Corporate strategy

SK seeks sale of specialty gas unit for around $3 bn

The conglomerate, which has more than $7.5 billion in net debt, is speeding up its restructuring to improve its financial health

By Aug 19, 2024 (Gmt+09:00)

3

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

SK Group, the second-largest conglomerate in South Korea, is considering selling global leading specialty gas producer SK Specialty Co. for around 4 trillion won ($3 billion) to accelerate the group’s restructuring push for effective management and financial health improvement.

The group’s holding firm SK Inc., which owns a 100% stake in the gas unit, is in talks with major buyout firms such as MBK Partners and Hahn & Co. for the sale of SK Specialty, investment banking industry sources said on Monday.

The sale is expected to reach around 3.6 trillion won, or 15 times the gas manufacturer’s earnings before interest, taxes, depreciation and amortization (EBITDA) last year. The deal value may exceed 4.5 trillion won given that the company is among the global top specialty gas makers, sources added.

The holding firm may sell a part of the gas unit and manage it jointly with a new shareholder, instead of divesting of a full stake in the subsidiary, according to sources.

SK Group has been in talks with potential bidders to understand market sentiment and is yet to confirm whether or not to pursue the sale, an official of the group said.

TOP PLAYER IN SPECIALTY GASES

Formerly SK Materials, SK Specialty manufactures gases used in the production of semiconductors, display and solar cells for global companies including SK Hynix Inc., Samsung Electronics Co. and LG Display Co.

The company is the world’s largest maker of nitrogen trifluoride (NF3), a gas used as a cleaning agent in semiconductors, with a 40% global market share.

SK Specialty is also the global top maker of tungsten hexafluoride (WF6), primarily used in the manufacturing of integrated circuits, with an annual production capacity of 2,000 tons.

It is also the world’s second-largest manufacturer of monosilane (SiH4), used for the production of silicon-based anodes for electric vehicle batteries.

The firm is seeing growing demand for its specialty gases as chipmakers increase production of 300 millimeter (mm) wafers, which require around 2.3 times the gases as for 200 mm wafers. Demand for gases used in battery anode production is also on the rise.

Compared with industrial gases, specialty gas manufacturing has higher entry barriers with licensing of production and sales under the country’s High-pressure Gas Safety Control Act.

RESTRUCTURING PUSH

Holding firm SK’s net debt exceeded 10 trillion won as of the end of June due to massive mergers and acquisitions over the past years. The company aims to speed up the improvement of its financial conditions by divesting of SK Specialty.

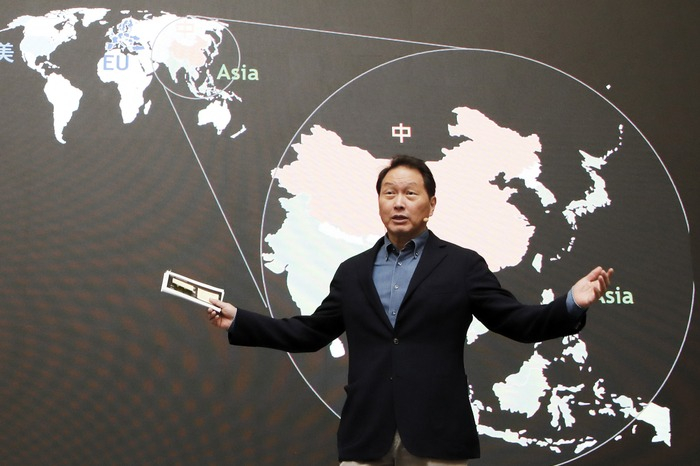

SK Group has sought drastic restructuring since Chairman Chey Tae-won said during the conglomerate’s annual seminar last October that companies may face “sudden death” if they fail to quickly adapt to disruptions. In its year-end reshuffle last December, the group streamlined the senior executive line for more efficient management.

As part of the restructuring efforts, SK Networks Co. sold its car rental unit SK Rent-a-Car Co. to Asian buyout firm Affinity Equity Partners for 800 billion won in April.

In February, resources developer SK Earthon Co. signed an agreement to sell its entire 20% stake in Peru LNG Co. to US liquefied natural gas (LNG) company MidOcean Energy LLC for $256.5 million. The deal was finalized in April.

Investment management firm SK Square sold its entire 2.2% stake in Korean gaming behemoth Krafton Inc. for 272.5 billion won through a block trade in April.

SK Group plans more deals, including the merger of the country’s top energy firm SK Innovation Co. with LNG arm SK E&S Co.

The group is also set to merge construction and waste management affiliate SK Ecoplant Co. with industrial gas unit SK Materials Airplus Inc. and consumer memory and storage maker Essencore Ltd.

Write to Ji-Eun Ha and Jun-Ho Cha at hazzys@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Mergers & AcquisitionsKorea’s top cinema chains seek merger to counter box office slump

Mergers & AcquisitionsKorea’s top cinema chains seek merger to counter box office slump8 HOURS AGO

-

Mergers & AcquisitionsSoon for sale: Altos Ventures-backed Cafe Knotted operator

Mergers & AcquisitionsSoon for sale: Altos Ventures-backed Cafe Knotted operatorMay 07, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsHarman acquires Masimo’s audio arm in Samsung’s car audio push

Mergers & AcquisitionsHarman acquires Masimo’s audio arm in Samsung’s car audio pushMay 07, 2025 (Gmt+09:00)

-

-

Woori Financial wins approval for Tongyang, ABL Life acquisition

Woori Financial wins approval for Tongyang, ABL Life acquisitionMay 02, 2025 (Gmt+09:00)

Comment 0

LOG IN