Economy

S.Korea’s Q2 GDP slows 0.2%, upholds rate cut expectations

The country’s central bank attributed growth moderation to weaker consumption and private investment

By Sep 05, 2024 (Gmt+09:00)

2

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

South Korea’s economic growth slowed in the second quarter on weaker domestic consumption and investment by private businesses, heightening expectations of a rate cut next month.

The Bank of Korea (BOK) on Thursday confirmed that the revised gross domestic product in Asia’s No. 4 economy grew 2.3% year over year in the April-June period, slower than the previous quarter’s 3.3% growth.

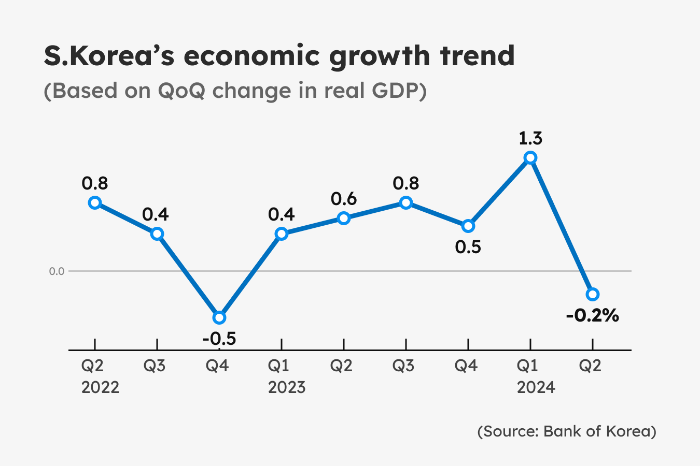

Against the prior quarter, the economy slowed 0.2% as anticipated, a reversal from the first quarter’s surprising 1.3% expansion and marking the first quarterly retreat in growth since the fourth quarter of 2022.

The central bank attributed the growth slowdown to a 0.2% on-quarter drop in private spending, as well as softer construction and facility investments with a fall of 1.7% and 1.2%, respectively.

Export growth was revised upwards to 1.2% from 0.9% but imports grew faster at 1.6%.

RIGHT TIME TO CONSIDER A RATE CUT

Coupled with eased inflation in August, the country’s growth moderation is expected to further heighten expectations of a rate cut by the BOK next month after the central bank kept the policy rate at 3.50% for the 13th straight month, the longest period without a change, last month.

The country’s inflation slowed to 2.0% in August, marking its slowest pace of year-on-year increase since recording 1.9% in March 2021 and meeting the central bank’s target of 2.0%.

Since July, BOK Governor Rhee Chang-yong has signaled a possible autumn rate cut, citing moderation in inflation and growth. At the same time, the central bank has been hesitant to change the rate faster than global peers due to the country’s soaring household debts and the fast recovery in the housing market.

But Rhee has turned more dovish lately after shifting his focus to economic growth.

On Tuesday, he said the timing to consider an interest rate cut has arrived as inflation cools.

“Looking at inflation only, the timing is sufficient to consider a rate cut,” Rhee told reporters on the sidelines of the 2024 Global Economy & Financial Stability Conference held in Seoul. “An appropriate time has arrived to think about how to move while looking at financial stability as well.”

His comment comes amid growing concerns that the central bank might have missed the right timing for a rate pivot.

The country’s presidential office and the ruling People Power Party have become vocal about an imminent rate cut, adding to pressure on the central bank to trim the country’s interest rate.

Korea’s benchmark stock index Kospi opened up, trading 1.2% higher from the previous session at 2,612.15 in the morning session.

The US dollar traded at 1,332.40 won, down from 1,336.50 a day ago.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

More to Read

-

-

Central bankAugust inflation puts BOK under fire for delayed pivot

Central bankAugust inflation puts BOK under fire for delayed pivotSep 04, 2024 (Gmt+09:00)

2 Min read -

Central bankBOK signals autumn rate cut as inflation, economic growth slow

Central bankBOK signals autumn rate cut as inflation, economic growth slowAug 22, 2024 (Gmt+09:00)

3 Min read -

Central bankBOK chief signals rate cut; warns of rising housing prices

Central bankBOK chief signals rate cut; warns of rising housing pricesJul 11, 2024 (Gmt+09:00)

3 Min read -

EconomyOECD sharply revises up S.Korea GDP forecast after strong Q1

EconomyOECD sharply revises up S.Korea GDP forecast after strong Q1May 02, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN