Korea’s 1st logistics public fund unveiled for Amazon’s Europe facilities

Jul 10, 2019 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

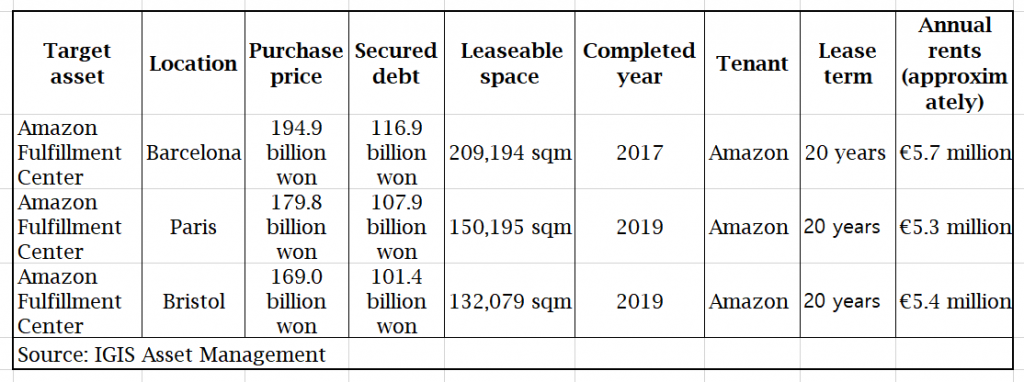

IGIS Asset Management Co. Ltd. has launched South Korea’s first public fund investing in logistics centers, targeting to raise up to 245 billion won ($207 million) to fund its purchase of three Amazon’s logistics centers in Europe.

The fundraising target represents about 40% of the 593.6 billion won acquisition price including fees and other expenses, according to IGIS Asset’s regulatory filing on July 8.

The three logistics centers leased to Amazon are located in Barcelona, Paris and Bristol, England respectively and among the largest storage facilities used by the online retail giant in Europe.

They will be fully leased to Amazon under 20-year contracts once the acquisition is closed on July 12 as planned, IGIS added.

IGIS Asset plans to close the five-day fundraising on July 12, reportedly offering an annual target return of mid-6% for the five-year fund.

Targeting individual investors switching away from low-yielding traditional assets, South Korean asset managers are expanding the scope of investment assets financed by public funds from office buildings to retail properties to logistics centers.

IGIS Asset is the biggest real estate investment firm in South Korea with 25 trillion won under management. It has reportedly raised more than 1.2 trillion won in blind-pool real estate funds for core, value-add and opportunistic strategies since 2017.

Yeonhee Kim edited this article

-

-

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepenMay 02, 2025 (Gmt+09:00)

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)