Corporate bonds

Korea’s Eduwill suffers credit-rating cuts, capital erosion

Its fall comes in line with the declining popularity of civil servant and real estate agent jobs in South Korea

By May 16, 2024 (Gmt+09:00)

3

Min read

Most Read

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

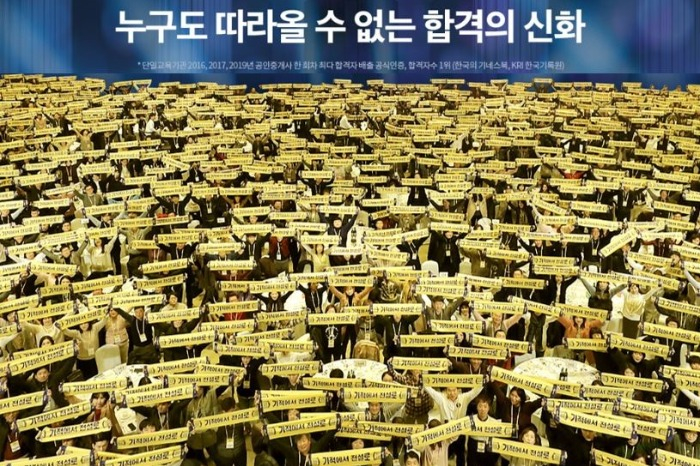

Eduwill Corp., South Korea’s leading provider of online and offline test prep courses for adults, has taken a hit from a series of credit-rating downgrades amid a decline in the popularity of real estate agent and civil service jobs in the country.

Korea Ratings announced on Monday it cut the credit rating of Eduwill’s debt by one notch, to B+ from BB- with a ‘Negative’ outlook, citing a fall in the popularity of those jobs among Koreans.

This marked the second rating cut for Eduwill since July 2022 when its credit was rated at BB with a ‘Positive’ outlook.

The company’s cash cows are prep courses for the national real estate agent licensing exams and rigorous state tests for selecting civil servants, accounting for 39.2% and 26.9%, respectively, of its total revenue between 2019 and 2021.

Applications for Korea’s real estate agent licensing exams last year dropped to 290,000 from 400,000 in 2021, while the competition ratio for the country’s public servant selection exams plunged to its lowest level, 21.8 to 1, since 2001, when it was 19.7 to 1. At one point in 2011, it surpassed 90 to 1.

What's worse, the end of the COVID-19 pandemic has significantly dampened demand for the company’s online learning courses.

Korea Ratings forecast no imminent recovery in the company’s operating income and financial health.

As fewer people register for real estate agent and civil servant exam courses, the company’s earnings have spiraled downward in recent years.

Last year, it stayed in the red with a net loss of 17.5 billion won ($13 million), slightly narrower than the previous year’s loss of 20.3 billion won. Its revenues fell 22.8% to 112.8 billion won over the same period.

Despite new share sales, the company’s capital has remained impaired for two years in a row since 2022.

JOB MARKET CHANGES

Founded in 1992, Eduwill quickly commanded Korea’s exam preparation and tutoring market as the nation’s young elite clamored for civil service work.

Public sector jobs in the country were long considered prestigious launch pads for careers with high job security.

But many young people now shun public service jobs due to low salaries compared with private sector jobs and the strict hierarchical structure.

Korea Ratings also cited recent changes in the country’s public service job recruitment policy as another reason for the fall in such jobs' popularity.

The country’s prolonged real estate market slump is also blamed for a drop in applicants for real estate agent licensing tests, Korea’s major credit rating firm said.

With no sign of an immediate recovery in the country’s real estate market, it appears hard for Eduwill to execute a rebound in the number of prep course students for a while.

As part of a restructuring, Eduwill has laid off employees, slashing its workforce to 337 at the end of 2023 from 874 a year earlier. Over the same period, it also cut ad spending to 13.3 billion won from 32.8 billion won while shuttering more than half of its brick-and-mortar learning centers, leaving only 15 sites open nationwide.

Its founder and chairman Yang Hyung-nam has returned to Eduwill’s CEO position to try to resuscitate the company.

Yet without a revival in these job markets, his return won’t revitalize the company any time soon, Korea Ratings said.

Write to Hyun-Ju Jang at blacksea@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EconomyKorea needs population growth for sustainability: World Bank chief

EconomyKorea needs population growth for sustainability: World Bank chiefJan 25, 2024 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s labor gains slow in November with fewer jobs for young people

EconomyS.Korea’s labor gains slow in November with fewer jobs for young peopleDec 13, 2023 (Gmt+09:00)

3 Min read -

EconomyShrinking youth jobs cast shadow over S.Korea’s labor market

EconomyShrinking youth jobs cast shadow over S.Korea’s labor marketJul 12, 2023 (Gmt+09:00)

2 Min read -

Alternative investmentsKorea Ratings forays into online due diligence for alternatives

Alternative investmentsKorea Ratings forays into online due diligence for alternativesMar 07, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN