PE secondaries top Korean LPs' global PE funds list

By Nov 18, 2020 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

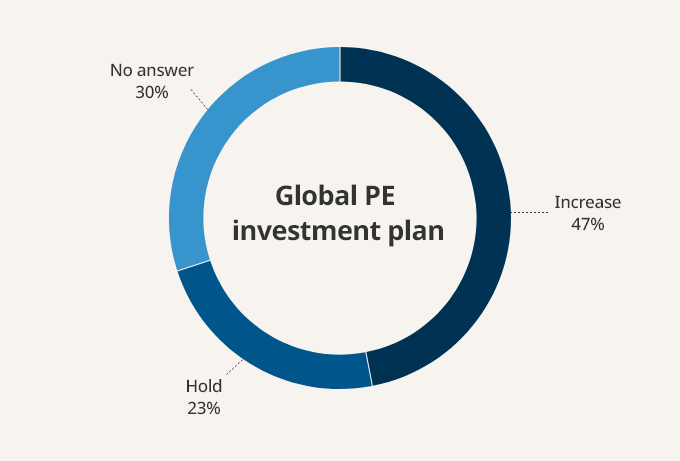

In the survey of 17 institutional investors, about half of the respondents said they will bulk up their global PE portfolios. None of those polled expressed an intention to cut exposure to that asset class.

To view individual responses, please see KED's Asset Owner Report.

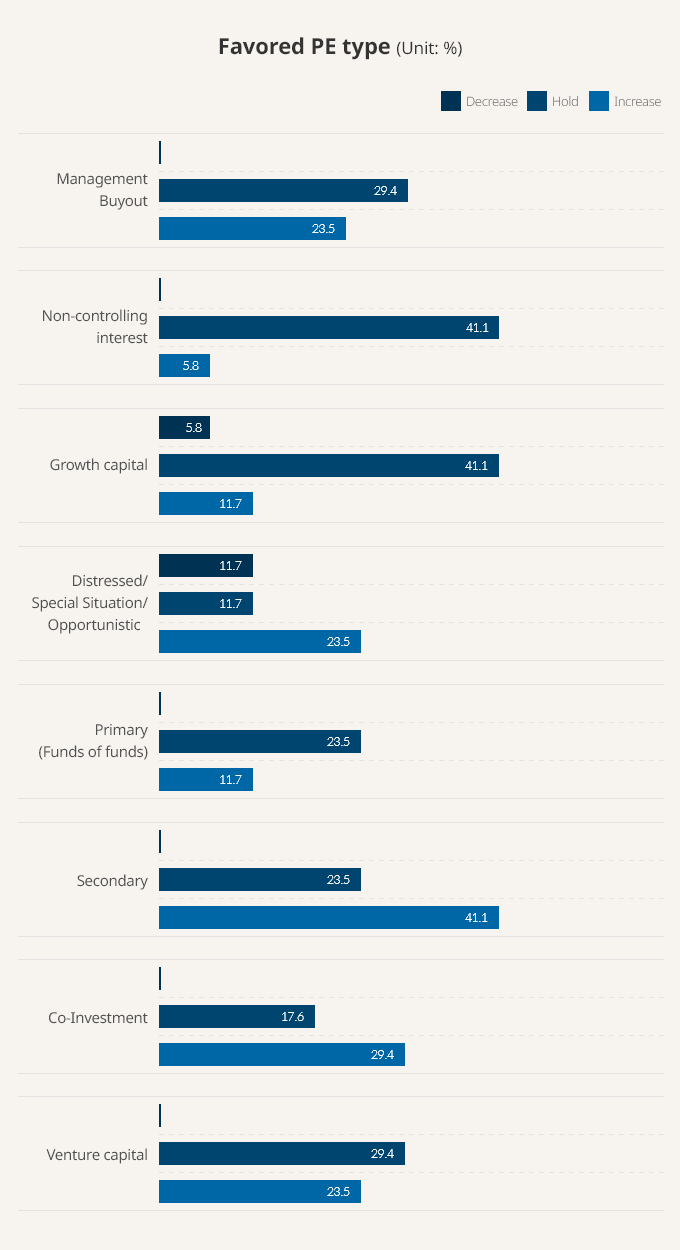

Among the respondents, which include the National Pension Service, the Government Employees Pension Service and the Korean Teachers’ Credit Union, 41.1% chose the secondary PE market as where they want to raise exposure the most.

Secondary PE transactions refer to buying and selling investor commitments to private equity funds before their expiration. Lured by double-digit returns, the NPS, Korea Post and other Korean institutional investors are piling into the market.

Co-investments and management buyouts came second and third on the list of favored PE funds, winning 29.4% and 23.5%, respectively. None of the respondents are inclined to decrease investments in the three PE types: secondaries, co-investments and management buyouts.

