean aesthetic medical services,” said Kim Kwang-soo, an official at the Ministry of Health and Welfare.

Analysts expect the growth trend to persist.

“With medical tourism accelerating and export markets expanding, companies like PharmaResearch are well-positioned for sustained growth,” said Jeong Dong-hee, a Samsung Securities analyst.

Write to Tae-Ho Lee at thlee@hankyung.com

In-Soo Nam edited this article.

-

Beauty & CosmeticsIn China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Beauty & CosmeticsIn China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'May 12, 2025 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsPackaging rides K-beauty wave: Shares of cosmetics container makers soar

Beauty & CosmeticsPackaging rides K-beauty wave: Shares of cosmetics container makers soarApr 21, 2025 (Gmt+09:00)

3 Min read -

Culture & TrendsS.Korea’s medical tourism thrives on weak currency

Culture & TrendsS.Korea’s medical tourism thrives on weak currencyApr 18, 2025 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsK-beauty defies trade headwinds as exports to China, US lead sales growth

Beauty & CosmeticsK-beauty defies trade headwinds as exports to China, US lead sales growthApr 08, 2025 (Gmt+09:00)

5 Min read -

Beauty & CosmeticsK-beauty exports to China rebound after 4-month slump

Beauty & CosmeticsK-beauty exports to China rebound after 4-month slumpApr 04, 2025 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declines

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declinesMar 12, 2025 (Gmt+09:00)

3 Min read -

HealthcareKorea’s booming medical tourism: Skin care, plastic surgery in demand

HealthcareKorea’s booming medical tourism: Skin care, plastic surgery in demandApr 29, 2024 (Gmt+09:00)

2 Min read