NPS appoints investment strategy head as new acting CIO

Jul 19, 2018 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

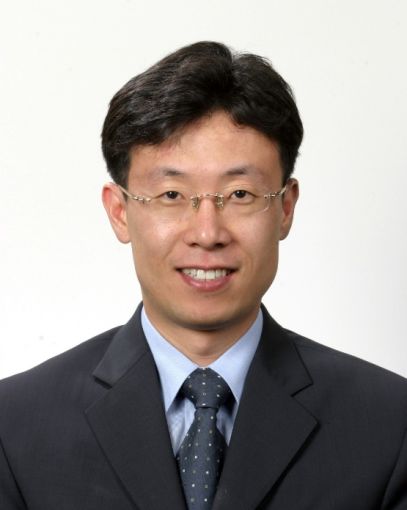

National Pension Service’s (NPS) investment strategy head Soo-Cheol Lee has assumed the role of acting chief investment officer of the $561 billion pension fund, as it has been looking for CIO for one year.

Last Friday, Lee took over from In-Sik Cho, former global public market head, who had acted as CIO since ex-CIO Myoun-Wook Kang abruptly resigned in July 2017.

Cho quit on July 13, according to an NPS statement, after he tendered a resignation for an undisclosed reason early this month.

“As an expert with diverse experience in investment strategy and management of the 635-trillion-won ($561 billion) fund, acting CIO Lee is viewed as the right person who can preemptively respond to the global fund management environment,” NPS said in the statement.

NPS restarted the CIO selection process this month, saying that it failed to find a qualified candidate during the previous four-month process. It will receive applications for the CIO post by July 19.

Meanwhile, it hired 20 new asset management employees last week, fewer than originally planned 38.

It plans to recruit additional 30 fund management staff in the second half of this year, it said in a separate statement on July 12.

To attract and retain qualified investment staff, it will improve their working conditions “to live up to the status as the world’s No.3 pension fund,” the statement added, without elaborating further.

Currently, NPS’ Investment Management department has 246 asset management employees.

Yeonhee Kim edited this article

-

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout funds

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout fundsMay 08, 2025 (Gmt+09:00)

-

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepenMay 02, 2025 (Gmt+09:00)

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)