NPS overweight in beauty, food; chases APR, Samwha higher

APR's share price has climbed 30% since its Kospi debut in February; Samhwa Electric was Kospi's top performer in H1 2024

By Jul 05, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

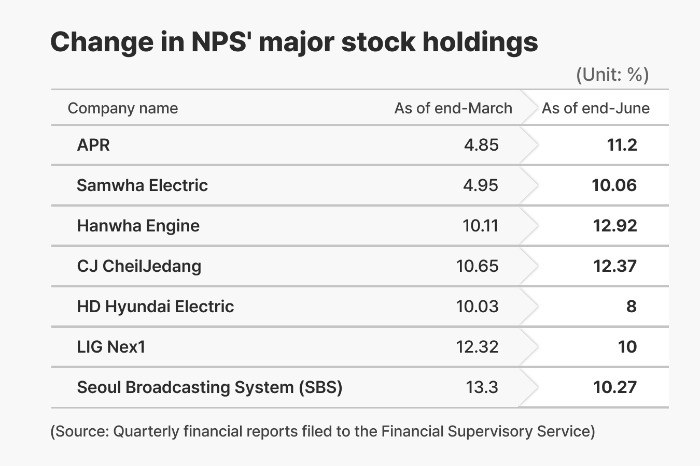

The National Pension Service (NPS) has raised its bets on South Korean beauty and food companies in the second quarter of this year on expectations that the ongoing Hallyu, or Korean Wave, will continue to power their export growth.

The world’s third-largest pension scheme remained overweight in the shipbuilding industry, but reduced its stake in defense stocks such as LIG Nex1 Co. and Poongsan Corp.

APR Co., a skincare products maker that debuted on the Kospi in February this year, topped the list of stocks to which the NPS sharply raised its exposure.

NPS has bumped up its stake in APR from 4.85% to 11.20% as of the end of June, according to its quarterly report to the Financial Supervisory Service. The share price of the beauty technology company has surged by 30% since its initial public offering.

In a portfolio reshuffling of domestic stocks in the April-June quarter, the pension plan adjusted its exposure to 112 listed companies: 87 stocks traded on the Kospi and 25 Kosdaq-listed companies.

Among cosmetics makers, NPS’ holdings in the two top original development and design manufacturers (ODMs) in South Korea -- Cosmax Inc. and Kolmar Korea Co. – rose by 0.66 percentage points and 0.57 percentage points, respectively.

By contrast, it cashed out gains in Cosmecca Korea Co., reducing its stake in the cosmetics manufacturer to 8.67% from 12.09% in November of last year. Its share price has more than doubled since the start of this year.

NPS remains upbeat on Korean food makers. It has lifted its stake in CJ CheilJedang Corp. and Daesang Corp., each by 1.7 percentage points.

But it has slashed its holdings in Samyang Foods Co. by 1.24 percentage points after its share price had trebled since the start of 2024.

Among power companies, its top pick was Samwha Electric Co., to which NPS has upped its stake to 10.06% from 4.95% as of the end of March.

The power equipment manufacturer logged the largest-percentage gain among Kospi-listed stocks in the first half of this year.

Among shipbuilding-related companies, the pension fund raised its exposure to ship engine maker Hanwha Engine Co. by 2.81 percentage points to 12.92%.

Write to Sang-Gi Lee at remind@hankyung.com

Yeonhee Kim edited this article.

-

Pension fundsNPS to cut global stocks under GP management, up its direct control

Pension fundsNPS to cut global stocks under GP management, up its direct controlJul 02, 2024 (Gmt+09:00)

1 Min read -

-

Pension fundsNPS logs 5.8% return in Q1 led by US tech stock rally

Pension fundsNPS logs 5.8% return in Q1 led by US tech stock rallyMay 30, 2024 (Gmt+09:00)

1 Min read -

Pension fundsNPS to spur buyout, VC in US tech sector: chairman

Pension fundsNPS to spur buyout, VC in US tech sector: chairmanMay 21, 2024 (Gmt+09:00)

1 Min read -

Pension fundsNPS to commit $1.1 billion to external managers in 2024

Pension fundsNPS to commit $1.1 billion to external managers in 2024Apr 28, 2024 (Gmt+09:00)

2 Min read -

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery shares

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery sharesApr 21, 2024 (Gmt+09:00)

3 Min read -

Tech, Media & TelecomNPS sells shares in KT, making Hyundai the top shareholder

Tech, Media & TelecomNPS sells shares in KT, making Hyundai the top shareholderApr 03, 2024 (Gmt+09:00)

1 Min read -

Korean stock marketNPS to invest up to $8.2 bn in undervalued Korean stocks

Korean stock marketNPS to invest up to $8.2 bn in undervalued Korean stocksMar 01, 2024 (Gmt+09:00)

3 Min read -

Pension fundsNPS logs record return rate in 2023 on stocks’ bull run

Pension fundsNPS logs record return rate in 2023 on stocks’ bull runFeb 28, 2024 (Gmt+09:00)

2 Min read -

Pension fundsNPS picks tech, electronics as its favorite local stocks in 2023

Pension fundsNPS picks tech, electronics as its favorite local stocks in 2023Jan 17, 2024 (Gmt+09:00)

3 Min read -

Pension fundsNPS bets on Samsung Electro-Mechanics, sells POSCO stocks in Q4

Pension fundsNPS bets on Samsung Electro-Mechanics, sells POSCO stocks in Q4Jan 15, 2024 (Gmt+09:00)

2 Min read