Private debt

Direct lending, a core allocation for investors: M&G Investments

M&G Investment's Robert Scheer explains why proven expertise is critical to unlocking direct lending's potential

May 29, 2024 (Gmt+09:00)

long read

Most Read

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

NCSOFT invests in US game startup emptyvessel

Private credit continues to lure investors, not least within one of the largest areas of private credit, direct lending. Providing reliable income stream potential and high risk-adjusted returns, the potential of direct lending is compelling.

As a rapidly growing investment area, proven expertise is crucial for success. M&G Investments has been a pioneer within this area with one of the longest track records in the industry dating back to 2009 for mid-market lending and 1999 for syndicated loans. Our scale and reputation provide access to the most attractive investment opportunities.

The portfolio benefits of allocating towards private lending include diversification and volatility reduction. However, for Korean investors, there are other factors to be considered. Not the least, with Europe and the US dominating the private lending sector, which region is more attractive? Further, which segment within the direct lending market should investors focus on?

M&G Investments, with a 25-year pedigree in private corporate credit investment, supports investors in navigating this asset class and identifying opportunities. Offering market-leading products with attractive product structures, M&G offers investors an array of vehicles to capture the full potential of this asset class. Robert Scheer, director of European origination at M&G, provides a roadmap for investors below.

What is direct lending and how does it play a role in markets?

Direct lending provides loans directly to corporate borrowers. The direct lending market has expanded significantly for several reasons. These include retrenchment by bank lenders of credit provision due to balance sheet constraints and a trend for companies both large and small choosing to remain private for longer.

Direct lending is a portfolio diversifier due to the contractual returns it offers, the ability to generate steady income and mitigate equity market volatility given limited mark-to-market price risk. An effective inflation hedge, direct loans typically have floating rates therefore providing a hedge when both rates and inflation rise.

How is direct lending different from syndicated loans?

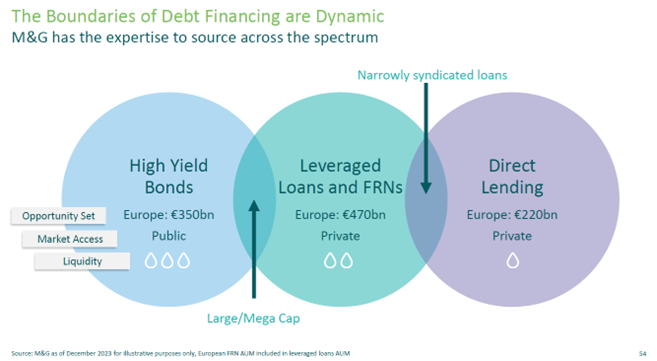

It is important to highlight that these market segments have more in common than they have differences. Both are sub-investment grade funding solutions for private equity-backed corporates, but at different ends of the spectrum. Direct lending is a subset of private corporate credit.

Rather than composed of distinctly separate asset classes, we view sub-investment grade corporate credit as being a continuum, from lending to mid-cap and large cap companies on the private side through to high-yield bond issuance by private companies from the public side. This is because most of the sub-investment-grade issuers based in Europe are private companies owned by private equity sponsors.

The main differences between the two broadly come down to the number of participants, deal size, pricing premium and liquidity. With direct lending the number of lenders involved will normally be small – often bilateral or typically less than six.

With broadly syndicated loans (BSL), there may be more than 100 participants within the syndicated pool. Consequently, the size of a syndicated loan will be far higher than the value of a direct loan, but not always. In the post-COVID-19 era, direct lending redirected about $150 billion of deal flow away from syndicated loan markets, much of which were sizeable deals.

Other differences relate to premium and liquidity. With fewer participants in a direct loan compared to a BSL, the risk is less widely spread. This concentration allows more time to be spent on each investment, both on the way in and during the life of the loan.

This results in high-conviction portfolio positions with a higher margin available to investors with the capability to forego liquidity. Finally, liquidity. Within direct lending, lenders often hold debt to maturity with limited secondary exit opportunities. Investors therefore need longer-term investment horizons. BSL are by comparison far more tradeable.

Between senior loans for the mid-market and the untrenched market, which do you highlight?

