Korea approves HD KSOE-STX Heavy merger with conditions

The FTC bans the merged company from refusing or delaying supplies, raising prices to guarantee minimum supplies

By Jul 15, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Samsung steps up AR race with advanced microdisplay for smart glasses

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

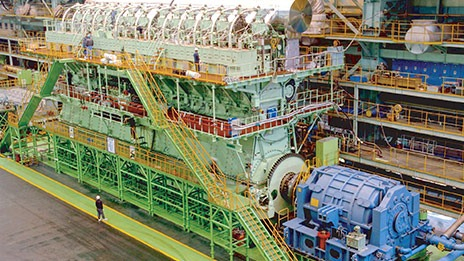

South Korea’s antitrust body has given a conditional nod to leading domestic shipyard HD Korea Shipbuilding & Offshore Engineering Co.'s (HD KSOE) acquisition of STX Heavy Industries Co., allowing the merged entity to cement its dominance in the local ship engine market.

The Korea Fair Trade Commission (FTC) said on Monday it has conditionally approved HD KSOE’s purchase of a 35.05% stake in STX Heavy, a vessel engine maker.

The deal is expected to allow HD KSOE, the intermediate shipbuilding holding firm of the country’s shipbuilding and machinery conglomerate HD Hyundai Co., to control 70% of the local vessel engine market and 80% of the domestic engine component sector since its subsidiary HD Hyundai Heavy Industries Co. manufactures such parts.

As conditions of the merger, the FTC prohibited the merged company from refusing to supply ship engine parts, raising prices or delaying component supplies to guarantee minimum supply volumes for three years.

“The approval kept the purpose of the merged company to strengthen competitiveness in the global engine market through investments in eco-friendly engines while preparing the minimum safety net for rival engine manufacturers,” the FTC said.

“We made sure that the national key industries – shipbuilding and related intermediate goods sectors – can maintain fair competition.”

HANWHA ENGINE

The antitrust body reviewed the potential restriction in competition in the vertical merger of engine parts and ship engines, the horizontal merger of ship engines, and the vertical merger of ship engines and vessels.

The watchdog judged that the merged entity may significantly interrupt rival ship engine makers with the vertical merger of components and engines if it does not supply crankshafts to competitors.

South Korea currently has three crankshaft manufacturers – HD Hyundai Heavy Industries, STX Heavy’s subsidiary KM Crankshaft Co. and Doosan Enerbility Co.

HD Hyundai Heavy Industries, STX Heavy and Hanwha Engine Co. are competing in the ship engine market.

Hanwha Engine, a unit of South Korea’s chemicals-to-defense conglomerate Hanwha Group, procures 80% of crankshafts for production from Doosan Enerbility and the rest from KM Crankshaft.

Hanwha Engine may suffer manufacturing disruption if the wholly owned subsidiary of STX Heavy suspends the supply of the core parts, the FTC said. HD Hyundai Heavy Industries and STX Heavy are likely to benefit from such issues, damaging fair competition in the market, the regulator added.

To prevent such moves, the antitrust body banned the merged company from refusing part supplies, hiking prices and delaying supplies to guarantee minimum supply volumes for three years with options to extend the measures if necessary as conditions to approve the combination.

The FTC did not see risks of limiting competition from the horizontal merger of ship engines, as well as the vertical merger of ship engines and vessels as the competition with Hanwha Engine is expected to make anti-competition practices such as price-fixing difficult.

SHIP ORDERS

Separately, HD KSOE said it has bagged a 3.7 trillion won ($2.7 billion) deal to build 12 15,500 twenty-foot equivalent unit (TEU) class container ships from a European customer, which was presumed to be with French CMA CGM.

Those containers to be built by HD KSOE’s subsidiaries – HD Hyundai Heavy Industries and HD Hyundai Samho Co. – will be equipped with duel fuel engines, which use liquefied natural gas (LNG) and bunker fuel.

HD KSOE was reportedly in talks with the world's third-largest shipping company to build six more container ships, industry sources in Seoul said.

HD KSOE has won $16.3 billion in shipbuilding contracts so far this year, 120.5% of its 2024 order target of $13.5 billion.

New container ship prices rose 15.8% to $220 million on average from $190 million in July 2023, according to industry tracker Clarksons Research.

Write to Hyung-Kyu Kim and Sul-Gi Lee at khk@hankyung.com

Jongwoo Cheon edited this article.

-

Shipping & ShipbuildingHD Hyundai Samho expands berthing facilities

Shipping & ShipbuildingHD Hyundai Samho expands berthing facilitiesJul 10, 2024 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingHD KSOE eyes $3.4 bn worth of orders from France's CMA CGM

Shipping & ShipbuildingHD KSOE eyes $3.4 bn worth of orders from France's CMA CGMJun 24, 2024 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingS.Korea’s HD KSOE bags $1.1 bn order to build LNG carriers

Shipping & ShipbuildingS.Korea’s HD KSOE bags $1.1 bn order to build LNG carriersFeb 26, 2024 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingKorea's HD KSOE to buy 35% stake in marine engine maker STX

Shipping & ShipbuildingKorea's HD KSOE to buy 35% stake in marine engine maker STXJul 31, 2023 (Gmt+09:00)

1 Min read