Corporate bonds

KoreaŌĆÖs non-financial firms rush to issue perpetual bonds

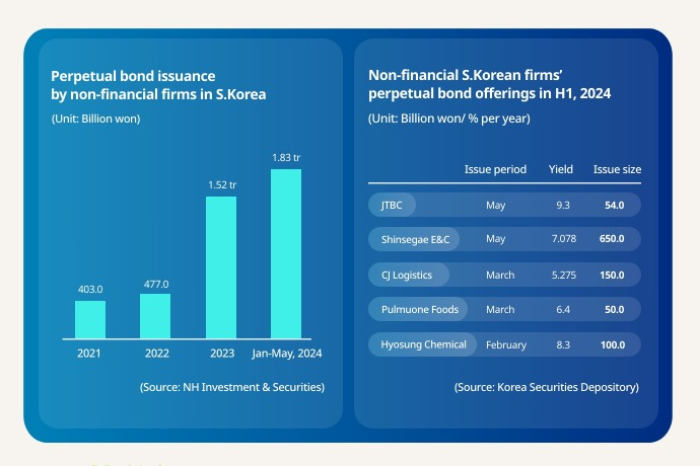

Non-financial firms offered 1.83 trillion won worth of perpetual bonds in the first half, versus 1.52 trillion won in all of 2023

By Jun 05, 2024 (Gmt+09:00)

2

Min read

Most Read

Macquarie eyes its 1st Korean data center valued around $722 mn

SK Inc. in talks to sell PharmtecoŌĆÖs US CDMO plant to Novo Nordisk

S.Korea's LS Materials set to boost earnings ahead of IPO process

Galaxy Ring, new foldables set to steal the show at Samsung Unpacked Paris

POSCO gears up for carbon-free steelmaking with hydrogen

Perpetual bond offerings by non-financial firms in South Korea are poised to hit new records this year as many companies have flocked to the hybrid bond market to improve their financial health as a quick fix to deal with their mounting debts.

According to NH Investment & Securities Co. on Tuesday the total offerings of perpetual bonds by non-financial Korean companies in the first five months of this year amounted to 1.83 trillion won ($1.3 billion), already surpassing last yearŌĆÖs total issuance of 1.52 trillion won.

Through 2024, the countryŌĆÖs total consol bond offerings are projected to top 3 trillion won, breaking the previous record of 2.38 trillion won in 2013.

Non-financial companies rushing to sell hybrid bonds without fixed maturity this year are grappling with huge debts.

Perpetual bonds with an average maturity of 30 years, which can be extended repeatedly, pay their holders interest almost forever like dividend-paying stocks. In this nature, they are often viewed as a type of equity, not a debt.

As perpetual bond offerings are booked as equities, financial companies have often sold them to lower their debt ratios.

MOUNTING DEBTS

JTBC, one of the Korean cable television channel operators, sold perpetual bonds worth 54 billion won, with an annual yield of 9.3%, to its affiliate Dabo Joongang Co. on the last day of May to improve its financial health.

It was sold with a step-up provision that increases the yield by 3 percentage points two years later if the issuer doesnŌĆÖt recall them. JTBCŌĆÖs debt ratio stood at 999% as of the end of 2023.

Shinsegae Engineering & Construction Inc., taking a toll from the countryŌĆÖs real estate project financing debacle, also offered 650 billion won worth of perpetual bonds at an annual yield of 7% in private placements on May 29th.

This was the largest perpetual bond sales for a non-financial firm in Korea, breaking the previous record of 600 billion won issued by SK Incheon Petrochem Co. in 2019.

As of the end of the first quarter this year, Shinsegae E&CŌĆÖs debt-to-equity ratio exceeded 800%. With the hybrid bond sales, its debt ratio is expected to dip below 200%.

SK On Co., the worldŌĆÖs fifth-largest electric vehicle battery producer, also plans to sell more than 300 billion won worth of perpetual bonds before the end of the first half of this year to enhance its financial soundness.

Many other non-financial companies are also said to be planning to follow suit this year.

Perpetual bond offerings are, however, viewed as only a temporary solution for debt-ridden firms because they often come with call options exercisable a few years later.

Compared with rights offerings or asset divestiture, perpetual bond offerings are just "a quick fix" because they can be redeemable three or five years later, said a bond broker at one of major securities firms in Korea.

Write to Hyun-Ju Jang at blacksea@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Real estateKoreaŌĆÖs Shinsegae building unit to raise $478 mn to cut debts

Real estateKoreaŌĆÖs Shinsegae building unit to raise $478 mn to cut debtsMay 28, 2024 (Gmt+09:00)

2 Min read -

-

Corporate bondsKorean firms' bond sales hit record in Q1 amid rate cut signal

Corporate bondsKorean firms' bond sales hit record in Q1 amid rate cut signalApr 05, 2024 (Gmt+09:00)

2 Min read -

Corporate bondsKorean brokerages expand bond issues to repay short-term debts

Corporate bondsKorean brokerages expand bond issues to repay short-term debtsFeb 20, 2024 (Gmt+09:00)

1 Min read -

ConstructionShinsegae E&C issues $150 mn bond to calm liquidity concerns

ConstructionShinsegae E&C issues $150 mn bond to calm liquidity concernsJan 19, 2024 (Gmt+09:00)

1 Min read -

MarketsKorean bond market squeezed by maturing debt, new issues

MarketsKorean bond market squeezed by maturing debt, new issuesOct 05, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN