PEFs

PEFs gaining clout in Korea’s broader M&A sectors

By Nov 30, 2020 (Gmt+09:00)

3

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

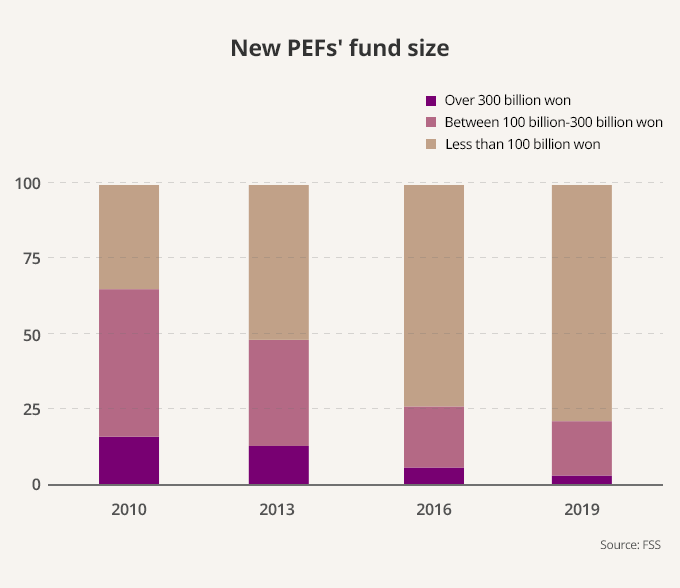

Management buyout funds, registered under the Korea Capital Market Act, managed a combined 92.2 trillion won ($83.4 billion) as of the end of September this year. Some of the money has already been invested.

In total, 321 investment firms run 750 buyout PEFs in Korea as of the end of September this year, including 136 new buyout funds launched this year, according to the regulatory Financial Supervisory Service (FSS).

Their aggregate fundraising represents more than a thirtyfold increase from the 2.9 trillion won raised in 2005 when South Korea introduced homegrown buyout PEFs in an aim to facilitate corporate restructuring and develop domestic capital funds.

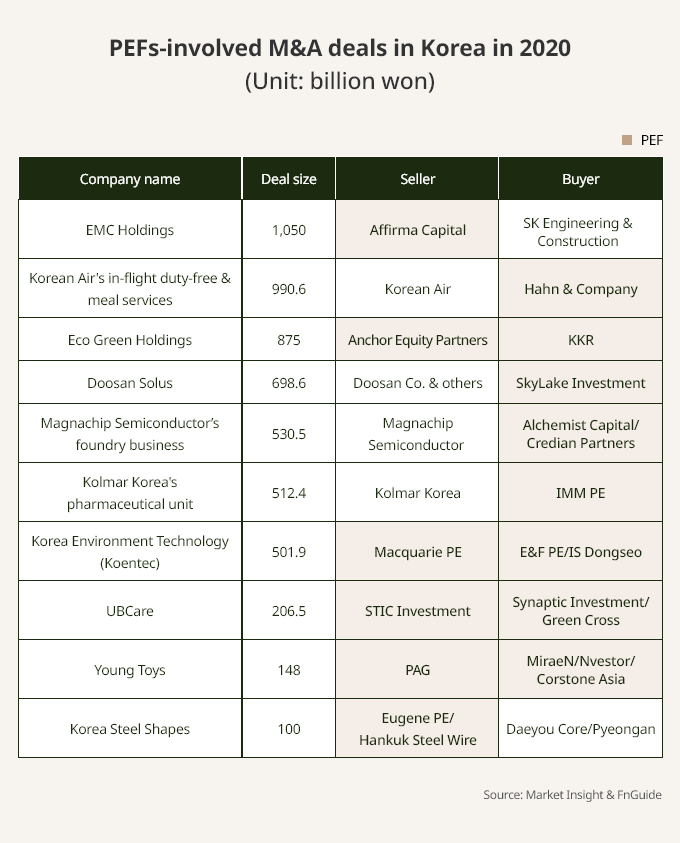

Between January and September, buyout funds participated in 38.4% of the 151 M&A transactions executed in South Korea, or 58 deals, according to data compiled jointly by The Korea Economic Daily’s capital market news outlet Market Insight and research firm FnGuide. Last year, PEF-involved M&A deals accounted for 31.1% of the total.

In bigger deals, PEFs further increased their clout. For the 37 deals valued over 100 billion won, PEFs' participation rate increased to 56.8%.

