Shein cracks Korea's ultra-low-cost online fashion market

Its monthly average users in South Korea have been on the rise since the start of this year

By Jun 20, 2024 (Gmt+09:00)

South Korea’s Rznomics inks $1.3 bn out-licensing deal with Eli Lilly

Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Kumho Tire shuts Gwangju plant after fire, derailing record sales run

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Shein, a Chinese fast fashion online retailer, announced on Thursday its official debut in South Korea with the launch of its Korea-dedicated platform in April and will step up marketing efforts in the country to lure cost-sensitive fashionistas.

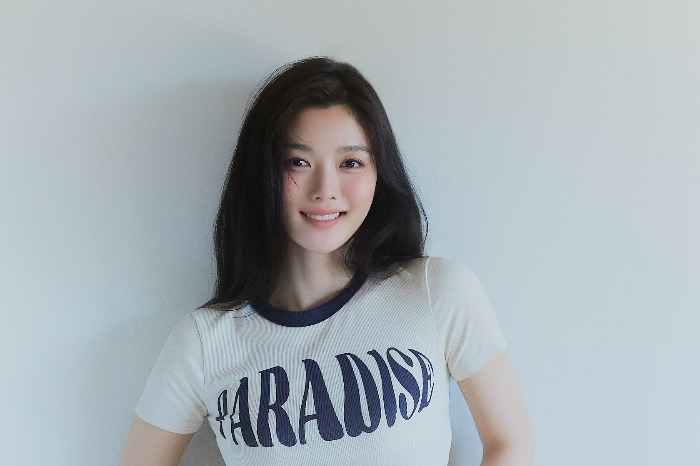

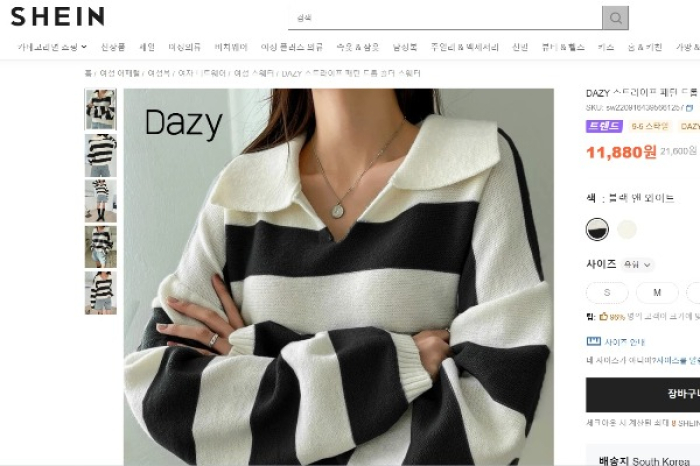

Targeting young female shoppers, it recently tapped Korean actress Kim Yoo-jung as the first global ambassador for its fashion subbrand, Dazy.

The Chinese e-commerce platform established its South Korean unit in December 2022. It has been promoting its products through social media since August of last year.

Its entry into Asia's No. 4 economy further threatens Korean e-commerce platforms, adding to the encroachment of Chinese rivals AliExpress and Temu, steadily eating away at Korean rivals' market shares.

Shein trails far behind Korean street fashion online malls such as Musinsa, Ably and ZigZag in terms of user numbers, but is rapidly penetrating into the country with ultra-low-price clothes.

Last year, Temu landed in South Korea following AliExpress' entrance in 2018, cracking the country's online retail landscape led by Coupang Inc., SSG.COM and Gmarket.

Shein, also known as the Chinese version of Uniqlo, has seen an increase in users in South Korea since the start of this year.

Last month, the number of Shein’s active monthly users in the country climbed 10.3% to its record 660,838 the month previous, according Mobile Index, a big data platform. The figures are based on its app users of both Android and Apple smartphones.

The user number is still just one-tenth that of each AliExpress and Temu, but contrasts the decline in MAU count of its two Chinese peers in Korea over the same period.

Shein sells fashion products in over 150 countries, excluding China. Last year, its net profit came in at $2 billion, surpassing that of each Zara and H&M.

“Just as AliExpress and Temu grew rapidly through their ultra-low prices, we cannot rule out the possibility Shein could rise to the top of domestic fashion apps," said a fashion industry official.

Despite Shein's competitive pricing, industry observers said its success will depend on how fast they can provide trendy and high quality products.

Shein, along with AliExpress and Temu, are under scrutiny in South Korea over the safety of products sold on their platforms and the appropriateness of consumer protection measures.

In April this year, the Seoul Metropolitan Government said some products sold on AliExpress were found to contain hazardous substances far exceeding permitted levels.

The announcement came a month after South Korea unveiled a set of consumer protection measures targeting Chinese e-commerce platforms amid rising complaints of fake or low-quality goods sold on their malls.

After moving its headquarters to Singapore in 2022, Shein is seeking to list on the London Stock Exchange.

Write to Sun A Lee at suna@hankyung.com

Yeonhee Kim edited this article.

-

RetailShinsegae hires Alibaba Korea head to lead online mall Gmarket

RetailShinsegae hires Alibaba Korea head to lead online mall GmarketJun 19, 2024 (Gmt+09:00)

2 Min read -

E-commerceCoupang fined $102 mn for alleged search algorithm manipulation

E-commerceCoupang fined $102 mn for alleged search algorithm manipulationJun 13, 2024 (Gmt+09:00)

3 Min read -

E-commerceYouTube, Coupang offer Shopping affiliate program in Korea

E-commerceYouTube, Coupang offer Shopping affiliate program in KoreaJun 05, 2024 (Gmt+09:00)

1 Min read -

EarningsCoupang to keep investing against Chinese players despite loss

EarningsCoupang to keep investing against Chinese players despite lossMay 08, 2024 (Gmt+09:00)

4 Min read -

E-commerceAlibaba eyes 1st investment in Korean e-commerce platform

E-commerceAlibaba eyes 1st investment in Korean e-commerce platformApr 22, 2024 (Gmt+09:00)

2 Min read -

RegulationsCarcinogens found in kids' goods sold on Chinese apps; Temu under probe

RegulationsCarcinogens found in kids' goods sold on Chinese apps; Temu under probeApr 08, 2024 (Gmt+09:00)

4 Min read -

-

RegulationsSouth Korea gets tough with Chinese platforms AliExpress, Temu, Shein

RegulationsSouth Korea gets tough with Chinese platforms AliExpress, Temu, SheinMar 13, 2024 (Gmt+09:00)

3 Min read -

E-commerceKorea probes AliExpress as Chinese e-commerce threat grows

E-commerceKorea probes AliExpress as Chinese e-commerce threat growsMar 07, 2024 (Gmt+09:00)

4 Min read -

E-commerceAliExpress’ zero-commission offer jolts Coupang, Naver

E-commerceAliExpress’ zero-commission offer jolts Coupang, NaverJan 31, 2024 (Gmt+09:00)

2 Min read -

E-commerceChina’s Temu challenges homegrown e-commerce platforms in Korea

E-commerceChina’s Temu challenges homegrown e-commerce platforms in KoreaOct 19, 2023 (Gmt+09:00)

3 Min read