Korea's bet on US assets up on bull stocks, EV incentives

Koreans' US-based financial assets hit a record in 2023, led by the strong stock market and Inflation Reduction Act-related sectors

By Jun 25, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

K-pop stocks surge as China set to loosen cultural ban after 9 years

South Korea’s financial assets in the US hit a record high last year due to the US stock market rally and Korean companies’ capital injection in US clean energy and electric vehicle sectors, incentivized by the Inflation Reduction Act (IRA).

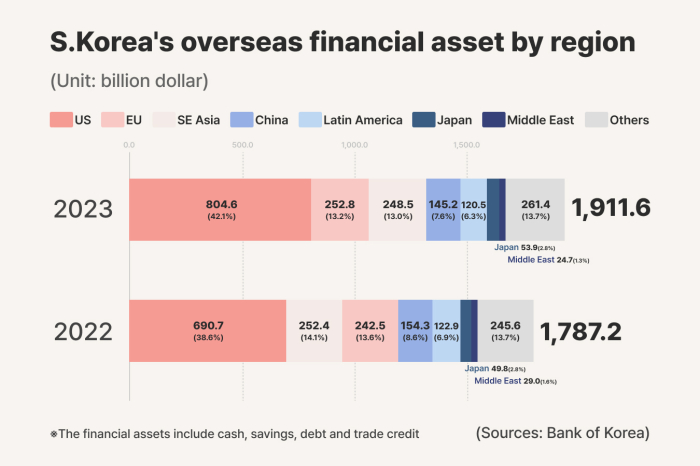

As of the end of 2023, Asia's No. 4 economy held $1.91 trillion worth of overseas financial assets such as cash, savings and loans, according to the Bank of Korea on Tuesday.

The US is their favorite investment destination, where 42.1% of their assets are located, the highest portion since the statistics were created for the first time in 2002.

Their US financial assets increased 16.5% on-year to $804.6 billion last year. The increase of $113.9 billion is the second-largest on record, after $152 billion in 2021, driven by Korean retail investors’ purchase of US stocks, according to the central bank.

“Korean investors’ financial assets in the US exceeded $800 billion last year, after surpassing $600 billion in 2021 and $400 billion in 2019,” said Park Sung-gon, overseas investment statistics team head at the BOK.

“Their holdings in the US securities, particularly stocks, have steadily increased amid the high growth rate of share prices. Also, Korean conglomerates expanded their investment in US-based factories that could benefit from the IRA,” Park added.

Some $252.8 billion or 13.2% of the overseas financial assets were located in the European Union (EU), Koreans’ second-favorite destination. Some $252.8 billion or 13% of the overseas assets were in Southeast Asia.

While financial assets in the US and EU increased in 2023, assets in China, the Middle East and Southeast Asia respectively fell 5.9%, 14.5% and 1.6% during the same period.

“Korea’s financial assets in China have decreased for two straight years due to deteriorating conditions for foreign investment, a decline in Chinese stocks and a slowdown in Korean exports to China,” said Park. “Assets in the Middle East reduced as Korea released ($6 billion worth of) Iranian funds last year,” he added.

Korea and the US decided to release the funds for better economic and diplomatic relations with Tehran in May of last year. The fund, which had been frozen in Korean banks since 2018, was transferred to Qatar via Switzerland last September under stringent conditions that Iran use the funds only for public purposes such as United Nations dues or purchasing COVID-19 vaccines.

Meanwhile, Korea’s overseas debt increased by 7.9% to $1.52 trillion as of the end of 2023.

Some 24.4% of the debt securities were in the US, followed by 21.7% in Southeast Asia and 16.2% in the EU.

Korea owned $1.13 trillion worth of US dollar-denominated financial assets, 59.2% of the offshore financial assets as of the end of 2023. The Asian country held $185.7 billion worth of euro-denominated assets, or 9.7%, and $108.6 billion worth of yuan-denominated assets, or 5.7% of the total.

Write to Jin-gyu Kang at josep@hankyung.com

Jihyun Kim edited this article.

-

MarketsKorean retail investors’ US stockholdings at record high

MarketsKorean retail investors’ US stockholdings at record highJun 10, 2024 (Gmt+09:00)

2 Min read -

Artificial intelligenceNvidia beats Tesla to emerge as top foreign stock held by Koreans

Artificial intelligenceNvidia beats Tesla to emerge as top foreign stock held by KoreansMay 30, 2024 (Gmt+09:00)

1 Min read -

Banking & FinanceForeign banks expand Korean operations amid China’s slowdown

Banking & FinanceForeign banks expand Korean operations amid China’s slowdownApr 18, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketForeign buying of Korean stocks hit record high in Q1

Korean stock marketForeign buying of Korean stocks hit record high in Q1Mar 31, 2024 (Gmt+09:00)

3 Min read