Korean startups

Colosseum poised for next leap with global expansion drive

The S.Korean on-demand logistics service-providing startup's revenue has seen a CAGR of 180% in its first five years

By Jul 29, 2024 (Gmt+09:00)

6

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Seoul-backed K-beauty brands set to make global mark

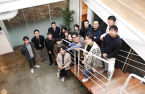

Colosseum Corporation Inc., a fulfillment startup based in South Korea, has set its sights on global conquest with its nationwide and international network of warehouses and proprietary artificial intelligence-powered one-stop logistics system Colo.

“We plan to focus more on global cross-border logistics services,” Park Jinsu, founder and chief executive officer of Colosseum, said in a recent interview with The Korea Economic Daily.

“Our five-year experience in handling the local business does not guarantee the success of our global business. Challenges abound because of differences in culture, customs, rules and habits, but we are dealing with them one by one.”

As part of its global expansion plan, the Korean logistics startup is seeking to bridge Asia and the US, where it provides cross-border logistics services that ensure the same level of stability and visibility as domestic logistics.

In November 2022, Colosseum started offering the global version of Colo, its AI-powered one-stop fulfillment program designed to streamline the logistics process and improve efficiency.

It recently secured logistics centers in the US, Japan, Taiwan, Malaysia and Thailand and set up a US entity in Los Angeles in February to penetrate the world’s biggest consumer market deeper.

To ensure robust logistics services, Colosseum is also expanding its network of logistics centers and partnerships across various sectors, including B2C, B2B, freight transportation and global logistics.

It is also an official partner of Korea SMEs and Startups Agency’s joint logistics program for online exports, meaning that any e-commerce seller using Colosseum’s global fulfillment service is entitled to a state subsidy covering 70% of Colosseum’s service fee.

The company is currently revamping its website to better serve its international clients, Park said, expecting this to accelerate its global conquest.

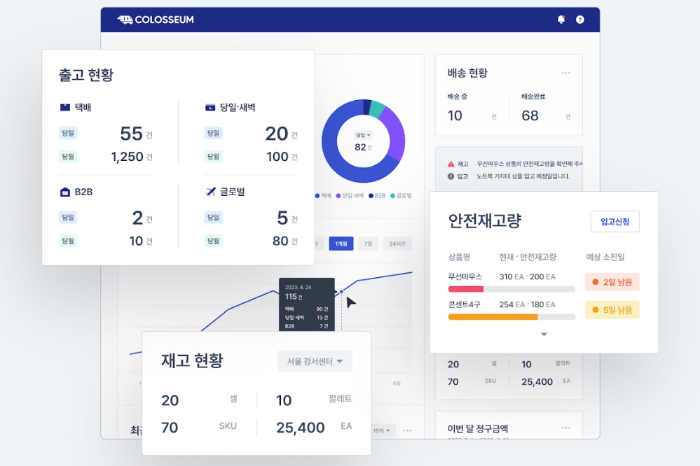

COLO AND INDIVIDUAL WAREHOUSE NETWORK

Founded in 2019, Colosseum has rapidly expanded its presence in the country’s logistics market, long dominated by bigger local and multinational corporations, thanks to its unconventional way of approaching logistics.

Logistics businesses are typically asset-based because companies need to own their own warehouses or fulfillment centers and delivery transportation systems. But Colosseum’s business is centered around technology, said its CEO.

At the core of its business is Colo, its AI-supported fulfillment program that receives orders; maps delivery data; recommends packaging size and materials; manages inventories; takes care of customer services including complaints and refunds; and deals with legal and cross-border tax issues.

With Colo, a privately held warehouse can offer end-to-end fulfillment services.

Colosseum plans to accelerate digital transformation to ensure the productivity of logistics centers, convenience of logistics operations and visibility of processes, focusing on implementing customer-centric services.

Colosseum has not built new fulfillment centers for its business. Instead, it partners with 45 individually owned existing warehouses at home and abroad to create a vast network of fulfillment centers.

Each center takes care of different items based on location, facility type and infrastructure with Colo to offer on-demand services. This means e-commerce merchants can pair up with warehouses that best meet their needs.

The network is formed with 39 fulfillment centers in Korea and the remaining six in other countries such as the US, Japan and Thailand.

“Based on our partnership with warehouses, our collaboration has expanded to include other players in the logistics value chain, and together we can offer integrated (logistics) services,” said the Colosseum founder. “The expanded partnership has created more opportunities.”

Colo is linked to scores of multinational marketplaces and e-commerce platforms, including Amazon.com, Coupang, Shopify, Shopee and Lazard, making it easier for small vendors to sell their products to customers.

Colosseum also deploys fulfillment directors (FDs) at each fulfillment center in its network.

FDs are facilitators who ensure the errorless application of Colo at each fulfillment center. With them, the host of Colosseum’s fulfillment centers can offer seamless, tailored logistics services for different clients, Park explained.

RAPID GROWTH AND R&D INVESTMENT

Thanks to the technology-based logistics infrastructure, Colosseum's performance has been escalating since its launch.

Its revenue grew at a compound annual growth rate of 180% over the past five years, and the company expects even higher revenue this year, said Park.

It offers fulfillment services not only for e-commerce players but also supermarket chains and restaurant franchises. It also deals with cargo transportation.

It shares its revenue with warehouse partners in its fulfillment center network based on services, Park said.

Colosseum invests mainly in technology development and talent recruitment for research and development to advance Colo and machine learning technology, as well as to validate and refine the quality of existing data collected from processing packages, said the Colosseum CEO.

Of its more than 80 employees, 40% are in R&D, he added.

Earlier this year, it was selected among 20 Korean startups for support from Asan Voyager, a program designed to assist Korean startups entering the US by providing acceleration, coaching, community learning and long-term residency support.

FUNDRAISING FROM OVERSEAS

The logistics startup raised more than 10 billion won ($7.2 million) in total during both pre-Series A and Series A rounds. It completed the Series A funding, which attracted funds mainly from investors in Korea, in October last year.

As Colosseum is actively seeking to go global, it hopes to raise funds from foreign venture capitalists during the next funding round, which is not yet planned, said Park.

“Because it is important to improve visibility (over the supply chain) and scale up through global expansion, the company hopes to raise funds from global VCs,” after building a track record in its next key markets such as the US and Asia, said Park.

The global logistics market is expected to extend its growth streak as more goods cross borders amid the booming e-commerce market.

“New e-commerce platforms and services are springing up every day, meaning that demand for faster and seamless delivery through logistics services is set to grow. This poses a great opportunity for us,” said Park.

“We offer services to streamline logistics workflow for warehouses. At the same time, we want to make online shopping a refined, seamless experience with high satisfaction with our more convenient and efficient handling of commodity transportation.”

Write to Sookyung Seo at skseo@hankyung.com

Jennifer Nicholson-Breen edited this article.

More to Read

-

-

Korean startupsPhyxUp closes in on pre-seed round with US advance

Korean startupsPhyxUp closes in on pre-seed round with US advanceJul 03, 2024 (Gmt+09:00)

4 Min read -

Korean startupsDentlink, virtual lab for dentists around the world

Korean startupsDentlink, virtual lab for dentists around the worldJun 20, 2024 (Gmt+09:00)

5 Min read -

-

Korean startupsKorea announces 1st local firm to issue multiple voting shares

Korean startupsKorea announces 1st local firm to issue multiple voting sharesFeb 22, 2024 (Gmt+09:00)

2 Min read -

Korean startupsColosseum rises to e-commerce challenge with one-stop solution

Korean startupsColosseum rises to e-commerce challenge with one-stop solutionMay 13, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN