Private equity

Korean PE funds shrink in 2023 for first time in 7 years

Rate hikes and the weak won impacted fundraising; investment may resume with $30 billion dry powder

By Jun 26, 2024 (Gmt+09:00)

2

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

NPS to cut global stocks under GP management, up its direct control

Korean PE funds shrink in 2023 for first time in 7 years

Galaxy Ring, new foldables set to steal the show at Samsung Unpacked Paris

POSCO gears up for carbon-free steelmaking with hydrogen

South Korean private equity investments declined last year for the first time since 2016 due to interest rate hikes, high inflation and the Korean won, which at one point fell to its weakest level against the US dollar, KoreaŌĆÖs financial watchdog found.

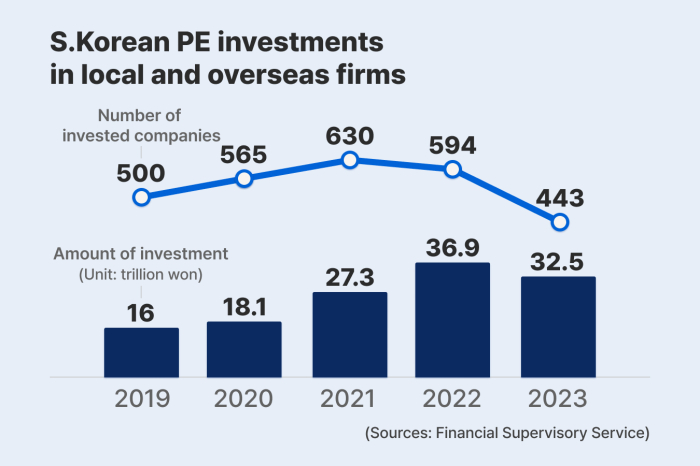

Korean PE funds that manage institutional investorsŌĆÖ capital invested 32.5 trillion won ($23.4 billion) in 443 domestic and overseas companies last year. That's 11.9% less investment in 25% fewer firms from a year earlier, according to the Financial Supervisory Service on Tuesday.

Korean PE investments in overseas markets plunged 64.9% to 4 trillion won last year. Investments in domestic private markets rose 11.8% to 28.5 trillion won, which included the MBK Partners-Unison Capital Korea consortiumŌĆÖs acquisition of dental implant maker Osstem Implant Co. for 2.5 trillion won.

It was the first year for Korean PE fundsŌĆÖ capital injection to drop since 2016, when global financial markets were hit by Britain's referendum on its European Union membership.

High rates impacted PE managersŌĆÖ fundraising, and the strong greenback made cross-border M&As more difficult, private market sources said.

ŌĆ£Elevated interest rates challenged acquisition finance, resulting in a reduction in private market investments,ŌĆØ said Samil PricewaterhouseCoopers deal division head Min Joon-seon. ŌĆ£Increased uncertainties in rate policy also negatively affected PE investments,ŌĆØ he added.

InvestorsŌĆÖ tepid interest in some large M&As further slowed new investments.

MBK has strived to divest a supermarket chain unit of Korean hypermarket operator Homeplus, which the North Asia-focused fund bought for 7.2 trillion won from British retail giant Tesco PLC in 2015.

Market insiders said the sale wonŌĆÖt be easy as Homeplus posted an operating deficit last year for the third straight year.

Seoul-based IMM Private Equity has postponed its sale of Able C&C, the parent of Korean low-priced cosmetics brand Missha, since 2022 due to the companiesŌĆÖ sluggish earnings.

The PE acquired the beauty products maker for about 400 billion won in 2017 and has seen the companyŌĆÖs market cap shrink to 260 billion won. ┬Ā┬Ā

Market watchers expect Korean PE managers to resume investing once interest rates fall, as the dry powder ŌĆö or cash reserves held by private market investors ŌĆö increased 33% on-year to 37.5 trillion won as of the end of 2023.

PE investment in the domestic market could rebound this year as KoreaŌĆÖs No. 2 conglomerate SK Group is ramping up the restructuring of its affiliates, including a planned merger of oil refiner SK Innovation Co. with energy unit SK E&S Co.

The merger, if successful, is expected to create the countryŌĆÖs eighth-largest company with total assets of 106 trillion won.┬Ā

Write to Ik-Hwan Kim at lovepen@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Private equityTcha Partners mulls largest-ever sale of Korean bus operators

Private equityTcha Partners mulls largest-ever sale of Korean bus operatorsJun 17, 2024 (Gmt+09:00)

2 Min read -

EnergyKolon Global inks KoreaŌĆÖs 1st private wind power supply deal

EnergyKolon Global inks KoreaŌĆÖs 1st private wind power supply dealMay 27, 2024 (Gmt+09:00)

1 Min read -

Asset managementKorean investors turn to private credit, secondaries: CIOs

Asset managementKorean investors turn to private credit, secondaries: CIOsMay 22, 2024 (Gmt+09:00)

3 Min read -

Private debtM&A rebound will drive private credit volume increase: Golub Capital

Private debtM&A rebound will drive private credit volume increase: Golub CapitalMay 16, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN