Korea likely to lift short-selling ban in April after leveling playing field

Institutional investors must repay borrowed stocks within a year, with more punishment if found guilty of naked short selling

By Jun 13, 2024 (Gmt+09:00)

S.Korea's LS Materials set to boost earnings ahead of IPO process

SK Inc. in talks to sell PharmtecoŌĆÖs US CDMO plant to Novo Nordisk

KAI inks $1.4 bn supersonic fighter jet mass production deal

Affirma Capital seeks to sell entire stake in both SeAH FS, S&G Holdings

Macquarie eyes its 1st Korean data center valued around $722 mn

South KoreaŌĆÖs financial regulator, the Financial Services Commission (FSC), said on Thursday it will extend its blanket stock short-selling ban by 10 months to the end of March 2025.

ŌĆ£If short sales resume now without a comprehensive monitoring system in place, there is a risk that large-scale illegal short selling will occur again,ŌĆØ said FSC Vice Chairman Kim So-young at a media briefing.

Analysts said Korea, AsiaŌĆÖs fourth-largest economy, will likely resume stock short-selling practice as early as April after revising relevant rules to level the playing field between retail and institutional investors and strengthening fines and punishments for illicit trading practices.

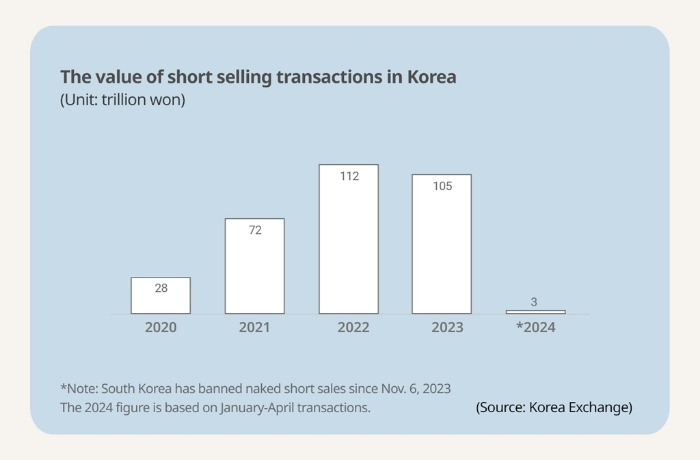

The government prohibited short selling of domestic stocks from Nov. 6 of last year through the first half of this year after some foreign banks were found to have executed a substantial amount of naked short sales, which is illegal in the country.

Last month, the Financial Supervisory Service said it fined Credit Suisse and Nomura Securities a combined 54 billion won ($40 million) in penalties over their short-selling practices.

HARSHER PUNISHMENT IN THE WORKS

Short-selling, a legitimate stock trading practice involving borrowing shares and then selling them in the market, has been an unpopular trading strategy among Korean retail investors, who often blame such a practice for sinking share prices.

Naked short selling, a practice that shorts stocks without making borrowing arrangements first, is not allowed in Korea.

Earlier on Thursday, the government held a meeting with the ruling People Power Party to finalize ways to revise short-selling rules before resuming the trading strategy.

After the meeting, the FSC said it would set up by March next year a centralized electronic monitoring platform to better detect naked short sales.

Government officials and the ruling party said they will consider mandating institutional investors, who account for more than 90% of short selling in Korea, to establish procedures to control illicit trade.

The authorities said they will also revise laws to introduce harsher punishment for illegal short sellers and adopt a mandatory repayment period of up to 12 months for both retail investors and institutional investors after short sales.

Currently, thereŌĆÖs no mandatory repayment period for institutional investors.

The FSC said it will hike the fines imposed on illegal short sellers.

Currently, those found guilty of naked short selling could be fined up to five times their gains from illegal trade.

The FSC said the maximum fine will be raised to as much as six times their profit.

BAN IMPEDES MSCI UPGRADE

Critics blame the inability to place bearish bets as a hedging strategy in Korea for reduced transparency in the domestic market.

Last week, global index provider MSCI, which categorizes Korea as an emerging market, downgraded the country's short-selling accessibility in its annual review ŌĆō a move widely seen as a hurdle for KoreaŌĆÖs inclusion in MSCIŌĆÖs developed-markets index.

Write to Han-Gyeol Seon at always@hankyung.com

In-Soo Nam edited this article.

-

Korean stock marketKorea's short-selling ban impedes MSCI index upgrade

Korean stock marketKorea's short-selling ban impedes MSCI index upgradeJun 07, 2024 (Gmt+09:00)

1 Min read -

MarketsKorea to fine Credit Suisse, Nomura $40 mn on short sales

MarketsKorea to fine Credit Suisse, Nomura $40 mn on short salesMay 07, 2024 (Gmt+09:00)

3 Min read -

RegulationsBNP Paribas, HSBC fined $20.4 million in Korea for naked short-selling

RegulationsBNP Paribas, HSBC fined $20.4 million in Korea for naked short-sellingDec 26, 2023 (Gmt+09:00)

3 Min read -

Korean stock marketKorea warns foreigners of stricter rules on illegal short selling

Korean stock marketKorea warns foreigners of stricter rules on illegal short sellingSep 07, 2023 (Gmt+09:00)

3 Min read -

MarketsShort-selling ban keeps Korea from MSCIŌĆÖs developed-markets index

MarketsShort-selling ban keeps Korea from MSCIŌĆÖs developed-markets indexJun 22, 2021 (Gmt+09:00)

3 Min read -

Short sellingKorea to lift short-selling ban on large stocks; retail investors resist

Short sellingKorea to lift short-selling ban on large stocks; retail investors resistFeb 04, 2021 (Gmt+09:00)

2 Min read