Celltrion revises up earnings goals to overtake Amgen

Celltrion is seeking to list its holding company by early next year and launch a $76 billion investment fund

By Jan 11, 2024 (Gmt+09:00)

South Korea’s Rznomics inks $1.3 bn out-licensing deal with Eli Lilly

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Kumho Tire shuts Gwangju plant after fire, derailing record sales run

Celltrion Inc., South Korea's leading biosimilar maker, on Wednesday expressed its ambition to join the global top 10 biotech and pharmaceutical companies and sharply revised its earnings goals upward just hours after unveiling its initial targets.

"We are aiming to overtake Amgen within the next seven years and rise to the top 10," Seo Jung-jin, founder and chairman of Celltrion Group, said at a press conference.

"To meet these goals, we must achieve 12 trillion won ($912 million) in EBITDA and sales of 24 trillion won by 2030."

EBITDA, an indicator of a company's profitability, stands for earnings before interest, tax, depreciation and amortization. Amgen Inc. is a California-based biosimilar leader.

The chairman said the company's EBITDA will reach 1.7 trillion won in 2024 and then swell to 3.5 trillion won in 2025 and 6 trillion won in 2026.

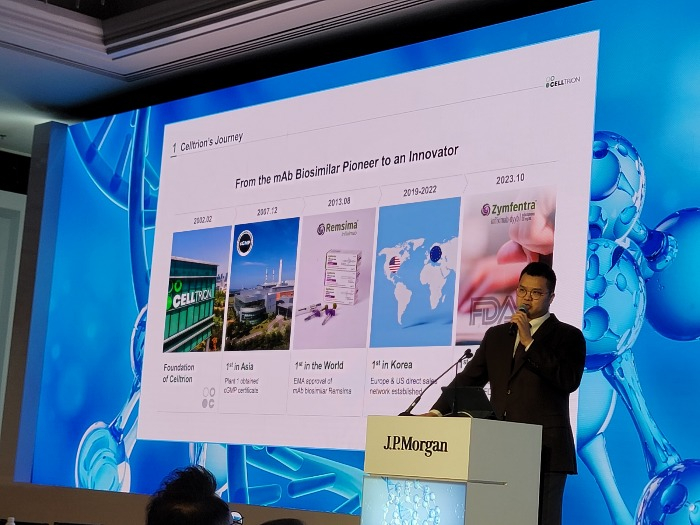

His figures are more than double the targets that his eldest son, Celltrion Inc. CEO Seo Jin-seok, unveiled earlier in the day at the J.P. Morgan Health Care Conference in San Francisco.

In his presentation at the annual event, the junior Seo said the company's sales could grow fivefold to about 11 trillion won by 2030, compared with 2.3 trillion won in 2022.

MILESTONE YEAR

The year 2030 is expected to mark a milestone for Celltrion as it is preparing to commercialize a portfolio of 22 biosimilars by that year. It currently has six biosimilars on the market.

The targets proposed by the chairman and CEO reflected the upcoming merger between three Celltrion Group arms under which Celltrion Inc. is set to absorb Celltrion Healthcare Co. and Celltrion Pharm Inc.

IPO FOR HOLDING COMPANY

Celltrion Group is seeking to list its holding company Celltrion Holdings Co. and form a 100 trillion won ($76 billion) global healthcare fund to invest in biotech companies and startups.

The group, founded in 2002, plans to transform the holding company into an investment firm.

“I am planning to list Celltrion Group’s holding company, where I have a 98.5% stake, as early as the end of this year or no later than early next year,” Chairman Seo said during a presentation at the J.P. Morgan Health Care Conference.

Tapping the proceeds from the initial public offering, Celltrion is looking to commit some 5 trillion won to the healthcare fund as an anchor investor while attracting between 50 trillion won and 100 trillion won from other investors, he said.

The fund it seeks to establish will be dedicated to investing in other companies and will not be used for mergers and acquisitions.

FORAY INTO NEW COUNTRIES, M&A

To achieve these goals, the company plans to enter the biosimilar market in Vietnam and Indonesia this year while accelerating its forays into new markets, including Russia, China and India.

Vietnam's biopharmaceutical product market is valued at about 1 trillion won, according to the chairman.

Celltrion is also considering investing about 500 billion won in an active pharmaceutical ingredient (API) developer to expand into the API market. APIs are produced from raw materials and contained in medicines.

"We are not thinking about buying 100% of an [API] company, but taking a stake from its top shareholder to win management rights," the chairman said.

IN THE PIPELINE

This year, Celltrion will launch Zymfentra in the US. Zymfentra is the first and only FDA-approved subcutaneous formulation of infliximab.

Celltrion’s biosimilars in the pipeline include antibody-drug conjugates, immune checkpoint inhibitors and multi-specific antibody drugs.

For solid tumor drugs, Celltrion prioritizes antibody-drug conjugate (ADC) projects and expects to release the details of their clinical development when animal testing on the drugs is completed, the CEO added.

(Updated after Celltrion Chairman revised upward the company's sales target for 2030 and revealed other numerical goals)

Write to Yoo-Rim Kim at youforest@hankyung.com

Yeonhee Kim edited this article.

-

Mergers & AcquisitionsCelltrion to sell portfolio of Takeda drugs to CBC Group

Mergers & AcquisitionsCelltrion to sell portfolio of Takeda drugs to CBC GroupJan 01, 2024 (Gmt+09:00)

3 Min read -

Bio & PharmaCelltrion applies for approval of Xolair biosimilar in Canada

Bio & PharmaCelltrion applies for approval of Xolair biosimilar in CanadaDec 27, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaCelltrion, Cyron to develop multi-specific antibody new drug

Bio & PharmaCelltrion, Cyron to develop multi-specific antibody new drugDec 06, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaCelltrion applies for approval in Europe for eye treatment biosimilar

Bio & PharmaCelltrion applies for approval in Europe for eye treatment biosimilarNov 24, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaCelltrion’s approved merger removes hurdle to three-way combination

Bio & PharmaCelltrion’s approved merger removes hurdle to three-way combinationOct 23, 2023 (Gmt+09:00)

4 Min read -

KOREA Investment Week 2023Celltrion builds clinical data bank for new biosimilars

KOREA Investment Week 2023Celltrion builds clinical data bank for new biosimilarsSep 12, 2023 (Gmt+09:00)

2 Min read