Samsung Electronics replaces chip head amid HBM crisis

The first challenge for Vice Chairman Jun Young-hyun will be to ensure HBM chip supply to Nvidia, analysts say

By May 21, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

K-pop stocks surge as China set to loosen cultural ban after 9 years

Samsung Electronics Co., the world’s top memory chipmaker, on Tuesday replaced its semiconductor business chief as the South Korean company struggles to catch up to its crosstown rival SK Hynix Inc. in the booming artificial intelligence chip segment.

Samsung said Jun Young-hyun, vice chairman and head of its future business planning unit, will now lead the Device Solutions (DS) division, which oversees the company’s chip business.

Jun, 64, replaces Kyung Kye-hyun, who will head up the future business planning unit and Samsung Advanced Institute of Technology (SAIT).

The executive reshuffle – the timing of which is highly unusual as it comes in the middle of the year – is aimed at catching up in the top-end AI chip market, such as for high-bandwidth memory (HBM) chips where Samsung has fallen behind its rivals.

"This is a preemptive measure to strengthen future competitiveness by renewing the atmosphere internally and externally," Samsung said in a statement.

The appointment comes after Kyung, the incumbent DS chief, offered to step down from his post, people familiar with the matter said. Kyung has led the DS division since 2022 as president.

Most personnel changes at Samsung and other major Korean companies take place at year’s end or the beginning of the year.

JUN, VETERAN CHIP EXECUTIVE

A KAIST graduate with a master's and a doctorate in electrical engineering, Jun joined Samsung Electronics in 2000 and worked in the DRAM and NAND flash memory development and strategic marketing divisions.

He became the head of Samsung’s memory business in 2014 and moved to the conglomerate's battery arm Samsung SDI Co. as its chief executive in 2017.

He returned to Samsung Electronics early this year to lead its future business unit as vice chairman.

“Given his track record of elevating Samsung’s memory and battery businesses to a global level and his management know-how, we expect Vice Chairman Jun to help Samsung overcome its current chip crisis,” Samsung said.

Samsung Electronics' chip business has struggled with sluggish sales for the past few years, logging an operating loss of nearly 15 trillion won ($11 billion) in 2023. The chip business experienced five consecutive quarters of operating losses, from the fourth quarter of 2022 to the fourth quarter of 2023.

However, in the first quarter of 2024, the chip business turned around with an operating profit of 1.91 trillion won on sales of 23.1 trillion won, thanks to rising memory chip prices.

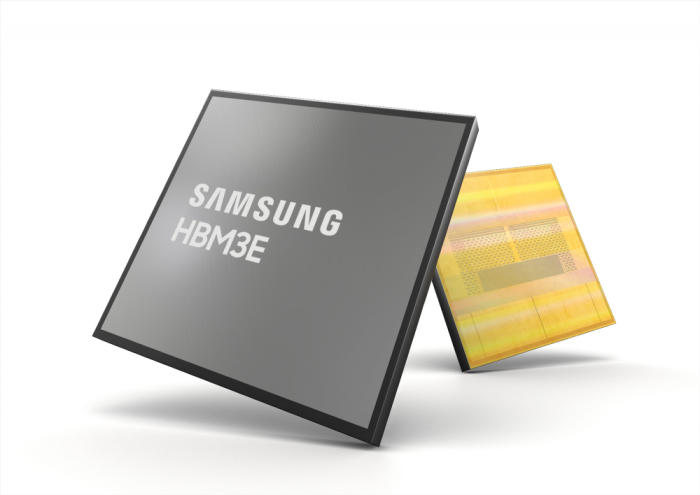

SAMSUNG LAGS PEERS IN HBM SEGMENT

Although Samsung is the industry’s top memory chipmaker, it falls far behind SK Hynix, the world’s second-largest memory maker, in the HBM segment.

According to Taiwan-based market researcher TrendForce, SK Hynix dominates the HBM sector with 53% market share as of end-2023, followed by Samsung’s 38%.

