MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Inc. to resume building partnerships with friendly investors, which had broken up as foreign hostile bids waned

By Oct 27, 2024 (Gmt+09:00)

North Asia-focused private equity firm MBK Partner Ltd.’s attempt to take control of Korea Zinc Inc. and the country’s plan to require the cancellation of treasury shares are expected to spur domestic companies to seek white knights to protect their management rights.

South Korea’s online giant Naver Corp., flag carrier Korean Air Lines Co., chemical and car parts maker KCC Corp. and petrochemical producer Kumho Petrochemical Co. are potential friendly investors that can help other companies maintain their control, banking industry sources said on Sunday.

Potential targets of hostile bids from private equity firms or hedge funds are likely to exchange their treasury shares with such white knights to protect their management rights, the sources said.

“Korea does not have strong measures such as a poison pill to keep management control,” said one of the sources. A poison pill defense involves the sale to shareholders of discounted shares to protect a company from a hostile takeover by an activist individual investor, company or institutional investor.

“Financial watchdogs’ tougher regulations on treasury shares are also likely to speed up the search for white knights.”

The government is considering requiring the cancellation of treasury shares to improve shareholder value, which could obviate companies’ measures to protect their control. The move is expected to cause firms to sell treasury shares to white knights in lieu of cancelling them, the sources said.

ATTACKS FROM FOREIGNERS

Korean conglomerates fretted in the late 1990s when US hedge fund Tiger Management LLC. tried to take control over the country’s top telecom carrier SK Telecom Co.

Monaco-based Sovereign Asset Management waged a battle to force reform on the flagship of Korean conglomerate SK Group in 2003, while the world’s No. 2 steelmaker ArcelorMittal S.A. attempted a hostile takeover of its Korean rival POSCO in 2006.

To defend against such attacks, those Korean companies sold their treasury shares to other local companies, turning them into white knights.

Tiger tried to replace SK Telecom’s executives after buying a 6.66% stake in the telecom service provider. In response, the Korean company swapped treasury shares with those of POSCO, KT&G Corp. and HD Hyundai Heavy Industries Co, formerly Hyundai Heavy Industries Co.

SK Inc., the group’s holding company, sold treasury shares equivalent to a 10.41% stake to Hana Bank, Shinhan Bank, Korea Development Bank, Pantech & Curitel and Japan’s Itochu Corp.

POSCO asked Hyundai Heavy and local banks to help it fight ArcelorMittal.

Those takeover targets succeeded in defending against hostile bids from foreign companies thanks to their coalitions with white knights. Such alliances were gradually broken up as hostile takeover threats from foreigners faded, leading the white knights to sell off the stocks they had bought.

MBK was expected to rekindle such alliances when the Seoul-based private equity firm secured a large enough stake in Korea Zinc through a tender offer to take control of the world’s largest lead and zinc smelter, industry sources said.

NAVER

Naver, Korean Air, KCC and Kumho Petrochemical are likely to play a crucial role in other companies’ defenses against such attempts, the sources said.

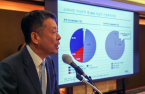

Naver already holds a 3.08% stake in the country’s top hypermarket operator E-Mart Inc., a 6.85% stake in fashion and cosmetics retailer Shinsegae International Co., 7.82% in brokerage house Mirae Asset Securities Co., 7.85% in logistics company CJ Logistics Corp., 4.99% in entertainment giant CJ ENM Co. and 0.99% in Korean Air’s holding company Hanjin KAL Corp.

The online behemoth formed white knight alliances with Hanjin Group, Shinsegae Group, CJ Group and Mirae Asset Group as CJ Logistics, CN ENM and E-Mart also have stakes in Naver of 0.64%, 0.3% and 0.24%, respectively. Mirae Asset Securities hold 1.73%.

That helped Naver founder and Global Investment Officer Lee Hae-jin maintain his control though he is only the third-largest shareholder with 3.77%. The company’s top shareholder is Korea’s National Pension Service with 7.78%, followed by global asset manager BlackRock Inc. with 5.05%.

HANJIN, KCC

Hanjin Group has expanded its friendly investor networks by exchanging stakes with Hanil Holdings Co., Hanil Cement Co., GS Retail Co., Hyosung Corp. and others since its fight against local activist fund KCGI Co.

KCC is a leading white knight for Korean conglomerates as the company has a 9.57% stake in Samsung Group’s de facto holding firm Samsung C&T Corp., 12% in Hyundai Corporation Holdings Co., 1.79% in HDC Holdings Co., 3.91% in HD Korea Shipbuilding & Offshore Engineering Co., 2.37% in Hyundai Development Company and 4.25% in HL Holdings Corp.

KCC bought shares in Samsung C&T in 2012 and 2015 while supporting the company in its battle against US activist fund Elliott Investment Management LP in 2015.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Jongwoo Cheon edited this article.

-

Mergers & AcquisitionsKorea Zinc takes control of key shareholder in management feud with MBK

Mergers & AcquisitionsKorea Zinc takes control of key shareholder in management feud with MBKOct 22, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsMBK wins enough stake in tender offer to control Korea Zinc

Mergers & AcquisitionsMBK wins enough stake in tender offer to control Korea ZincOct 14, 2024 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsKorea Zinc ups share buyback price, volume to counter MBK

Mergers & AcquisitionsKorea Zinc ups share buyback price, volume to counter MBKOct 11, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK not to raise Korea Zinc tender offer price after regulator warning

Mergers & AcquisitionsMBK not to raise Korea Zinc tender offer price after regulator warningOct 10, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea Zinc, MBK face-off for control of zinc smelter takes new twist

Mergers & AcquisitionsKorea Zinc, MBK face-off for control of zinc smelter takes new twistOct 04, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK ups stakes for Korea Zinc to match buyback offer

Mergers & AcquisitionsMBK ups stakes for Korea Zinc to match buyback offerOct 04, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKorea Zinc, Bain Capital offer $2.4 bn share buyback vs MBK

Mergers & AcquisitionsKorea Zinc, Bain Capital offer $2.4 bn share buyback vs MBKOct 02, 2024 (Gmt+09:00)

3 Min read -

Shareholder activismSeoul rejects Elliott’s $20 mn claim against Samsung C&T

Shareholder activismSeoul rejects Elliott’s $20 mn claim against Samsung C&TSep 27, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsMBK ups Korea Zinc bid price as management feud intensifies

Mergers & AcquisitionsMBK ups Korea Zinc bid price as management feud intensifiesSep 26, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea Zinc to sell $301 mn in CPs amid management feud with MBK

Mergers & AcquisitionsKorea Zinc to sell $301 mn in CPs amid management feud with MBKSep 25, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsHanwha, LG to support Korea Zinc in battle against MBK

Mergers & AcquisitionsHanwha, LG to support Korea Zinc in battle against MBKSep 23, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea Zinc teams up with brokerage firm to counter MBK

Mergers & AcquisitionsKorea Zinc teams up with brokerage firm to counter MBKSep 19, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK not to sell Korea Zinc to China after tender offer

Mergers & AcquisitionsMBK not to sell Korea Zinc to China after tender offerSep 19, 2024 (Gmt+09:00)

4 Min read -

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea Zinc

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea ZincSep 13, 2024 (Gmt+09:00)

4 Min read -