Activst fund KCGI struggles to fund Hanyang Securities deal

Its bid for the brokerage firm is more than four times the latter’s market price

By Sep 03, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

K-pop stocks surge as China set to loosen cultural ban after 9 years

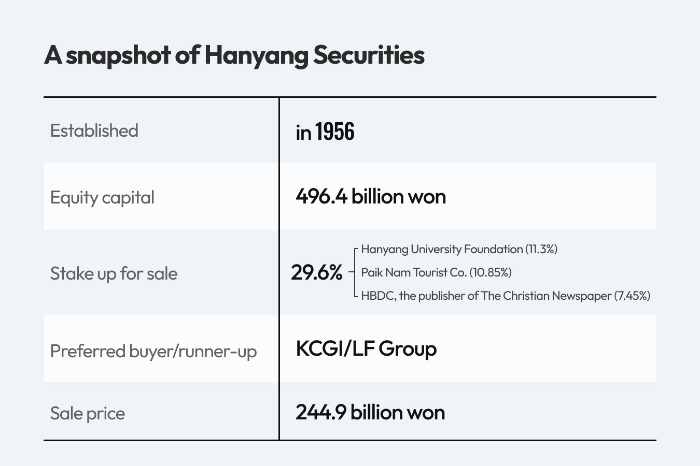

KCGI, a South Korean private equity firm, has been struggling to raise funds for its 244.9-billion-won ($183 million) purchase of a controlling stake in Hanyang Securities Co. with investors put off by its high bidding price and regulatory hurdles, putting the deal at risk of collapse, according to people familiar with the situation on Monday.

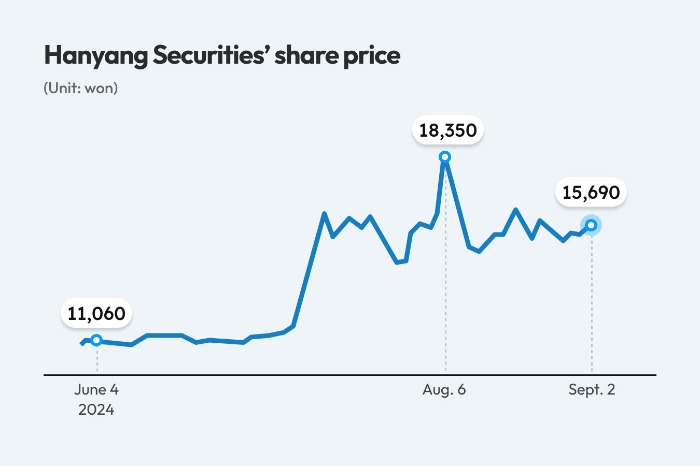

Last month, KCGI, known as an activist fund, was named the preferred buyer of a 29.6% stake in Hanyang Securities, a small-sized specialist in fixed-income trading. For the deal, it tentatively agreed to pay 65,000 won per share, more than four times its market price of 15,690 won as of Monday's close.

The two sides are set to finalize their negotiations this week before signing a binding deal.

To fund the stake purchase, Kang Sung-boo, chief executive of KCGI, has reached out to domestic financial services firms, including Daol Investment & Securities Co., Cape Investment & Securities Co. and OK Financial Group, the parent of OK Savings Bank.

To entice them to back the deal, Kang offered them call options for the brokerage house. But none of them have signed their letters of commitment to the transaction, said the sources, raising doubts about the finalization of the deal.

DAOL INVESTMENT & SECURITIES

In particular, Kang persuaded Daol Investment’s Chairman Lee Byung-chul to

join a consortium to take control of Hanyang Securities, South Korea’s 28th largest brokerage firm.

Lee was said to have shown interest in joining hands with Kang in hopes that Hanyang Securities may act as his white knight in a possible hostile takeover bid for Daol Investment, in which he owns a 24.82% stake as the largest shareholder.

But Daol Investment decided at a recent executive meeting not to team up with KCGI on concerns that KCGI's financial support for the deal would deteriorate its bottom line.

OK Financial Group is considering participating in the consortium to expand into the brokerage sector, said the sources. But the group said it has not determined yet whether to join KCGI in securing control of Hanyang Securities.

Cape Investment, which had also vied for Hanyang Securities, is understood to be focused on improving its financial structure.

REGULATORY HURDLE

Regulatory authorities had pledged to strictly review the deal that bankers argued had been conducted in an untransparent manner: not hiring a sale manager and skipping the due diligence process for preliminary bidders.

In addition, industry observers said KCGI’s offer of call options on Hanyang Securities to financial backers could make it difficult to win regulatory approval.

A failure to close the Hanyang Securities deal would hurt the credibility of KCGI, once a vocal activist fund. Recently, it gave up on the purchase of Nextin Inc., a Kosdaq-listed semiconductor equipment maker, after failing to pay the acquisition price by the deadline.

The runner-up for the controlling stake in Hanyang Securities is domestic fashion retailer LF Group.

Write to Jong-Kwan Park, Ji-Eun Ha and Hyeong-Gyo Seo at pjk@hankyung.com

Yeonhee Kim edited this article.

-

Banking & FinanceActivist fund KCGI to buy Hanyang Securities for $180 mn

Banking & FinanceActivist fund KCGI to buy Hanyang Securities for $180 mnAug 04, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsHanyang Securities stake draws bids without sale manager

Mergers & AcquisitionsHanyang Securities stake draws bids without sale managerJul 24, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsBrokerage firm Hanyang Securities' 11.3% stake up for sale

Mergers & AcquisitionsBrokerage firm Hanyang Securities' 11.3% stake up for saleJul 19, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsHanyang Securities up for sale; in talks with KCGI, Woori

Mergers & AcquisitionsHanyang Securities up for sale; in talks with KCGI, WooriJul 15, 2024 (Gmt+09:00)

3 Min read -

Shareholder activismKCGI’s ascent to intensify family feud over DB control; DB stocks rally

Shareholder activismKCGI’s ascent to intensify family feud over DB control; DB stocks rallyApr 04, 2023 (Gmt+09:00)

3 Min read -

Shareholder activismS.Korean activist fund KCGI eyes foundry DB HiTek buyout

Shareholder activismS.Korean activist fund KCGI eyes foundry DB HiTek buyoutMar 31, 2023 (Gmt+09:00)

2 Min read -

Shareholder activismActivist fund KCGI to sell Osstem stake to UCK, MBK Partners

Shareholder activismActivist fund KCGI to sell Osstem stake to UCK, MBK PartnersFeb 10, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKorean activist fund KCGI buys Meritz Asset Management

Mergers & AcquisitionsKorean activist fund KCGI buys Meritz Asset ManagementJan 09, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsKorean activist fund KCGI joins in consortium to buy Ssangyong

Mergers & AcquisitionsKorean activist fund KCGI joins in consortium to buy SsangyongAug 09, 2021 (Gmt+09:00)

2 Min read -

Local activist fund KCGI opposes Korean Air's sale of in-flight businesses

Local activist fund KCGI opposes Korean Air's sale of in-flight businessesJul 17, 2020 (Gmt+09:00)

3 Min read