Korea’s economy sees slower-than-expected rebound in Q3

BOK may downgrade its economic growth forecast for this year from the previous 2.4%; bond yields fall

By Oct 24, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

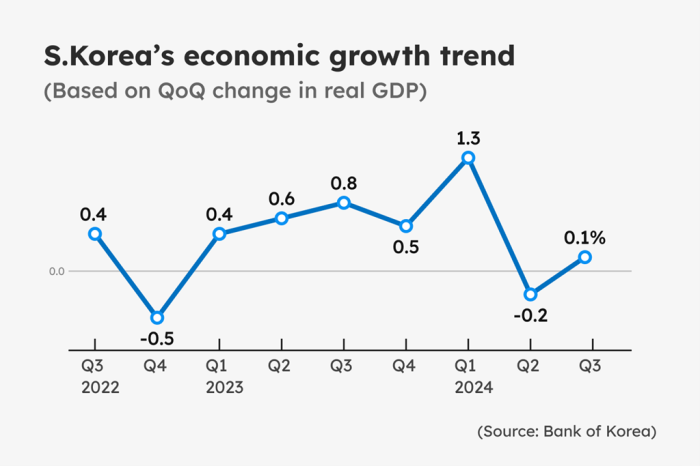

South Korea’s economy rebounded slower than central bank expectations in the third quarter on sluggish exports, adding to predictions that the Bank of Korea (BOK) may cut interest rates earlier than forecast to bolster Asia’s fourth-largest economy.

The country’s gross domestic product grew 0.1% in July-September from a quarter earlier on a seasonally adjusted basis, according to the BOK’s advance estimates released on Thursday. The central bank had expected the economy to expand 0.5% on-quarter in August.

That helped the economy avoid a recession, commonly defined as two consecutive quarters of contraction, as the economy shrank 0.2% in the second quarter.

From a year earlier, the economy grew 1.5% in the third quarter, slower than the BOK’s forecast of 2.0% and the 2.3% in the April-June period, the BOK said.

The central bank may downgrade its growth forecast next month when it meets for a rate decision, Shin Seung Cheol, head of the research department, told reporters. In August, it had expected the economy to expand 2.4% this year.

“It cannot be considered good although the growth rate rebounded in the third quarter from a negative figure in the second,” Shin said. “Mathematically, We need 1.2% growth in the fourth quarter to achieve the 2.4% forecast for this year.”

BOND YIELDS DOWN

South Korean government bond yields fell across the board in the morning after the data's release, although US Treasury yields rallied overnight.

The highly liquid South Korean government’s three-year bond yield slid 5.3 basis points (bps) to 2.883%, while the five-year debt yield lost the same bps to 2.958% on Thursday morning, according to the Korea Financial Investment Association.

The 10-year yield skidded 4.7 bps to 3.081%.

The BOK earlier this month cut its policy interest rate for the first time in more than four years but said the monetary authority will reduce borrowing costs further only in slow and gradual steps due to high domestic household debt.

WEAK EXPORTS

South Korea’s exports dipped 0.4% in the third quarter from the previous three months, logging the first decline since the fourth quarter of 2022, while imports rose 1.5%.

The BOK said shipments of automobiles and chemicals dragged the overall overseas sales and the export growth in information technology products such as semiconductors slowed.

“Exports are expected to stay sluggish in the fourth quarter, given the slow recovery in demand for goods in developed countries and risk of a supply glut,” said Shinhan Securities Co. in a note.

Overseas sales in the first 20 days of October fell 2.9% amid falling demand for cars and petroleum products, separate government data showed on Monday.

The country is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc. – as well as global No. 3 automaker Hyundai Motor Group encompassing Hyundai Motor Co. and Kia Corp.

Domestic demand, however, showed signs of recovery.

Private consumption expanded 0.5% in the third quarter after a 0.2% contraction, while facilities investment rose 6.9% after a 1.2% decline. Government consumption also grew 0.6% given higher spending on social security benefits.

Write to Jin-gyu Kang at josep@hankyung.com

Jongwoo Cheon edited this article.

-

EconomyS.Korea’s exports fall 2.9% in first 20 days of October; chip sales strong

EconomyS.Korea’s exports fall 2.9% in first 20 days of October; chip sales strongOct 21, 2024 (Gmt+09:00)

2 Min read -

Central bankBOK flags more rate cuts but in gradual, small steps

Central bankBOK flags more rate cuts but in gradual, small stepsOct 11, 2024 (Gmt+09:00)

3 Min read -

Central bankS.Korea’s inflation dips below 2% for 1st time in 42 months

Central bankS.Korea’s inflation dips below 2% for 1st time in 42 monthsOct 02, 2024 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s Q2 GDP slows 0.2%, upholds rate cut expectations

EconomyS.Korea’s Q2 GDP slows 0.2%, upholds rate cut expectationsSep 05, 2024 (Gmt+09:00)

2 Min read -

EconomyKorea’s household debt hits record high on mortage loans

EconomyKorea’s household debt hits record high on mortage loansAug 20, 2024 (Gmt+09:00)

2 Min read