South Korean webtoon makers in quandary after pandemic

Domestic webtoons are increasingly sidelined by short-form content available on TikTok and YouTube

By Jun 14, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

At the height of the COVID-19 pandemic a few years back, social distancing was the rule of life. People stayed at home, with many of them killing time reading webtoons and watching videos on their smartphones.

South Korea’s webtoon companies enjoyed the boom, as quite a few webtoons were made into K-drama and then featured on over-the-top (OTT) platforms around the globe. Those were the days.

Post-pandemic, people don't watch mobile webtoons as much. The good old days are over. And Korean webtoon makers are suffering.

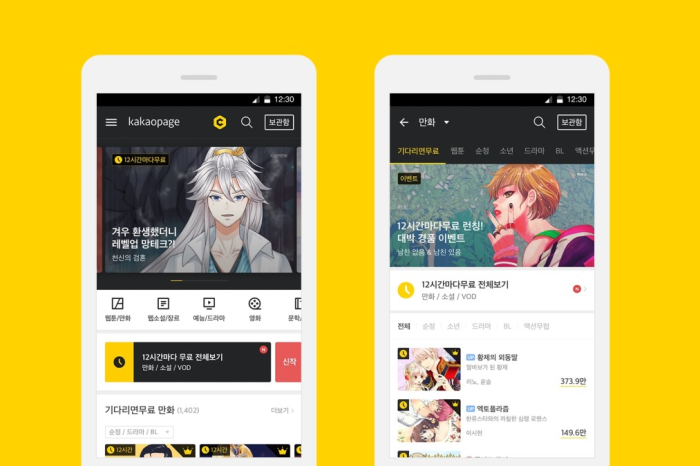

According to IGAWorks Co., a Korean mobile data analysis firm, the combined use time of Korea’s four major webtoon platforms – Naver Webtoon, KakaoPage, Naver Series and Kakao Webtoon – peaked at the end of 2022 and is continuing to fall.

The major four’s monthly platform use time on Android smartphones was 99.49 million hours in April, down 11.2% from the same month a year earlier.

The decline accelerated from a decrease of 5.8% in 2023 from the year prior.

During the pandemic, people’s monthly use of the four webtoon platforms rose 29.3% in April 2022 from the same month three years earlier.

Despite the declining popularity of webtoons, however, the domestic webtoon industry steadily grew to 1.83 trillion won ($1.33 billion) in 2022, up 16.8% from the previous year, according to the Korea Creative Content Agency.

FEELING THE PINCH

Industry officials said growth in the Korean webtoon market peaked in 2022.

“Naver Webtoon and KakaoPage have seemed to maintain their growth. But webtoon makers, which supply webtoons to such platforms, have been feeling the pinch for some time,” said Choi Sang-gyu, chief executive of RealDraw, an AI webtoon generator.

According to InnoForest, a Korean company that analyzes startups’ growth models, nine out of 10 domestic webtoon makers saw their earnings worsen last year, with eight of them remaining in the red.

KidariStudio Inc. posted an operating loss of 5.74 billion won in 2023, a turnaround from 4.26 billion won in profit the year prior.

Samyang CNC Co. also swung to a loss. It posted 1.45 billion won in operating losses last year compared with a profit of 1.92 billion won in 2022.

YLAB Co. saw its losses dramatically widen to 5.51 billion won from 440 million won a year earlier.

Naver Webtoon, an affiliate of Korea’s leading online platform operator Naver Corp., posted a 2023 operating profit of 64.3 billion won, barely changed from its year-earlier profit.

“If the webtoon industry remains in a quandary, it means K-drama producers will also find it hard to secure good original webtoons to dramatize,” said an industry executive.

Korean drama series that have enjoyed global popularity on the back of the Korean wave, or hallyu, are mostly based on webtoons.

Recent examples include “Moving,” “Mask Girl,” “Sweet Home,” and “All of US Are Dead,” which have also become popular abroad.

OVERWHELMED BY TIKTOK, YOUTUBE

Analysts attribute the declining popularity of webtoons to the rise of short-form video content available on platforms such as TikTok and YouTube.

The use time of TikTok on Android smartphones in Korea more than tripled to 39.31 million hours in April from the same month five years ago.

The use time of YouTube, which recently strengthened its short-form content Shorts, increased 15.5% to 1.24 billion hours in April from two years earlier.

With the domestic webtoon market struggling, companies are turning their sights overseas.

Realdraw, established in 2023, said it is targeting the Japanese market rather than the domestic market for its drama production debut.

Analysts said overseas markets are also hard for Korean webtoon makers to crack.

In 2020, some 56.7% of Korean webtoon producers exported their products. The ratio fell to 43.6% in 2022, meaning selling webtoons overseas became harder.

Write to Joo-Wan Kim at kjwan@hankyung.com

In-Soo Nam edited this article.

-

EntertainmentDisney Plus movin’ on up in Korea with hit K-drama series 'Moving'

EntertainmentDisney Plus movin’ on up in Korea with hit K-drama series 'Moving'Sep 06, 2023 (Gmt+09:00)

2 Min read -

IPOsNaver enlists Goldman Sachs, Morgan Stanley for US IPO of webtoon unit

IPOsNaver enlists Goldman Sachs, Morgan Stanley for US IPO of webtoon unitFeb 19, 2024 (Gmt+09:00)

2 Min read -

Korean startupsAI webtoon generator Realdraw earns most votes at D.Day

Korean startupsAI webtoon generator Realdraw earns most votes at D.DaySep 01, 2023 (Gmt+09:00)

1 Min read -

EntertainmentK-content shares rise as OTTs bask in success of dramatized webtoons

EntertainmentK-content shares rise as OTTs bask in success of dramatized webtoonsJan 20, 2021 (Gmt+09:00)

3 Min read -

WebtoonsNaver Webtoon to pursue profits with Yonder app launch in US

WebtoonsNaver Webtoon to pursue profits with Yonder app launch in USOct 31, 2022 (Gmt+09:00)

3 Min read -

WebtoonsNaver Webtoon to pursue profitability with more paying subscribers

WebtoonsNaver Webtoon to pursue profitability with more paying subscribersAug 30, 2022 (Gmt+09:00)

2 Min read