Pension funds

NPS to cut Korean stock allocation to 13% by 2029

S.Korea’s biggest institutional investor will up its total equity investment by 6.6 percentage points over the same period

By May 31, 2024 (Gmt+09:00)

3

Min read

Most Read

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

NCSOFT invests in US game startup emptyvessel

South Korea’s National Pension Service (NPS), also the world’s third-largest pension fund, will gradually reduce the proportion of its local equity holdings to 13% of its total assets over the next five years, which could bode ill for the overall Korean stock market.

The National Pension Fund Management Committee, the highest decision-making body at the NPS, on Friday approved a new NPS mid-term asset allocation plan for 2025-2029.

According to the new five-year plan, NPS will allocate 14.9% of its assets to domestic equity in its target portfolio by the end of 2025, down from 15.4% by the end of 2024. The weight will be eventually lowered to 13% by the end of 2029.

Under the new plan, Korea’s biggest institutional investor is set to hold 169 trillion won worth of domestic stocks in five years versus 185 trillion won under the 2024-2028 plan.

By asset, equity will account for 55% of its new target portfolio for 2029, while fixed income and alternatives will make up 30% and 15%, respectively.

Compared with the confirmed fund management plan for the end of 2024, the new equity and alternative allocation weightings will increase by 6.6 percentage points and 0.8 percentage point, respectively. However, fixed income will drop by 7.4 percentage points.

The NPS has decided to reduce the allocation of local equities in its asset portfolio to balance them with its rapidly growing assets.

Its assets under management stood at 1,101 trillion won ($796 billion) as of end-March, the world’s third-biggest pension fund, and they are expected to reach 1,300 trillion won five years later.

But the NPS is forecasting its asset growth to slow after 2027, suggesting that the fund may have to sell off some of its investment gains to pay out pensions three years later.

To prevent any market panic, which could be caused by later massive equity selloffs by the NPS, the Korean pension fund has decided to gradually reduce local stock holdings, said market analysts.

MEAGER RETURNS

Considering that Korean stocks make up a mere 1.8% of the global stock market, the Korean pension fund’s current domestic equity allocation weight of about 15% is also deemed excessive. As of end-March, they accounted for 14.2% of NPS' asset portfolio.

Despite such a sizable allocation, the annualized return on NPS investment in local equity from 1988 to 2023 was 6.53%, whereas that of global equity investment was 11.04%.

The NPS also gained 167 trillion won from its investment in overseas stocks over the same period, but collected 105 trillion won from Korean stock investment.

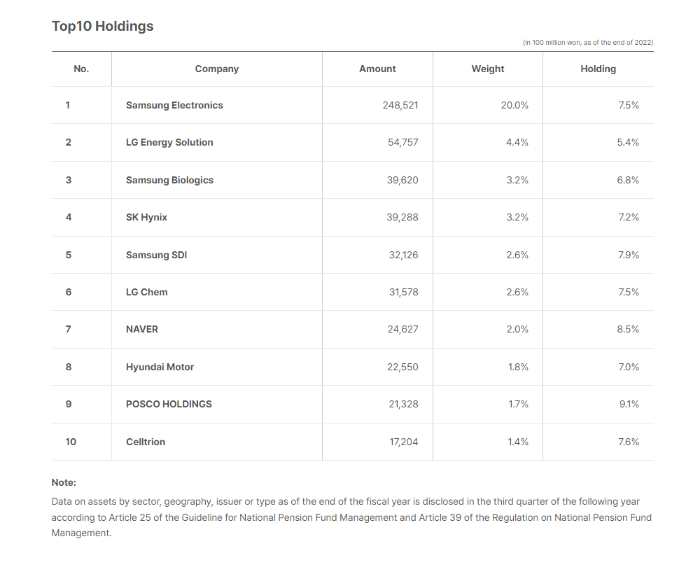

As of the end of the first quarter this year, the NPS owned 155.9 trillion won worth of Korean stocks listed in both the Kospi and Kosdaq markets, accounting for 5.8% of the total market capitalization of the two bourses.

As of May 30, it had over a 5% stake in some 276 stocks each, including 31 stocks with more than a 10% stake each.

It is also the largest shareholder of Shinhan Financial Group Co., KB Financial Group Inc., Naver Corp. and POSCO Holdings Inc.

VALUE-UP PROGRAM COULD LOSE STEAM

Under the new mid-term asset allocation plan, the NPS is expected to buy Korean stocks less than before or dispose of its stock holdings, which could weigh on the broader Korean stock market.

Considering that the NPS is the biggest institutional investor in the Korean market, the Korean government’s plan to revitalize the local stock market under the so-called corporate value-up program also could lose steam due to the new portfolio allocation plan, market analysts said.

In February, the Korean financial regulator announced guidelines for the program designed to bolster the value of local stocks with a price-to-book ratio (PBR) of less than 1.

Anticipating a boost from the program, investors have cherry-picked some of those undervalued Korean stocks since early this year.

For the value-up program to succeed, a pension fund should actively buy local stocks, said market analysts.

The financial industry had wished for the NPS to significantly increase local stock purchases like Japan’s Government Pension Investment Fund (GPIF), which had 24.7% of its total assets invested in Japanese stocks as of the end of 2023, nearly doubling the figure from 2010.

The Japanese stock market enjoyed a heyday in the first quarter of this year, breaching record highs above the 40,000 level in March.

Write to Byeong-Hwa Ryu at hwahwa@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Pension fundsNPS logs 5.8% return in Q1 led by US tech stock rally

Pension fundsNPS logs 5.8% return in Q1 led by US tech stock rallyMay 30, 2024 (Gmt+09:00)

1 Min read -

Pension fundsNPS to spur buyout, VC in US tech sector: chairman

Pension fundsNPS to spur buyout, VC in US tech sector: chairmanMay 21, 2024 (Gmt+09:00)

1 Min read -

Pension fundsNPS to hike risky asset purchases under simplified allocation system

Pension fundsNPS to hike risky asset purchases under simplified allocation systemMay 02, 2024 (Gmt+09:00)

2 Min read -

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery shares

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery sharesApr 21, 2024 (Gmt+09:00)

3 Min read -

Pension fundsNPS vows to raise alternative investment ratio, cut bond purchases

Pension fundsNPS vows to raise alternative investment ratio, cut bond purchasesJun 01, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN