Korean LPs favor direct lending for private debt investment

By Nov 17, 2020 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

Blind pool funds are the preferred vehicle for global private debt investment, chosen by 70.5% of the 17 institutional investors polled by The Korea Economic Daily. The respondents include NPS, the Government Employees Pension Service and the Korean Teachers’ Credit Union.

To view individual responses, please see Asset Owner Report.

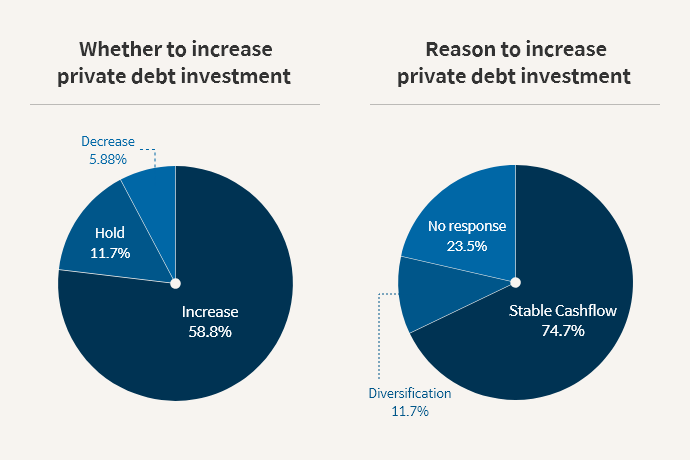

In the survey, 58.8% said they will increase overseas private debt investment, with another 11.7% opting to maintain their private debt portfolios at current levels. The remaining 5.8% is looking to cut exposure to private debt.

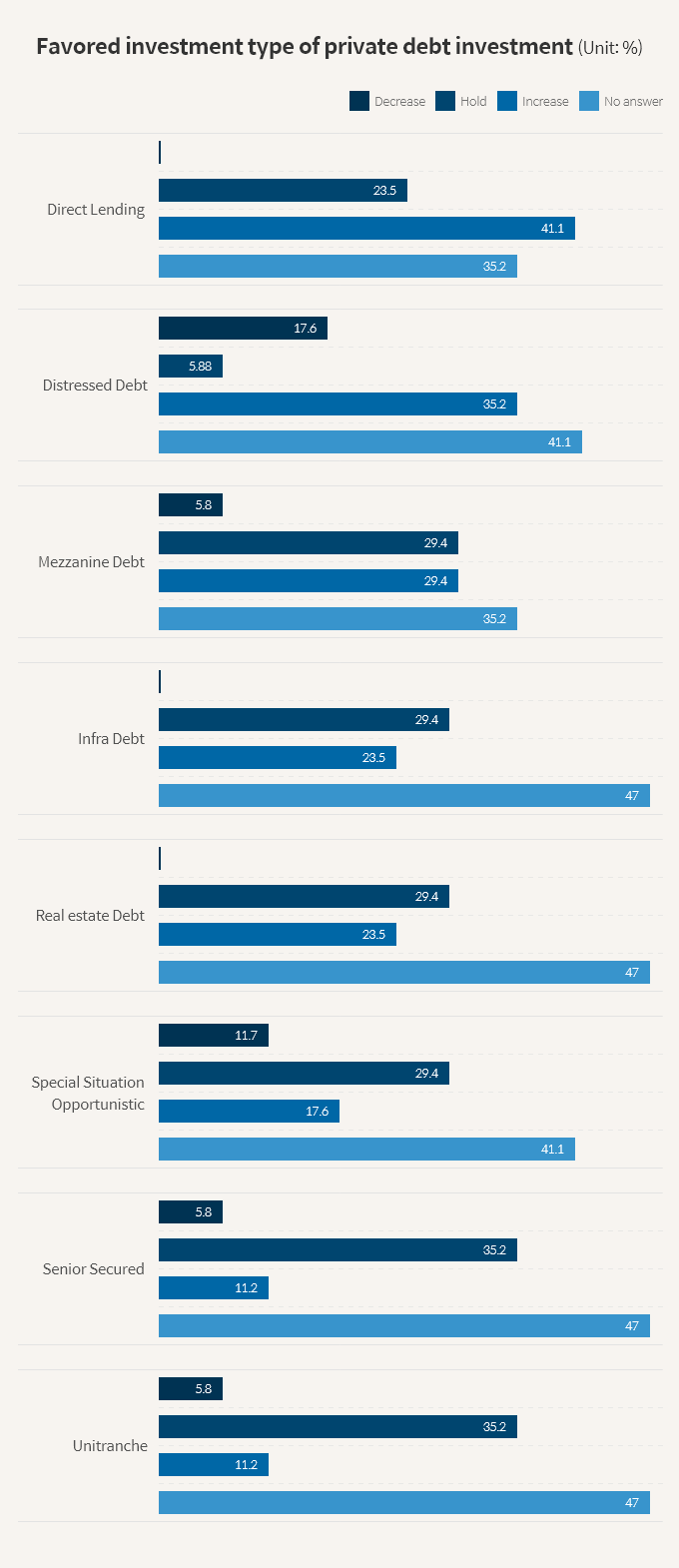

By investment type, 41.1% chose direct lending as their preferred private debt investment. None planned to reduce direct lending.

