Europe looms large as K-beauty brands look to blue ocean; shares rise

Silicon2, APR and Amorepacific are among those named as the industry’s top picks amid the European momentum

By 7 HOURS AGO

South Korea’s Rznomics inks $1.3 bn out-licensing deal with Eli Lilly

Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Kumho Tire shuts Gwangju plant after fire, derailing record sales run

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

South Korea’s beauty industry has been reaping decent gains from traditionally strong markets such as China and the US – the world’s two largest – since early this year.

Beyond traditional markets, Korean beauty brands are now setting their sights on a growing niche market – Europe – sparking renewed investor interest in cosmetic stocks.

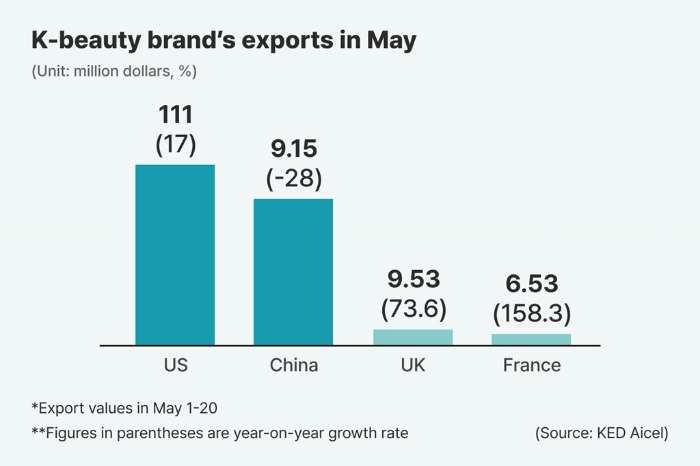

According to the Korean alternative data platform KED Aicel on Friday, cosmetics exports to France and the UK showed steeper growth rates than exports to other regions in the first 20 days of the month.

Korean cosmetics shipments to France, often considered the cradle of the global cosmetics industry, reached $6.5 million in May 1-20, up 158.3% from the year-earlier period, while exports to the UK rose 73.6% on-year to $9.5 million, far outpacing the industry’s overall growth rate of 8.2%.

GROWING APPETITE FOR K-BEAUTY IN EUROPE

Though the US and China remain Korea’s largest beauty product export markets, the European uptick signals a growing appetite for K-beauty on the continent, analysts said.

Exports of Korean makeup products to the US reached $111 million in the first 20 days of May, up 17% from a year earlier. Shipments to China fell 28% on-year to $91.5 million.

According to Seoul-based brokerage Samsung Securities Co., cosmetics exports to five European countries climbed 42% in April compared to a year earlier.

Notably, Poland – a key logistics hub for Korean cosmetics firms, including Silicon2 Co. – saw monthly imports of Korean cosmetics exceed $20 million for the first time in March.

SILICON2: A RISING STAR IN EUROPE

Silicon2, a Kosdaq-listed cosmetics distributor with an increasing continental footprint, has emerged as a key beneficiary of the trend.

Shares of the company have risen 15% year to date, outperforming the Kosdaq index’s 4.2% gain.

In the first quarter, Europe accounted for a third of Silicon2’s overseas revenue, followed by 22% for Asia and 18% for North America.

The company’s European sales rose to 81.3 billion won in the first quarter from 47.1 billion won in the previous quarter.

Analysts said as Europe has a lower e-commerce penetration rate than the US that there is more room for cosmetics distributors such as Silicon2 to expand their business.

Silicon2 is also actively expanding its distribution centers worldwide, from Poland to Western Europe, Russia and Eastern Europe.

Park Eun-jeong, a Hana Securities Co. analyst, recently raised its price target for Silicon2 to 50,000 won ($36.4) from 40,000 won, citing a more than twofold increase in the cosmetics distributor’s non-US sales, including Europe and the Middle East, which reached 210 billion won, or $153 million, in the first quarter.

On Friday, shares of Silicon2 finished 3.1% higher at 39,950 won.

APR, AMOREPACIFIC ALSO AMONG TOP PICKS

Cosmetics maker APR Co., which has proven its solid presence in the US and Japan, is now ramping up its business-to-business (B2B) operations in Europe to diversify its distribution channels.

In February, the company signed a large-scale supply contract with a European distributor.

As it achieved 200% sales increases in the US and Japan in the first quarter, there are expectations that it will also quickly establish itself in the European market.

Shares of APR, listed on the main bourse, have risen 118% this year.

Meanwhile, Meritz Securities Co. analyst Park Jong-dae named Amorepacific Corp. as its top pick with the highest upside potential for the stock among Korea’s Europe-focused beauty shares. He has a buy recommendation for the stock, with a target price of 158,000 won.

Amorepacific closed up 8.2% at 135,200 won on Friday.

The cosmetics maker’s overseas sales in the first quarter increased 40% from a year earlier, with sales in Europe, the Middle East and Africa rising 80%.

“Amorepacific is uniquely positioned to capture the full extent of global K-beauty momentum,” the brokerage said in a research note. It said the Korean beauty brand’s recent restructuring efforts have resulted in the company returning to revenue growth across all major regions.

Write to Jiyoon Yang at yang@hankyung.com

In-Soo Nam edited this article.

-

HealthcareKorea’s aesthetic medicine enjoys golden era with surge in foreign spending

HealthcareKorea’s aesthetic medicine enjoys golden era with surge in foreign spendingMay 19, 2025 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsK-Beauty defies seasonal slump with record $980 mn in April exports

Beauty & CosmeticsK-Beauty defies seasonal slump with record $980 mn in April exportsMay 16, 2025 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsIn China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Beauty & CosmeticsIn China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'May 12, 2025 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsPackaging rides K-beauty wave: Shares of cosmetics container makers soar

Beauty & CosmeticsPackaging rides K-beauty wave: Shares of cosmetics container makers soarApr 21, 2025 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsK-beauty defies trade headwinds as exports to China, US lead sales growth

Beauty & CosmeticsK-beauty defies trade headwinds as exports to China, US lead sales growthApr 08, 2025 (Gmt+09:00)

5 Min read -

Beauty & CosmeticsK-beauty exports to China rebound after 4-month slump

Beauty & CosmeticsK-beauty exports to China rebound after 4-month slumpApr 04, 2025 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declines

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declinesMar 12, 2025 (Gmt+09:00)

3 Min read