Samsung chip head vows drastic revamp after flagging weak Q3 earnings

Samsung faces a triple whammy – a slow response to the AI chip market, Chinese rivals and an uphill foundry battle versus TSMC

By Oct 08, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Samsung steps up AR race with advanced microdisplay for smart glasses

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

Jun Young-hyun, vice chairman and head of Samsung Electronics Co.'s semiconductor business, on Tuesday vowed to take drastic steps to improve profitability and regain memory leadership after flagging weaker-than-expected third-quarter earnings.

Analysts said a personnel overhaul and reorganization of Samsung’s chip division is possible during the regular year-end reshuffle of executives to imbue a sense of crisis among its employees.

"I am sorry for not meeting market expectations, causing concerns about our technological competitiveness and the company's future,” he said in a written message to employees, investors and clients.

"The management leading the business is fully responsible, and we will take the lead in overcoming this crisis and making the third quarter’s weak earnings a turning point for the company," said Jun, head of Samsung’s Device Solutions (DS) division.

His apology marks the first time one of Samsung's top executives has issued a separate statement regarding a performance report.

Jun, who took the post in May, outlined three key strategies to overcome the crisis: restoring fundamental technological competitiveness, preparing more thoroughly for the future, and innovating organizational culture and work processes.

"Technology and quality are our lifeblood and the pride of Samsung Electronics. We cannot compromise on them," he said. "We will focus on securing fundamental competitiveness rather than short-term fixes."

DISAPPOINTING Q3 RESULTS

Earlier in the day, the South Korean tech giant flagged a four-fold jump in third-quarter profit, but its earnings came well below market expectations, prompting its chip head to offer a rare apology for weak performance.

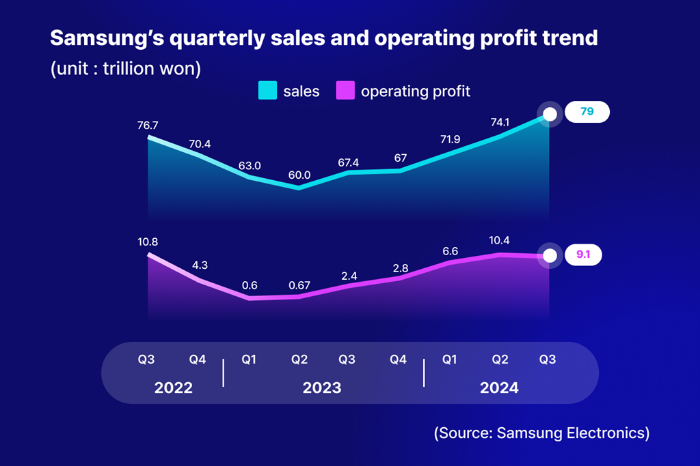

The world’s largest memory chipmaker said in a regulatory filing that its July-September operating profit is estimated at 9.1 trillion won ($6.8 billion) on a consolidated basis, up 274.5% from 2.43 trillion won in the year-earlier period.

The preliminary operating profit came in below the market consensus forecast of 10.8 trillion won.

Samsung said third-quarter sales likely rose 17.2% from the same period a year earlier to 79 trillion won – lower than the market consensus of 80.78 trillion won.

Samsung plans to announce detailed quarterly results, including net profit and divisional performance, on Oct. 31.

In the second quarter, the company posted 10.44 trillion won in operating profit on sales of 74.1 trillion won.

Samsung's share price, already down more than 20% this year, closed 12% lower at 60,300 won on Tuesday, underperforming a 0.6% fall in the benchmark Kospi index.

TRIPLE WHAMMY

The global semiconductor market has been recovering from last year’s downturn, driven by chips used in AI devices and servers, but demand recovery for conventional chips used in smartphones and PCs is slowing.

