Korean chipmakers

KLA to stop chip tool supply to customers in China: Report

SK Hynix plans to work with Korean government for necessary process and documents to secure a license from the US

By Oct 12, 2022 (Gmt+09:00)

1

Min read

Most Read

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

K-pop stocks surge as China set to loosen cultural ban after 9 years

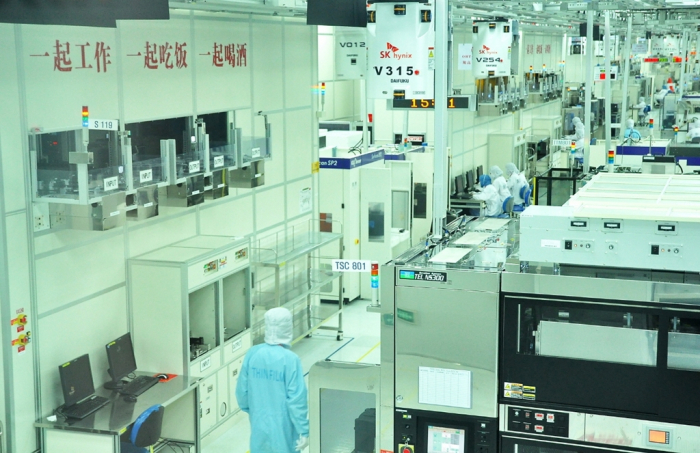

US chip toolmaker KLA Corp. will cease offering some supplies and services from Wednesday to China-based customers including SK Hynix Inc., the world’s second-largest memory chipmaker, in compliance with recent U.S. regulations, Reuters reported on Tuesday.

Reuters quoted an unidentified source as saying staff in China received an email from KLA's legal department stating that effective 11:59 p.m. local time (1559 GMT) on Tuesday, the company shall stop sales and service to "advanced fabs" in China for technology of NAND chips with 128 layers or more, and DRAM chips 18nm and below, and advanced logic chips.

The source also said that the company would also cease supplying China chip plants owned by Intel Corp. and South Korea’s SK Hynix, according to the global news agency.

“KLA may have notified the following measure after the US government’s new export regulations,” said an SK Hynix official. “We will closely work with the (South Korean) government for the necessary process and documents to secure a license from the US.”

NEEDS A LICENSE FROM US GOVERNMENT

Washington on Oct. 7 released new regulations to require companies looking to supply chipmakers in China with advanced manufacturing equipment to first obtain a license from the US Department of Commerce. SK Hynix and its bigger rival Samsung Electronics Co. need the approval as they have factories in China.

China is KLA's largest geographic market, bringing in $2.66 billion in sales, or nearly 30% of its total revenue in the last fiscal year that ended in June, Reuters said.

The new US regulations, aimed at thwarting Beijing's technological ambitions and blocking its military advances, are expected to directly hit Yangtze Memory Technologies Corp (YMTC) and ChangXin Memory Technologies Inc. (CXMT), the top two memory chipmakers in the mainland, as well as the No. 1 foundry manufacturer Semiconductor Manufacturing International Corp. (SMIC) and others.

Those Chinese tech companies have yet to make any comment on the restrictions.

Write to Yoo-Chung Roh and Sungsu Bae at yjroh@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Corporate investmentLG Electronics breaks ground on $600 mn home appliance plant in India

Corporate investmentLG Electronics breaks ground on $600 mn home appliance plant in India30 MINUTES AGO

-

-

-

Asset managementKorea Investment & Securities deepens global ties with 2nd IR in New York

Asset managementKorea Investment & Securities deepens global ties with 2nd IR in New York24 HOURS AGO

-

Korean chipmakersSouth Korea asks US for tailored approach to chip tariffs

Korean chipmakersSouth Korea asks US for tailored approach to chip tariffsMay 07, 2025 (Gmt+09:00)

Comment 0

LOG IN