Distressed debt and mezzanine debt ranked second and third as investment choices for private debt, scoring 35.2% and 29.4%, respectively, in multiple choice questions.

For asset owners, private debt is emerging as an alternative to real estate — which the respondents saw as the most overvalued asset class among alternatives — while bond yields are close to zero.

Generating a steady stream of income is the main reason behind the push into overseas private debt, chosen by 64.7% of those polled. A portfolio diversification comes next at 11.7%.

Among the respondents, overseas private debt investments by 12 institutions are worth a combined 4.9 trillion won ($4.4 billion), equivalent to a mere 2.6% of their alternative assets of 184.3 trillion won in aggregate.

This may signal plenty of room to boost private debt investment. The other five respondents declined to give details of their portfolio.

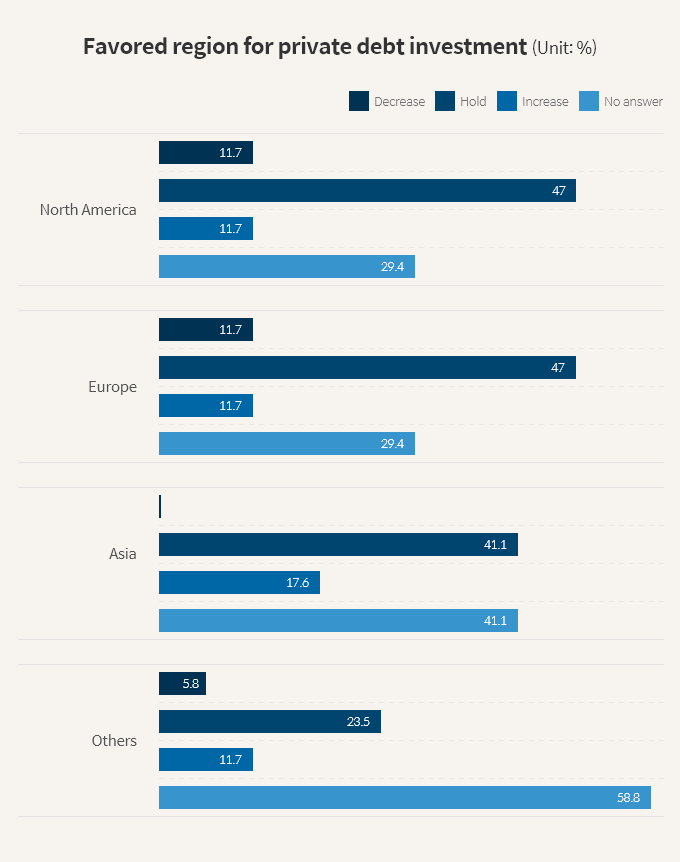

By region, most of the institutional investors prefer to maintain their current exposure to North America, Europe and Asia. In Asia, particularly, none plan to reduce private debt investment.

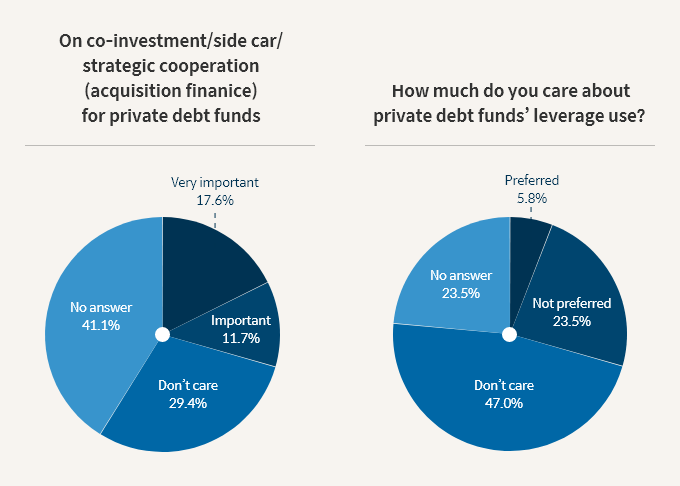

When asked about their views on co-investment opportunity and leverage use by private debt funds, more than half of the respondents said they didn’t care about them, or declined to answer.

To meet demand for private debt investment, global asset managers are ramping up their credit businesses in Asia.

In July, Ares Management Corp. acquired Hong Kong-based SSG Capital Holdings to expand into Asia’s private credit market. SSG focuses on credit and special situation investments, with assets of $7 billion won under management.

Michael Dennis, BlackRock’s Asia-Pacific head of alternative strategy and capital markets, told The Korea Economic Daily that Asian banks' reluctance to lend to middle-market companies pointed to growth potential in Asia's private debt market, particularly in Indonesia.

Write to Seon-Pyo Hong at rickey@hankyung.com

Yeonhee Kim edited this article.

-

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout funds

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout fundsMay 08, 2025 (Gmt+09:00)

-

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepenMay 02, 2025 (Gmt+09:00)

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)