Korean startups

Race to win tableside ordering market heats up in Korea

The market for tableside meal ordering is expected to burgeon amid a rising minimum wage and soaring management costs

By Sep 20, 2024 (Gmt+09:00)

3

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

Baemin, South Korea's top food delivery platform, and the country’s leading travel and accommodation booking platform operator Yanolja Co. have thrown down the gauntlet to win the automated meal ordering market now dominated by smaller startups.

Yanolja announced on Thursday it has upgraded ‘yaorder,’ a mobile ordering system developed by its subsidiary Yanolja F&B Solution, to enable diners to use it to order meals at tableside in a restaurant.

Baemin and Viva Republica Inc., operator of Korea’s leading financial super-app Toss, have joined Yanolja in the race for the country’s tableside meal-ordering market.

Korea’s big platform companies are rushing to enter the self-serve meal-ordering market as they anticipate the market’s rapid growth amid rising labor costs due to the country's high minimum wage.

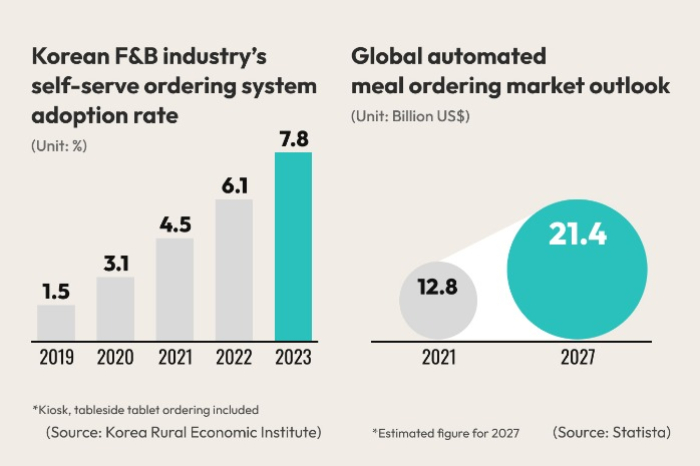

The global automated meal-ordering market is forecast to grow to $21.4 billion in 2027 from $12.8 billion in 2021, according to Statista.

The Korean tableside meal-ordering market is expected to grow to over 1 trillion won ($752 million) annually over the mid- to long term from about 100 billion won today, according to the country’s food and beverage industry.

ROOM TO GROW

T’order Inc., a Korean startup commanding more than 60% of the country’s tableside meal-ordering market, saw revenue grow 77% last year to 58.7 billion won from the prior year.

The market still has room to grow considering that Korea's rate of adopting automated meal-ordering systems is less than 10%.

“It costs more than 2 million won a month to hire one employee but it costs less than 30,000 won per tablet or almost nothing to set up QR codes for self-serve meal ordering at tableside,” said an official from the Korean F&B Industry.

Yanolja’s ‘yaorder’ does not require separate devices like kiosks or tablets because it is based on QR code scanning or near-field communication (NFC) tagging for contactless meal ordering.

Restaurants using ‘yaorder’ need to have only QR code or NFC tag stickers on tables, which require minimal upfront costs, said Yanolja, which expects strong demand for its self-serve meal ordering system.

Baemin plans to officially roll out a QR code-based tableside meal-ordering system called ‘Baemin Order’ next week.

Last March, Viva Republica’s subsidiary Toss Place introduced a QR code-integrated tableside meal-ordering service.

The country’s top mobile carriers such as KT Corp. and LG Uplus Corp. have also entered the market.

NEW REVENUE SOURCE

With big platform companies joining the market, the Korean tableside meal-ordering market is poised to be reshaped.

The market is now dominated by smaller startups such as market leader t’order and menuit Inc.

“If big platform companies succeed at providing better services backed by their massive data and capital, they could snatch the crown from smaller players and take the lead in the market,” said an F&B industry observer.

Their foray into the automated meal-ordering market is also part of their effort to find a breakthrough amid intensifying competition in the app-based food delivery and accommodation booking markets.

Baemin will seek to develop synergy between its online and offline services in the automated meal-ordering system to fend off its rapidly ascending cross-town food delivery rival Coupang Eats.

Users of its tableside meal-ordering system will be able to use Baemin’s digital reward points and gift cards at offline restaurants.

Yanolja, closely trailed by local booking app latecomer Yeogi Eottae, will accelerate diversification of its business portfolio by adding the F&B business.

Write to Sun A Lee and Eun-Yi Ko at suna@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean startupsMoney pours in for technology to reshape Korean restaurants

Korean startupsMoney pours in for technology to reshape Korean restaurantsApr 01, 2024 (Gmt+09:00)

3 Min read -

Korean startupsKorean kitchen automation startups' US advance gains traction

Korean startupsKorean kitchen automation startups' US advance gains tractionApr 03, 2023 (Gmt+09:00)

2 Min read -

Venture CapitalMobile POS maker Payhere receives $84.2 mn in Series A funding

Venture CapitalMobile POS maker Payhere receives $84.2 mn in Series A fundingDec 28, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN