SK Square to ramp up chip investment with new CEO

The SK Group unit will focus on semiconductors while speeding up divestments of loss-making subsidiaries

By Jul 04, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

South Korea’s No. 2 conglomerate SK Group said on Thursday that its investment arm SK Square Co., led by new CEO Han Myung-jin, will ramp up semiconductor funding in efforts to rebalance its portfolio.

Han, the current CFO of SK Square, will be officially nominated as CEO and a member of the board on August 14 after an extraordinary general meeting of shareholders and a board meeting.

SK Square said that Han will be responsible for growing the firm as an asset manager specializing in chip investment.

He has highlighted semiconductors as the company’s new growth driver. In SK Square’s 2023 earnings call in February, he said the firm will strengthen its identity as a chip-centered investment firm by funding industries linked to the semiconductor value chain.

NEW INVESTMENTS, EXIT PLANS

SK Square, which holds around 1 trillion won ($724.3 million) worth of cash and cash equivalents, is expected to invest significant capital in Korean and overseas semiconductor industries as the chip business is the parent group’s new growth driver, industry observers said.

The company is increasing investments in chip components and equipment makers in the US and Japan via TGC Square, a 100 billion won joint venture that the firm established last year in partnership with global No. 2 memory chipmaker SK Hynix Inc., Shinhan Financial Group and defense company LIG Nex1 Co.

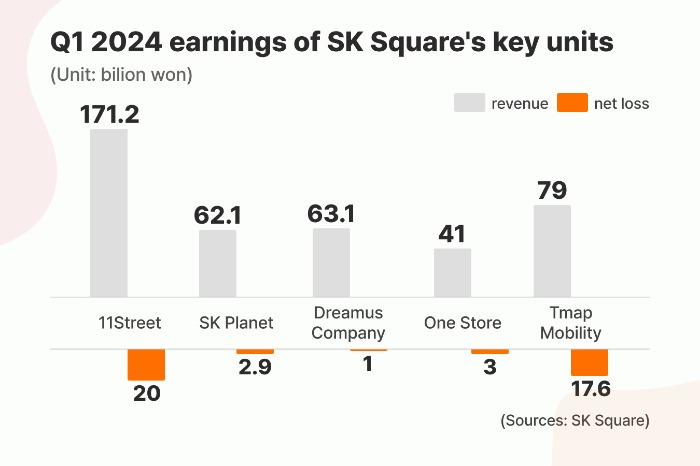

Given that the company posted a 2.34 trillion won operating loss last year, SK Square will prioritize improving the profitability of its portfolio companies, except for semiconductor firms, and accelerate mergers and divestments of the subsidiaries, industry sources said.

The company will continue with procedures to merge its over-the-top media platform Content Wavve Corp. with entertainment powerhouse CJ ENM Co.'s TVing Co. and divest its shares in UT LLC, a taxi-hailing platform jointly established by Uber Technologies Inc. and SK Square, sources added.

SK Square will also ramp up the sale of its e-commerce operator 11Street to domestic grocery delivery platform Oasis Corp., following the divestment of security firm SK Shieldus Co. to Swedish private equity giant EQT Partners AB last year.

EARNINGS TO IMPROVE

Analysts said SK Square’s earnings will likely improve thanks to SK Hynix, the investment firm’s cash cow. SK Square and its affiliated persons owned a 20.07% stake in the memory chipmaker as of the end of May.

SK Hynix’s first-quarter net profit reached 333.3 billion won on a consolidated basis, swinging to the black compared with the same period last year.

Given that the semiconductor company’s second-quarter earnings are set to be higher than initially expected, SK Square’s net profit will increase, analysts added.

Write to Seung-Woo Lee at leeswoo@hankyung.com

Jihyun Kim edited this article.

-

E-commerceKorean grocery delivery platform Oasis to buy e-commerce 11Street

E-commerceKorean grocery delivery platform Oasis to buy e-commerce 11StreetJul 03, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketKrafton shares sink as SK Square taps 2.2% block trade

Korean stock marketKrafton shares sink as SK Square taps 2.2% block tradeApr 23, 2024 (Gmt+09:00)

2 Min read -

EntertainmentCJ ENM, SK Square to merge OTTs to take on Netflix

EntertainmentCJ ENM, SK Square to merge OTTs to take on NetflixNov 29, 2023 (Gmt+09:00)

6 Min read -

Shareholder valueSK Square to buy back $152 mn of its stocks by March 2024

Shareholder valueSK Square to buy back $152 mn of its stocks by March 2024Aug 09, 2023 (Gmt+09:00)

1 Min read -

Corporate investmentSK Square, SK Hynix set up $77 million chip investment unit

Corporate investmentSK Square, SK Hynix set up $77 million chip investment unitJul 04, 2023 (Gmt+09:00)

3 Min read