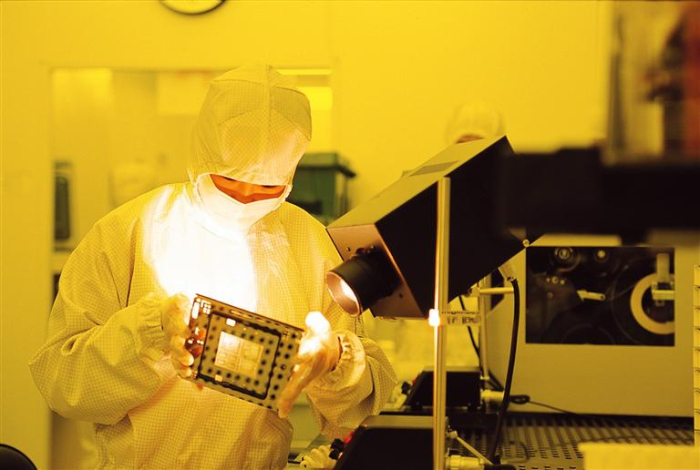

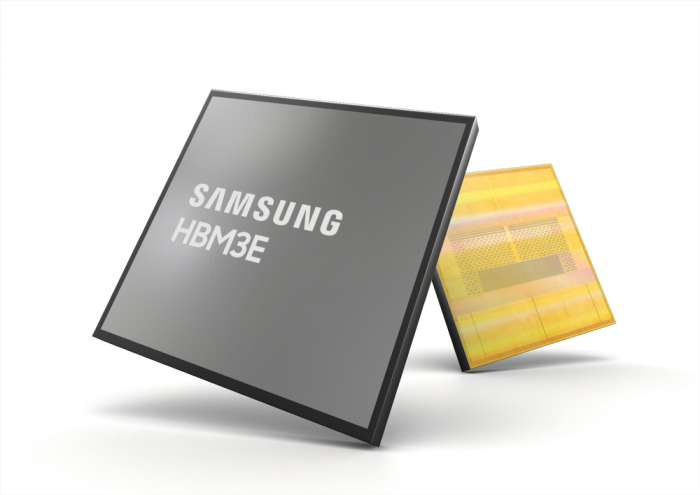

Samsung has been scrambling to catch up with smaller crosstown rival SK Hynix Inc. in a race to supply high-end AI chips such as high-bandwidth memory (HBM) to Nvidia Corp., the world’s top AI chip designer.

While SK Hynix said more than half of its sales revenue comes from HBM and other high-value server DRAMs, Samsung has a relatively higher proportion of smartphone and PC DRAMs.

On Tuesday, Samsung said the sale of its high-end HBM3E chips to a major customer has been delayed. It did not elaborate on the issue.

Samsung is working to supply its latest HBM chips to Nvidia.

Chinese chipmakers have recently increased supplies of “legacy” chips, contributing to the decline in prices of conventional chips and hurting Samsung’s semiconductor earnings, analysts said.

Some 1.5 trillion won in one-off charges related to employee performance bonuses also affected Samsung’s third-quarter earnings, industry officials said.

DIVISIONAL PERFORMANCE

Although Samsung didn’t provide a divisional performance breakdown, its DS division, which oversees its chip business, likely posted an operating profit of 4 trillion won in the third quarter, much less than the previous quarter and the year-earlier period.

Its foundry, or contract chip manufacturing business, likely continued to lose money to the tune of 1.5 trillion won in the third quarter as it is struggling to compete with leader Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), which counts Apple and Nvidia among its customers.

Samsung’s System LSI division, which makes logic and system chips, also likely posted 1.5 trillion won in losses.

Analysts said Samsung’s bread-and-butter memory business likely posted 5.5 trillion won in operating profit. If the figures are confirmed later this month, Samsung will post lower memory profit than SK Hynix for the first time.

SK, which produces only memory chips, DRAM and NAND, is widely expected to post an operating profit of 6.77 trillion won in the July-September quarter.

Samsung’s Device eXperience (DX) division, which makes and sells smartphones, displays and appliances, likely posted 2.6 trillion won in operating profit, buoyed by the new Galaxy series of smartphones and the Galaxy Ring.

(Rewrites throughout the story. Adds analysts’ estimates for the company’s other business divisions)

Write to Chae-Yeon Kim and Eui-Myung Park at why29@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip development

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip developmentSep 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boom

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boomSep 04, 2024 (Gmt+09:00)

3 Min read -

EarningsSK Hynix to supply 12-layer HBM3E to Nvidia in Q4; profit soars in Q2

EarningsSK Hynix to supply 12-layer HBM3E to Nvidia in Q4; profit soars in Q2Jul 25, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersHBM chip war intensifies as SK Hynix hunts for Samsung talent

Korean chipmakersHBM chip war intensifies as SK Hynix hunts for Samsung talentJul 08, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung launches dedicated HBM, advanced chip packaging teams

Korean chipmakersSamsung launches dedicated HBM, advanced chip packaging teamsJul 05, 2024 (Gmt+09:00)

3 Min read -

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisis

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisisMay 21, 2024 (Gmt+09:00)

4 Min read