FOOD & BEVEARGE

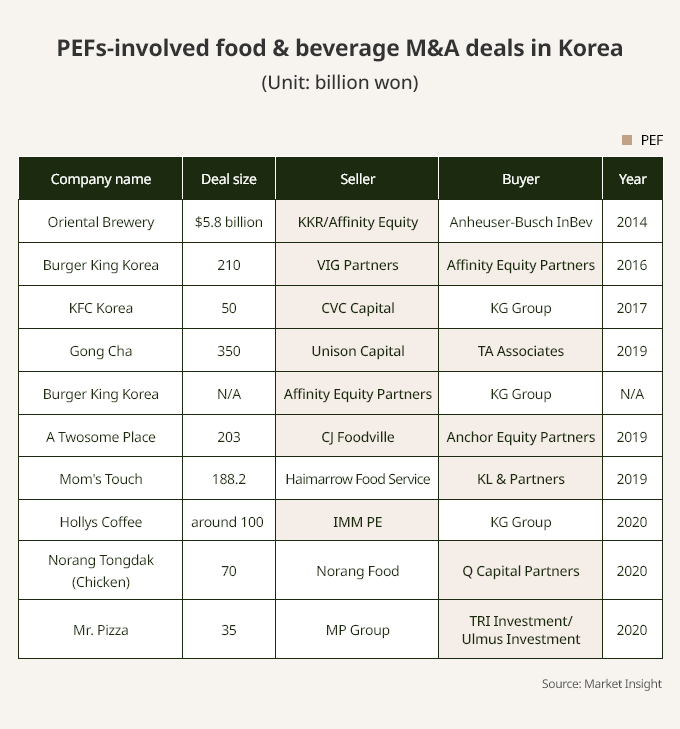

The growing presence of PEFs is notable in the food and beverage M&A market recently, as well as in the waste management industry.

In pending retail industry M&A deals, including bakery franchise Tous Les Jours and CJ Olive Young, PEFs have also participated aggressively.

“Korean PEFs have established themselves as regular liquidity providers not only in an economic crisis but also for conglomerates' voluntary restructuring,” said Korea Capital Market Institute’s analyst Park Yong-rin.

He found in his study that Korean companies saw their assets and sales grow by 16.2% and 14.2% on average, respectively, in the three years following acquisitions by PEFs between 2005 and 2019. Their debt-to-equity ratio dropped by 7.1 percentage points on average during the same period.

In Korea, buyout funds target companies shunned by large business groups, given the difficulty of post-acquisition restructuring.

Instead of carrying out job cuts and business restructuring, PEFs focus on fixing the target company’s operating inefficiency and business practices oriented towards maximizing top shareholders’ profits. Further, they tend to bulk up the target firm through bolt-on acquisitions so they can achieve economies of scale in the consolidated market.

Such an approach paid off in the waste treatment industry. Three PEFs – Macquarie PE, Affirma Capital and Anchor Equity Partners – exited from Korean waste management companies this year for handsome returns. Competitions for those companies drew KKR, Goldman Sachs and Singapore's Keppel Infrastructure Holdings.

Korea-based PEFs, including VIG Partners, also zoomed in on small and fragmented markets such as funeral services and local bus, food catering and car parking services, targeting bolt-on acquisitions.

BRINGING IN STRATEGIC INVESTORS

As buyout funds are increasingly playing a leading role in the domestic M&A market, they began to attract strategic investors after closing a deal.

Seoul-based SkyLake Investment brought in Lotte Chemical Corp. into the 698.6 billion won deal to acquire Doosan Solus Co., a battery copper foil and OLED materials maker.

A consortium of two Korean PEFs – Alchemist Capital and Credian Partners – attracted SK Hynix Inc. as an investor in the 530.5 billion won acquisition of Magnachip Semiconductor’s foundry business.

Meanwhile, secondary PE deals, or transactions between PEFs, represented 6.0% of the buyout deals sealed between January and September in Korea.

Secondary deals were picked as the preferred global PE investment choice of South Korea’s top asset owners, according to a survey by The Korea Economic Daily.

Write to Sang-eun Lucia Lee at selee@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Mergers & AcquisitionsKorea’s top cinema chains seek merger to counter box office slump

Mergers & AcquisitionsKorea’s top cinema chains seek merger to counter box office slump22 HOURS AGO

-

Mergers & AcquisitionsSoon for sale: Altos Ventures-backed Cafe Knotted operator

Mergers & AcquisitionsSoon for sale: Altos Ventures-backed Cafe Knotted operatorMay 07, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsHarman acquires Masimo’s audio arm in Samsung’s car audio push

Mergers & AcquisitionsHarman acquires Masimo’s audio arm in Samsung’s car audio pushMay 07, 2025 (Gmt+09:00)

-

Comment 0

LOG IN