HBM has become an essential part of the AI boom, as it provides much faster processing speed than traditional memory chips.

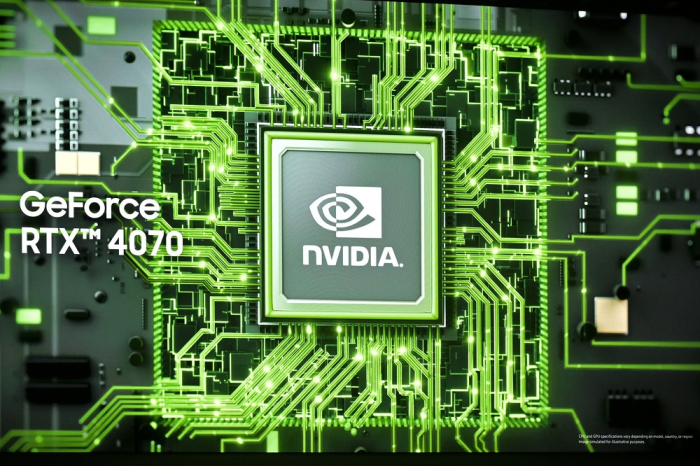

SK Hynix has been the top supplier of HBM chips to Nvidia Corp., which controls over 80% of the market for graphics processing units (GPUs), the core of AI computing tasks. Currently, the Korean chipmaker is Nvidia’s only supplier of the fourth-generation HBM3 chip.

TrendForce said SK and Samsung are set to benefit from explosive HBM sales growth in the coming years as the AI chip is projected to account for more than 20% of the total DRAM market starting in 2024, potentially exceeding 30% by 2025.

JUN’S IMMEDIATE CHALLENGES

Analysts said the first litmus test for the new Samsung chip leader will be to ensure that Samsung supplies its HBM chips to Nvidia.

Samsung, which vows to triple its HBM output this year, is eager to pass quality testing currently underway by Nvidia.

Kim Jae-june, Samsung’s memory business vice president, said in late April that the company had begun mass production of its HBM chips for generative AI chipsets, called 8-layer HBM3E, and will see sales revenue from the chips from the end of the second quarter.

In February, Samsung said it developed HBM3E 12H, the industry's first 12-stack HBM3E DRAM and the highest-capacity HBM product to date.

Samsung plans to start making the fifth-generation 12-layer version as early as the second quarter.

HBM3E is expected to power Nvidia’s new AI chips such as B100 and GB200 and AMD’s MI350 and MI375, which are set for launch later this year.

Kyung, the outgoing Samsung chip leader, said in March the company is developing a next-generation artificial intelligence chip, Mach-1, with which it aims to upend SK Hynix.

Mach-1 is an AI accelerator in the form of a system-on-chip (SoC) that reduces the bottleneck between the graphics processing unit (GPU) and HBM chips, according to Samsung.

Samsung is also actively developing high-performance NAND flash products, in growing demand from high-capacity storage server operators.

Following the industry's first mass production of 1 terabit (Tb) triple-level cell (TLC) ninth-generation V-NAND last month, the company plans to develop quad-level cell (QLC)-based products in the second half of the year.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growth

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growthMay 07, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung shifts gears to focus on HBM, server memory chips

Korean chipmakersSamsung shifts gears to focus on HBM, server memory chipsApr 30, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK Hynix’s HBM leadership

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK Hynix’s HBM leadershipMar 20, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung establishes HBM team to up AI chip production yields

Korean chipmakersSamsung establishes HBM team to up AI chip production yieldsMar 29, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip era

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip eraMar 27, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung rallies on expectations of Nvidia’s HBM order

Korean chipmakersSamsung rallies on expectations of Nvidia’s HBM orderMar 20, 2024 (Gmt+09:00)

3 Min read -

Korean innovators at CES 2024Samsung to double HBM chip production to lead on-device AI chip era

Korean innovators at CES 2024Samsung to double HBM chip production to lead on-device AI chip eraJan 12, 2024 (Gmt+09:00)

3 Min read