Automobiles

GM Korea’s 2024 sales growth likely stunted due to protracted labor strike

If the partial strike continues at its current pace, it could also negatively affect Korea’s vehicle exports this year

By Jul 17, 2024 (Gmt+09:00)

3

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

GM Korea Co., the South Korean unit of US auto giant General Motors Co., faces growing disruptions to its vehicle production amid a protracted labor strike over wage increases.

If the work disruption continues at its current pace, the Korea unit may fail to meet its annual sales target, which could also hurt Korea’s car exports this year, analysts said.

According to data obtained by The Korea Economic Daily, unionized workers at GM Korea stopped doing overtime work on July 1 and began a partial strike on July 8, leading to the loss of 11,130 units of production during the first 14 days of this month.

Sources said GM Korea's union is determined to continue its partial strike until management offers a “satisfactory” proposal — a move that could lead to over 20,000 lost units of production this month alone.

Unionized workers are said to be demanding a basic pay increase and a performance bonus amounting to 15% of GM Korea’s 2023 net profit of 1.5 trillion won ($1 billion).

THIS YEAR’S SALES TARGET

GM Korea, the largest foreign corporate investor in Korea, has set this year’s sales target at 529,200 vehicles, up 13% from last year’s 468,059 units, based on expectations for growing demand from North America.

However, the Korean subsidiary of the Detroit auto giant has seen its operations disrupted for half a month as wage negotiations failed.

Once rumored to be pulling out of Korea over weak sales, GM Korea saw its sales grow to an all-time high of 13.73 trillion won last year, up 52% from the previous year. Its 2023 operating profit soared 388% to 1.35 trillion won, buoyed by strong exports of its two flagship SUV models, the Trailblazer and the Chevrolet Trax Crossover.

After years of bleeding, the US headquarters of GM worked out a business normalization plan for its Korean unit after consultations with the Korean government in 2018. The plan included the sale of its Gunsan plant.

GM currently holds 76% of GM Korea while the second-largest shareholder, state-run Korea Development Bank, holds a 17% stake.

GM operates three plants in Korea: two production lines in Bupyeong, west of Seoul, one in Changwon, South Gyeongsang Province, and a third in Boryeong, South Chungcheong Province.

Most of the vehicles made by GM Korea are exported, with some models sold in Korea under the Chevrolet brand.

GM KOREA PLAYS KEY ROLE IN KOREA’S CAR EXPORTS

GM Korea plays a key role in Korea’s vehicle exports.

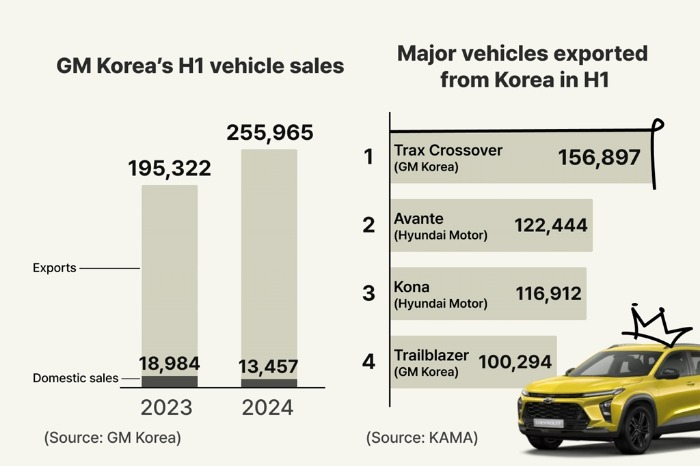

According to the Korea Automobile & Mobility Association (KAMA), the Trax Crossover, produced at GM Korea’s Changwon plant, topped the list of Korea’s vehicle exports last year with 216,833 units, overtaking perennial export leader Hyundai Motor Co.'s Kona SUV, which sold 212,489 units overseas last year.

The Trailblazer, manufactured at GM Korea’s Bupyeong plant, ranked second with 214,048 units.

In the first half of this year, GM Korea’s domestic sales declined 29.1% on-year to 13,457 units while exports rose 31% to 256,000 vehicles, resulting in a 25.7% overall sales increase.

Exports accounted for 95% of GM Korea’s total sales in the first half.

Industry officials said a continued labor strike would likely negatively affect Korea’s vehicle exports.

“GM Korea’s production disruption is not just a problem for the company alone. It will also significantly impact Korean auto exports,” said an industry official.

Korea’s vehicle exports rose 3.8% from the year-earlier period to a record $37.1 billion in the first half.

GM Korea accounts for some 20% of Korea’s total automobile exports.

Industry watchers said GM Korea’s 273 auto parts suppliers could also suffer if the labor action is protracted.

“We are worried that the GM Korea strike will lead to job losses, as some suppliers are already suffering from a liquidity problem,” said Moon Seung, CEO of Dasung Co. and chief of the GM Korea parts suppliers association.

Write to Jung-Eun Shin at newyearis@hankyung.com

In-Soo Nam edited this article.

More to Read

-

AutomobilesGM Korea releases new Trailblazer geared for S.Korean market

AutomobilesGM Korea releases new Trailblazer geared for S.Korean marketJul 19, 2023 (Gmt+09:00)

1 Min read -

-

AutomobilesGM Korea to launch Trax, Cadillac EV; likely turn to profit this year

AutomobilesGM Korea to launch Trax, Cadillac EV; likely turn to profit this yearJan 30, 2023 (Gmt+09:00)

2 Min read -

Factory suspensionGM Korea to halt 2 main plants next week on automotive chip shortage

Factory suspensionGM Korea to halt 2 main plants next week on automotive chip shortageApr 15, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersGM Korea to curb production as global chip shortages worsen

Korean chipmakersGM Korea to curb production as global chip shortages worsenJan 22, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN