Samsung’s Q2 profit soars on AI chips; second-half outlook rosy

Strong AI chip demand, new foldable phones and the Galaxy Ring will continue to boost its sales and earnings

By Jul 05, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

Samsung steps up AR race with advanced microdisplay for smart glasses

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

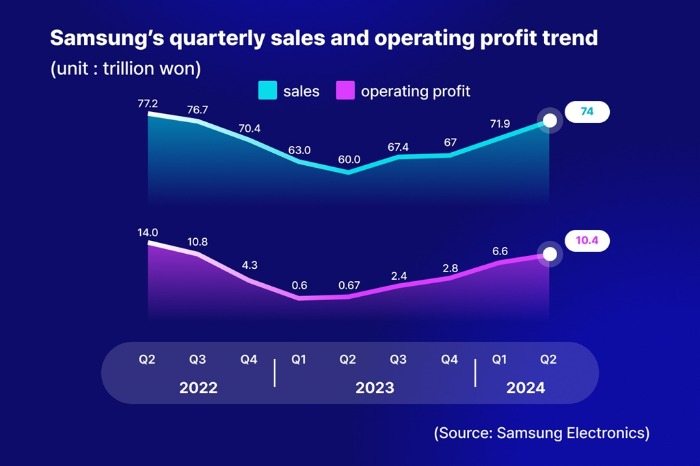

South Korean tech giant Samsung Electronics Co. on Friday flagged a more than 15-fold increase in its second-quarter operating profit as the artificial intelligence boom lifted chip prices.

The world’s largest memory chipmaker will likely continue to post handsome earnings and sales growth for the rest of the year on the back of strong demand for AI chips such as high-bandwidth memory (HBM), analysts said.

Samsung said in a regulatory filing that its April-June operating profit is estimated at 10.4 trillion won ($7.5 billion), up 1,452% from 670 billion won in the year-earlier period on a consolidated basis.

The preliminary operating profit exceeds the market consensus forecast of 8.3 trillion won. If figures are confirmed later this month, the second quarter will be Samsung's most profitable since the third quarter of 2022, when it posted a profit of 10.8 trillion won.

The second-quarter figure surpasses Samsung’s 2023 full-year operating profit of 6.57 trillion won.

Second-quarter sales likely rose 23.3% from the same period a year earlier to 74 trillion won, it said.

Samsung plans to announce detailed quarterly results, including net profit and divisional performance, on July 31.

Following the better-than-expected earnings, Samsung’s shares rose 3% to close at 87,100 won on Friday, outperforming the benchmark Kospi index’s 1.3% rise.

SAMSUNG’S Q2 MEMORY PROFIT SEEN UP TO $5.1 BILLION

Although Samsung didn’t provide a divisional performance breakdown, its Device Solutions (DS) division, which oversees its chip business, likely posted much stronger profit than in the first quarter, boosted by higher average DRAM and NAND sales prices.

Analysts said they expect Samsung’s chip business to post a second-quarter operating profit of 6.5 trillion won-7 trillion won ($4.7 billion-$5.1 billion), compared to the first-quarter profit of 1.9 trillion won.

Analysts said that explosive demand for high-end DRAMs, including HBM used in AI chipsets, and chips used in data center servers and gadgets that run AI services, has buoyed chip prices.

According to market tracker TrendForce, DRAM chip prices rose 13%-18% in the second quarter from the first quarter, while NAND prices gained 15%-20% on-quarter.

Samsung’s device business, which includes smartphones and laptops, likely posted 2.3 trillion won in operating profit in the seasonally weak second quarter, down from the first-quarter profit of 3.5 trillion won.

Q3 OUTLOOK

Analysts expect a continued tailwind for Samsung in the coming quarters on robust demand for AI chips, the launch of new flagship Galaxy smartphones and the debut of the Galaxy Ring, its health tracker, in the third quarter.

On Thursday, Samsung officially launched dedicated HBM and advanced chip packaging teams as its new semiconductor division leader Jun Young-hyun vowed to overtake crosstown rival SK Hynix Inc., the HBM segment leader.

The launch of the two dedicated teams, part of Samsung’s organizational revamp, is its first reshuffle since Vice Chairman Jun took the helm of Samsung’s semiconductor business in May to overcome what it called a "chip crisis.”

Samsung, which vows to triple its HBM output this year, is eager to pass quality testing currently underway by Nvidia Corp., the world’s top AI chip designer.

Analysts expect general-purpose DRAM prices to remain solid in the third quarter as chipmakers are largely using their facilities to produce more profitable HBM chips, resulting in a tight supply of commoditized DRAMs.

Write to Chae-Yeon Kim, Jeong-Soo Hwang and Eui-Myung Park at why29@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung launches dedicated HBM, advanced chip packaging teams

Korean chipmakersSamsung launches dedicated HBM, advanced chip packaging teamsJul 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSouth Korea sets sights on fostering EDA tech to win HBM chip war

Korean chipmakersSouth Korea sets sights on fostering EDA tech to win HBM chip warJun 28, 2024 (Gmt+09:00)

3 Min read -

ElectronicsGalaxy Ring, new foldables set to steal the show at Samsung Unpacked Paris

ElectronicsGalaxy Ring, new foldables set to steal the show at Samsung Unpacked ParisJun 26, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung unveils new foundry tech; AI chip sales to rise ninefold

Korean chipmakersSamsung unveils new foundry tech; AI chip sales to rise ninefoldJun 13, 2024 (Gmt+09:00)

4 Min read -

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisis

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisisMay 21, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growth

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growthMay 07, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung shifts gears to focus on HBM, server memory chips

Korean chipmakersSamsung shifts gears to focus on HBM, server memory chipsApr 30, 2024 (Gmt+09:00)

3 Min read