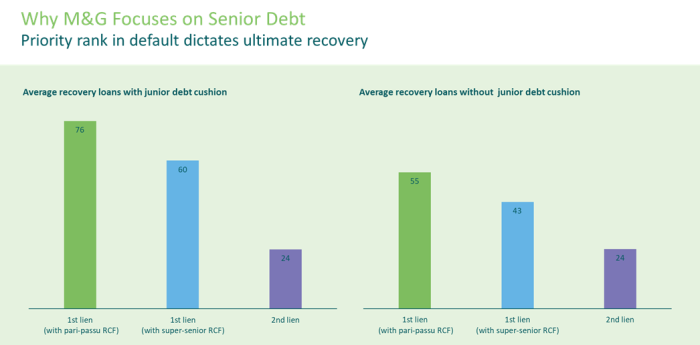

Whilst there are opportunities across the private debt spectrum, I would highlight the senior mid-market. The attraction is that facilities tend to be more conservatively structured, have lower leverage, tighter documentation and are not blended with a junior debt package. Ranking in the capital structure is one of the principal factors to recovery in the case of default, the principal risk factor in this sub-investment grade asset class.

The chart below shows the impact on recovery based on ranking. Recoveries can range from 76% for senior debt to 43% for blended type debt¹. The risk/return dynamics in direct lending are asymmetric with limited potential for capital upside, consequently minimizing credit deterioration is a key driver for returns. Senior debt offers the potential for high single-digit to double-digit yields without compromising on seniority.

The untrenched market is a hybrid of senior and subordinated debt combining both into a single loan package. For investors, the advantages are they normally offer a higher yield, a simple one-stop solution and can be more flexible. However, they are more susceptible to credit events during market downturns. The senior mid-market offers more attractive opportunities.

Where do you find most opportunities between Europe and the US?

It is important to appreciate the US direct lending market is markedly more mature than Europe. This means the US is a more competitive market. Consequently, European direct lending tends to offer superior margins versus the US.

European markets are also at lower risk, evidenced by lower default rates and tighter covenants. Whilst fluctuating, historically Europe has also tended to offer superior interest cover compared to the US. As Europe offers better returns at lower risk, this region would be my preference.

What are the key risks investors should be aware of within direct lending?

Direct lending is not risk-free and not appropriate for every investor. Inherent illiquidity within direct lending means investors need to have a long-term investment horizon – tradability within many private credit funds will be limited. Whilst borrowers are less exposed to macro factors, they are not immune to weakening overall business conditions. Any serious recession would lead to higher default rates.

A mitigating factor however is the tighter documentation of the deals via maintenance covenants, governing the depth of access direct lenders have to company management and financial information. This allows a higher level of due diligence both before and during the life of a loan relative to a bank. This close ongoing relationship and maintenance covenant requirements means potential corporate problems are highlighted early with the lender and sponsor potentially being able to assist and prevent a default.

Manager selection is crucial – what differentiates M&G Investments?

I would say be wary of choosing a manager based on short-term performance. The last 10 years have been a benign environment and not the best indicator of a manager’s investment ability. At M&G we have been investing in private debt since 1999, deploying €40 billion over the last 10 years maintaining a highly selective approach through multiple credit cycles. In our large-cap strategy, we have avoided 94% of defaults and in our mid-market strategy, we have never realized an impairment.

Further differentiating M&G is our market reputation and scale. We manage £29 billion in private debt as of March 31, providing superior access to the most attractive investment opportunities. Our borrowers regard us as a trusted partner.

Commitment of resources is another key factor. I recommend investors research the quality of credit expertise within investment teams. What is their pedigree? How long have they been investing in the direct lending market? What resources are at their disposal? Do they have workout capabilities? M&G excels in being one of the most established managers within the asset class. We have a 25-year heritage managing private credit investments, supported by over 500 professionals across our wider private markets team.

Important Information for qualified professional investors only. Not for onward distribution. No other persons should rely on any information contained within.

Before joining M&G, Scheer spent more than 10 years at ING most recently as a director in the acquisition finance team in Frankfurt and worked at Commerzbank in Franfurt for more than three years.

He holds a bachelor's degree in business administration from the Frankfurt School of Finance & Management and a master's in finance from INSEAD, Singapore.

Jennifer Nicholson-Breen edited this article.

More to Read

-

-

Asset managementFlexibility unlocks opportunities: M&G Investments

Asset managementFlexibility unlocks opportunities: M&G InvestmentsNov 30, 2023 (Gmt+09:00)

7 Min read -

Private debtOptimizing flexibility for fixed-income in new era: M&G

Private debtOptimizing flexibility for fixed-income in new era: M&GJul 03, 2023 (Gmt+09:00)

7 Min read

Comment 0

LOG IN