CU, GS25 in fierce race for top spot in Korea’s convenience store market

CU, operated by BGF Retail, is rapidly narrowing the sales gap with GS Retail’s GS25, which aims to boost profitability

By Oct 07, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Samsung steps up AR race with advanced microdisplay for smart glasses

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

Using multiple measures, CU and GS25 both claim they are the No. 1 player in South Korea’s convenience store (CV) market.

CU, operated by BGF Retail Co., says it is the top Korean convenience store chain in terms of store count and profitability. Meanwhile, GS Retail Co., the operator of GS25, asserts it is Korea’s No. 1 in terms of sales revenue.

The battle for the top spot is so fierce that the two rivals employ a variety of tactics in a bid to become the undisputed leader in the Korean market, with CU striving to outdo GS25 in sales while GS makes efforts to boost profitability.

According to BGF Retail, CU has created and positioned mobile convenience stores at regional festivals and sporting events more than 20 times this year.

BGF Retail said these trucks are used for periods as short as a few days or even one day.

In March, CU made its mobile convenience stores official by stipulating such practices in its in-house regulations after testing the system on a trial basis for months.

HIGHLY PROFITABLE

The mobile stores have proven highly profitable, with daily sales exceeding ten times those of traditional stores.

For example, during a soccer match in August between Seoul E-Land FC and Suwon Samsung Bluewings at the Mokdong Sports Complex in Seoul, CU set up a mobile store outside the venue near the visiting team's section, which lacked convenience stores.

In just one day, more than 1,200 people visited that mobile store, generating tens of millions of won in sales, according to BGF officials.

Given that the average daily sales of a standard convenience store range from 1.5 million won to 2 million won ($1,115 to $1,487), mobile stores earned more than ten times as much. Revenue from these mobile stores is recorded as part of CU's franchise store sales.

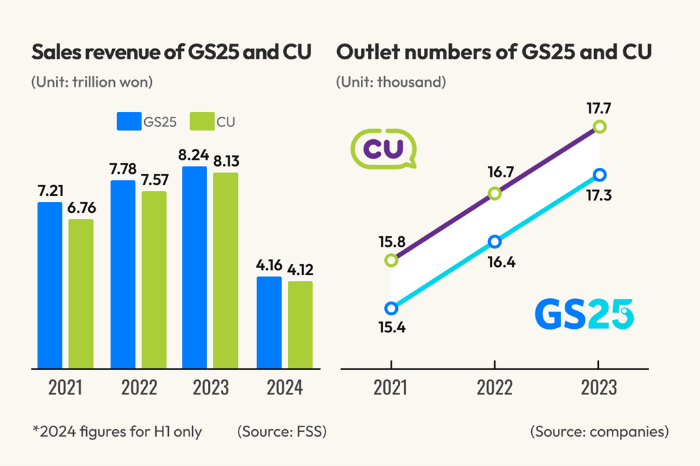

In terms of store numbers and profitability, CU is already ahead of GS25.

CU has been operating the largest number of convenience stores in Korea since outnumbering GS25 in 2020.

CU also earns more than GS25.

In the first half, CU posted 108.8 billion won in operating profit — more than GS25’s 91.2 billion won.

"Achieving No. 1 sales is the final step for CU to firmly establish itself as the number one convenience store in Korea,” said an industry executive.

NARROWING SALES GAP

To boost its sales, CU has also launched “hit products” this year, such as Dubai-style chocolates and fresh-lemon highball. Each has generated hundreds of billions of won in sales, fueling expectations it could surpass GS25’s quarterly sales before the end of the year.

In the first half, GS25, with sales of 4.16 trillion won, outpaced CU, which posted 4.12 trillion won in sales for the same period.

The 40 billion won sales gap, however, has narrowed from a gap of 113 billion won three years earlier.

On a yearly basis, the sales gap between GS25 and CU has also narrowed quickly from 449.2 billion won in 2021 to 202.2 billion won in 2022 and 114 billion won in 2023.

GS COUNTERATTACKS WITH QUICK COMMERCE

GS25 is countering by working to increase its average transaction value.

Rather than aggressively open new stores, GS25 has been seeking to boost profitability.

As part of such efforts, GS25 is bolstering its quick commerce services, delivering convenience store products within an hour through its app and third-party platforms such as Korean food delivery apps Baedal Minjok (Baemin) and Yogiyo.

According to GS25, the average order value for a delivery is 2.5 times more than the sales value of in-store customers' orders.

In May, BGF also partnered with domestic pizza franchise GoPizza to unveil GS25 stores where customers can pick up or order pizza for delivery.

There are currently about 1,000 such locations and GS25 plans to ramp up those stores to 1,500 by the end of the year.

Write to Sun-A Lee at Suna@hankyung.com

In-Soo Nam edited this article.

-

RetailBGF Retail’s CU looks beyond Kazakhstan deep into Central Asia

RetailBGF Retail’s CU looks beyond Kazakhstan deep into Central AsiaAug 20, 2024 (Gmt+09:00)

3 Min read -

-

RetailE-Mart’s No Brand success story: A Korean snack chain goes global

RetailE-Mart’s No Brand success story: A Korean snack chain goes globalJul 26, 2024 (Gmt+09:00)

2 Min read -

RetailStruggling Korean retail stores lick Dubai chocolate, Dippin' Dots

RetailStruggling Korean retail stores lick Dubai chocolate, Dippin' DotsJul 19, 2024 (Gmt+09:00)

3 Min read -

-

Business & PoliticsGS25 becomes No. 1 convenience store chain in southern Vietnam

Business & PoliticsGS25 becomes No. 1 convenience store chain in southern VietnamAug 03, 2023 (Gmt+09:00)

1 Min read -

RetailGS Retail sells unmanned serving robots in convenience stores

RetailGS Retail sells unmanned serving robots in convenience storesJun 21, 2023 (Gmt+09:00)

1 Min read