Korean investors on track to pour nearly $1 bn into US, UK airports in 2019

Sep 22, 2019 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

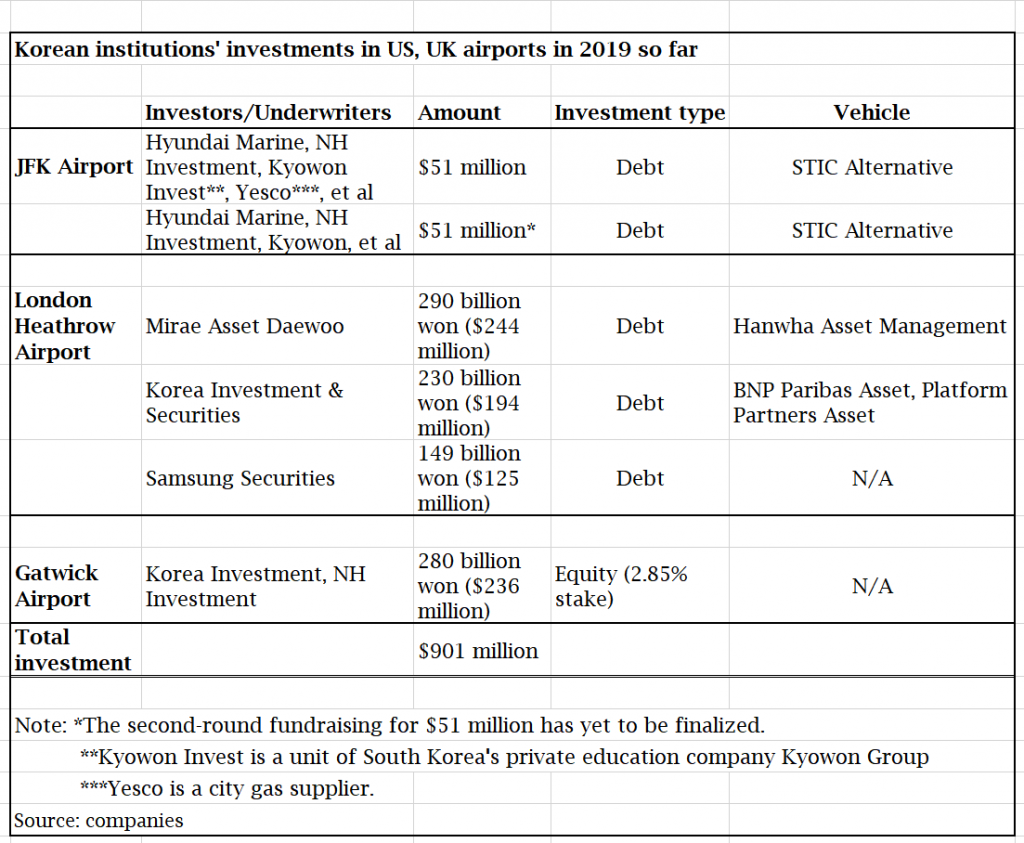

South Korean institutional investors are on track to pour nearly $1 billion into US and UK airports in 2019, including the planned $51 million co-investment in the John F. Kennedy Airport’s Terminal One redevelopment project.

For the Terminal One project for which the Carlyle Group is leading financing of about $13 billion, Seoul-based STIC Alternative Co. Ltd. is targeting to raise $51 million from Korea for co-investment, according to investment banking sources on Sept. 20.

The fundraising comes after STIC Alternative had collected $51 million from Korean institutions, including Hyundai Marine & Fire Insurance Co. Ltd. and NH Investment & Securities, earlier this year, to commit to Carlyle Global Infrastructure Opportunity Fund.

Its limited partners are provided with co-investment opportunities for the Terminal One in proportion to their commitment to the latest global fund.

The infrastructure fund raised $2.2 billion in its final close in July, and the Terminal One at JFK Airport is one of projects Carlyle is financing with the fund.

Among the LPs, Hyundai Marine, which had committed $25 million to the Carlyle infrastructure fund, recently invested an additional $35 million in the Terminal One project as a co-investor through STIC Alternative.

NH Investment and Kyowon Invest Co. Ltd., a unit of Korea’s private education company, are expected to participate in the second $51 million fund for the JFK Airport, according to the sources. (For details, see Table below)

The growth outlook for air traffic and the safety of airport infrastructure facilities as an asset class lured Korean institutional investors into the global airport investments.

Earlier this year, South Korean brokerage companies had underwritten a combined 669 billion won ($563 million) of debts to finance the third runway construction at London’s Heathrow Airport.

Most of them were resold to domestic insurance companies.

“Insurance companies, which chase long-term assets, rushed to the products because they guarantee annualized 5% returns on top of currency hedging premiums with a term of up to 15 years,” a Mirae Asset Daewoo source told the Korean Investors.

“Airports as an investment asset have a similar safety to government bonds. Core infrastructure such as airports will never break apart in the air although their operators go bankrupt,” said Hanwha Asset’s alternative investment head Gyeong-il Huh.

By Hyun-il Lee

hiuneal@hankyung.com

(Photo: Getty Images Bank)

Yeonhee Kim edited this article

-

-

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepenMay 02, 2025 (Gmt+09:00)

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)