HD KSOE eyes $3.4 bn worth of orders from France's CMA CGM

The company is expected to exceed its sales target for this year; prolonged US-China conflicts benefit Korean shipbuilders

By Jun 24, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

South Korea’s largest shipbuilder, HD Korea Shipbuilding & Offshore Engineering Co. (HD KSOE), is eyeing around $3.4 billion worth of orders from CMA CGM, the global No. 3 shipping company, amid expectations of rising container ship prices.

Shipping industry sources said on Sunday that HD KSOE, the interim shipbuilding holding company under HD Hyundai, has signed a letter of intent with CMA CGM to build 18 container ships, including six vessels of 80,000 twenty-foot equivalent units (TEUs) each and 12 vessels of 15,000 TEUs each, and will close the deal in around a month.

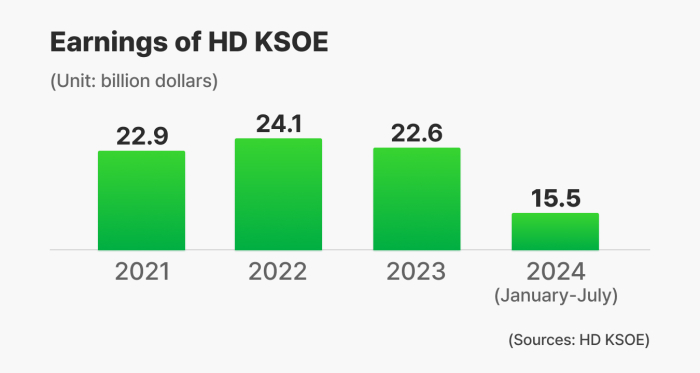

If the final deal is clinched, HD KSOE will achieve $15.5 billion in orders this year, exceeding the target of $13.5 billion. The company will build the six and 12 dual-fuel container ships in sequence for delivery in 2027 and 2028.

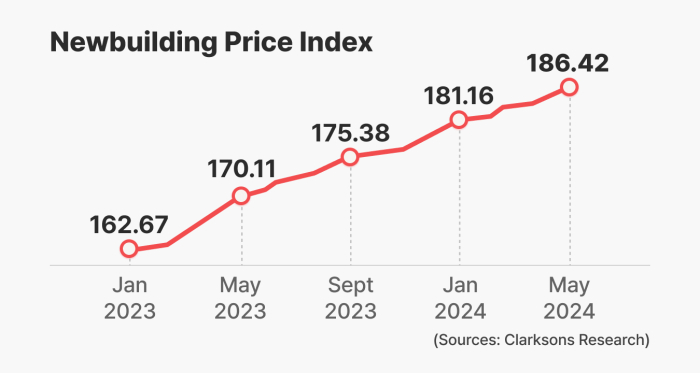

The newbuilding price of 15,000-TEU LNG dual-fuel vessel is more than $200 million per unit, nearly doubling the year-earlier price, according to Clarksons Research.

“The price of container ships continues to increase, compared with the price growth slowdown in LNG carriers and large oil tankers,” a shipbuilding industry official said.

Global shipping giants, including Denmark’s A.P. Moller - Maersk A/S, Germany’s Hapag-Lloyd AG and China’s Cosco Shipping Corp. are also poised to award shipbuilding orders amid expectations that the maritime transport market is on a long-term upward curve, according to industry sources.

RISE IN CONTAINER SHIP PRICES

The Shanghai Containerized Freight Index (SCFI), a key indicator for container shipping rates, has continued to increase since March 29 due to prolonged disruptions to global trade in the Red Sea.

The index increased for 11 straight weeks to 3476.60 last week, driving a surge in the container vessel newbuilding price index.

Korean shipbuilders haven’t built container vessels, once a cash cow, in recent years as China has become the dominant player in the market. Chinese shipbuilders make up more than 50% of the global container ship market and 96% of global container orders, according to the Center for Strategic and International Studies (CSIS).

Korea’s shipbuilding major Hanwha Ocean Co. has temporarily suspended taking container ship orders since last year, while HD KSOE has focused on sales of gas carriers such as ammonia carriers as its dockyards are full with three-year deliveries, without enough space for large-sized container ships.

As the US-China trade feud expands into maritime logistics, Korean shipbuilders are expected to attract more orders from global ship owners, which will keep Chinese companies in check, industry sources said.

Write to Hyung-Kyu Kim at khk@hankyung.com

Jihyun Kim edited this article.

-

Leadership & ManagementHD Hyundai’s ascent driven by visionary spinoff push

Leadership & ManagementHD Hyundai’s ascent driven by visionary spinoff pushJun 10, 2024 (Gmt+09:00)

3 Min read -

EnergyKorea’s HD Hyundai Electric wins $60 mn transformer deal in UK

EnergyKorea’s HD Hyundai Electric wins $60 mn transformer deal in UKMay 29, 2024 (Gmt+09:00)

1 Min read -

IPOsHD Hyundai Marine Solution stock price doubles on Kospi debut

IPOsHD Hyundai Marine Solution stock price doubles on Kospi debutMay 08, 2024 (Gmt+09:00)

2 Min read -

Upcoming IPOsOverhang concerns loom over HD Hyundai Marine IPO shares

Upcoming IPOsOverhang concerns loom over HD Hyundai Marine IPO sharesMay 03, 2024 (Gmt+09:00)

3 Min read