MBK not to sell Korea Zinc to China after tender offer

Korea Zinc shares exceed tender offer price to hit record high as investors expect fight between Choi, MBK to intensify

By Sep 19, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Samsung steps up AR race with advanced microdisplay for smart glasses

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

MBK Partners Ltd. does not plan to sell Korea Zinc Inc., the world’s largest zinc and lead smelter, to China if MBK's takeover bid of up to 2 trillion won ($1.5 billion) succeeds, a senior executive of the North Asia-focused private equity firm said on Thursday.

MBK is seeking the buyout of Korea Zinc in partnership with its top shareholder Young Poong Group as the smelter’s financial structure has deteriorated since its current Chair Choi Yun-birm took office, said Kim Kwang Il, a partner at MBK.

MBK and Young Poong Corp., the group’s controlling company, last week unveiled a plan to buy a 7.0% to 14.6% stake in Korea Zinc through a tender offer at 660,000 won per share. The tender offer is estimated to cost between 953.7 billion and 2 trillion won, the largest-ever takeover bid in Korean history.

The private equity firm is set to use its buyout fund for the tender offer. Choi and some local politicians said the fund is mostly made up of Chinese capital, raising concerns that the smelter will come under the control of investors on the mainland.

But Kim stressed that Chinese capital does not make up much of the buyout fund, and that MBK has no plan to sell the company to China.

“We are not a foreign fund but a first-generation private equity fund launched in Korea in 2005. The claim is just a malicious rumor that we are Chinese,” Kim said at a press conference on the bid. “Chinese capital accounts for about only about 5% (of the fund), although it is difficult to confirm it as we have yet to complete the capital call.”

The Seoul-based private equity firm will likely sell Korea Zinc to a South Korean company later as the smelter is part of a national key industry, he said.

Korea Zinc is expanding its business scope to eco-friendly energy and materials while supplying key ingredients to local automakers and electric vehicle sectors.

“Korea Zinc will be of great help to any large company in Korea as it is a technologically advanced company with an EBITDA of 1 trillion won,” Kim said, referring to earnings before interest, taxes, depreciation, and amortization.

WEAKENING BALANCE SHEET

Kim said Korea Zinc’s financial structure has deteriorated since Choi took control of the company in 2019.

“Korea Zinc’s EBITDA margin fell to 10.1% last year from 16.2% in 2019 when Choi took office as president and CEO,” Kim said.

The company’s debt surged to 1.4 trillion won in 2023 from only 41 billion won four years ago, while it is likely to report a net debt of 44 billion won this year, compared with a net cash of 2.5 trillion won in 2019, Kim said. Its borrowings will balloon to 10 trillion won by 2029, he added.

Choi invested in companies that were not related to Korea Zinc’s main business and were not checked for profitability, Kim said.

“Thirty companies out of 39 in which Korea Zinc has invested since 2019 have been making cumulative net losses,” he said, adding the smelter acquired Igneo Holdings LLC at a cost 200 times annual sales although the company’s shareholder equity was negative.

Korea Zinc bought a majority stake in the US-based electronic waste recycling company for $332 million in 2022 to expand its footprint in the battery materials market.

Kim also said Korea Zinc’s investment in K-pop pioneer SM Entertainment Co. faced legal risks.

ATTRACTIVE TENDER OFFER PRICE

Kim was confident in the success of the takeover bid, saying the tender offer price was attractive to shareholders.

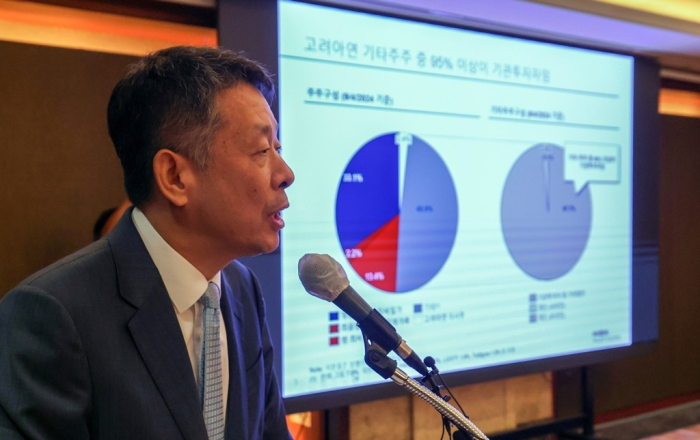

MBK is set to buy a 48.8% stake, which includes 2.2% from individual shareholders, through the tender offer.

“Institutional investors hold 97.7% of the shares to be purchased through the bid and they were estimated to have bought the stocks at an average of around 450,000 won per share,” he said. “The tender offer price of 660,000 won is about a 51% premium, which is attractive enough.”

Kora Zinc shares ended up 6.16% at 707,000 won Thursday on the South Korean main stock market after hitting an all-time high of 720,000 won on the day, as investors expected the feud over its management control to further heat up.

Hyundai Motor Group, Hanwha Corp. and LG Chem Ltd., which investors saw as Choi’s allies, are not Choi’s friendly shareholders but business partners, Kim emphasized.

MBK does not plan to delist Korea Zinc nor cut jobs after the takeover, Kim said.

Write to Jong-Kwan Park and Hyeon-woo Oh at pjk@hankyung.com

Jongwoo Cheon edited this article.

-

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea Zinc

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea ZincSep 13, 2024 (Gmt+09:00)

4 Min read -

Leadership & ManagementKorea Zinc speeds up separation from Young Poong in management feud

Leadership & ManagementKorea Zinc speeds up separation from Young Poong in management feudJun 21, 2024 (Gmt+09:00)

2 Min read -

BatteriesHyundai to invest $398 mn in Korea Zinc for battery materials

BatteriesHyundai to invest $398 mn in Korea Zinc for battery materialsAug 30, 2023 (Gmt+09:00)

2 Min read -

Corporate investmentKorea Zinc exchanges treasury shares with LG Chem, Hanwha Corp.

Corporate investmentKorea Zinc exchanges treasury shares with LG Chem, Hanwha Corp.Nov 24, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsKorea Zinc buys US e-waste recycling firm for $332 mn

Mergers & AcquisitionsKorea Zinc buys US e-waste recycling firm for $332 mnJul 12, 2022 (Gmt+09:00)

2 Min read