Private equity

Kamur PE sells cutting tool maker JJ Tools to Blackstone

JJ Tools derives half of its sales from overseas markets with an operating profit margin close to 50%

By Nov 27, 2024 (Gmt+09:00)

1

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

Seoul-based Kamur Private Equity has signed a definitive agreement to sell a majority stake in South Korean industrial cutting tool manufacturer JJ Tools Co. to Blackstone, according to investment banking sources on Wednesday.

Through the deal, Kamur earned more than twice its investment, including dividend income, six years after buying the company for 200 billion won ($143 million). The deal size was not disclosed.

Blackstone confirmed the purchase of JJ Tools, but did not identify its seller.

“JJ Tools is an industry-leading business in one of our key investment themes for private equity Asia — valued-added industrials,” said Kyungmin Song, principal at Blackstone Private Equity, in a press release on Tuesday.

“We seek to . . . support JJ Tools in becoming the top pan-Asian consolidator in the cutting tools sector,” he added.

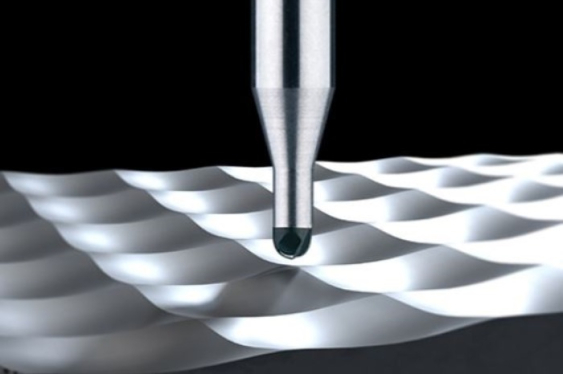

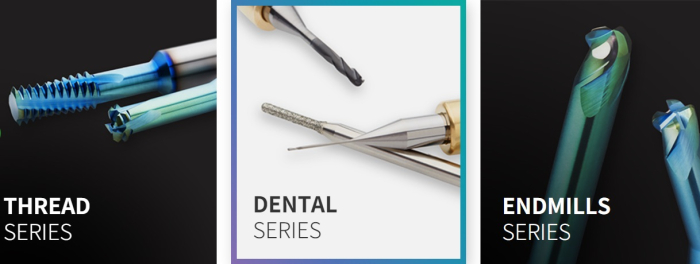

Established in 1997, JJ Tools specializes in high-precision cutting tools, including carbide end-mills, thread mills and drills, used in industries spanning semiconductors, engineering, automotive, aviation and medical.

It boasts a steady cash flow and high profit margins. In 2023, the company earned 27.4 billion won in operating profit on sales of 55.9 billion won, half of which came from overseas markets.

Its operating profit margin stood at 49.0% in 2023, with a net profit of 22.7 billion won.

Kamur PE, founded in 2018, focuses on buyout deals of small- and medium-sized enterprises in Korea. Since investing in JJ Tools, it has led its global expansion and technology development.

JJ Tools founder and Chief Executive Park Jong-ik will maintain a stake in the company and stay involved in its management.

Samjong KPMG managed the deal.

Write to Jong-Kwan Park at pjk@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepenMay 02, 2025 (Gmt+09:00)

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

Comment 0

LOG IN