In a CIO panel session at the ASK Summit 2020 held in Seoul Oct. 28, Public Officials Benefit Association Chief Investment Officer Jang Dong-hun said the $12 billion pension fund will increase exposure to secondary PE and opportunistic funds next year.

NPS is also planning to boost investments in secondary PE transactions, alongside private debt and hedge funds. In July, it announced a plan to create a private debt team and a secondary investment team under the existing private securities division.

HEALTHCARE, TECH AND ASIA

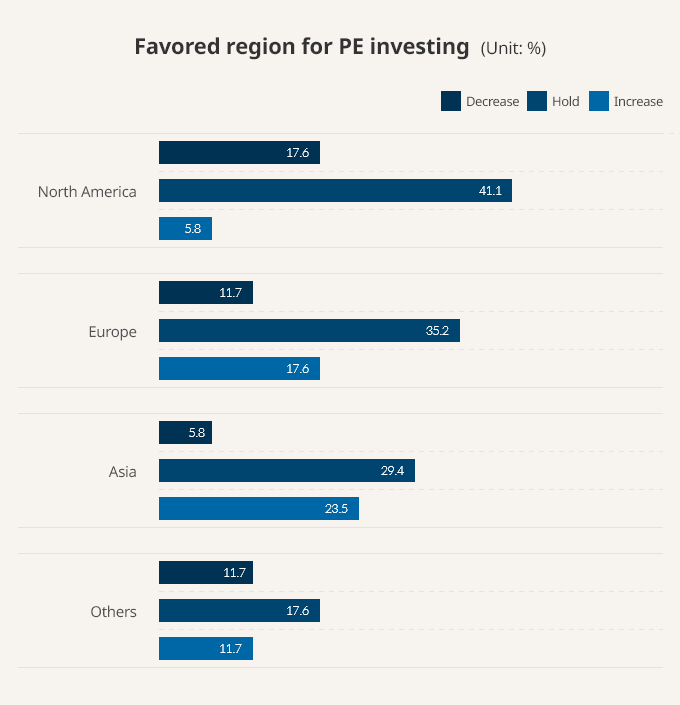

By region, Asia was picked as the best destination for PE investment, as was seen in the KED poll for private debt investment, conducted simultaneously.

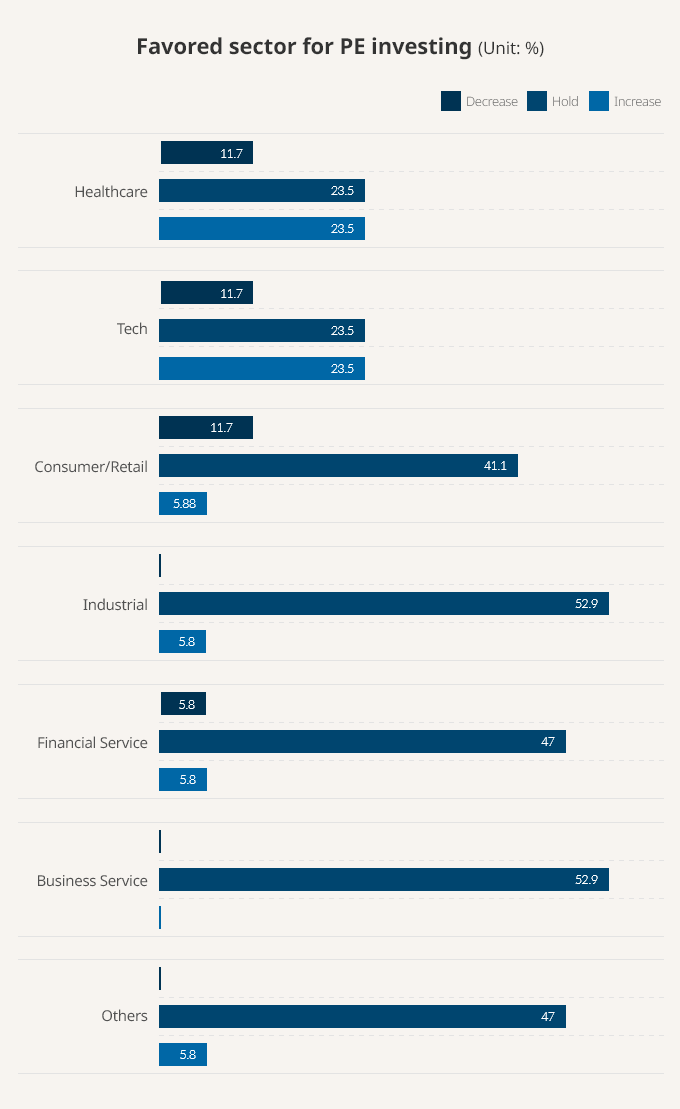

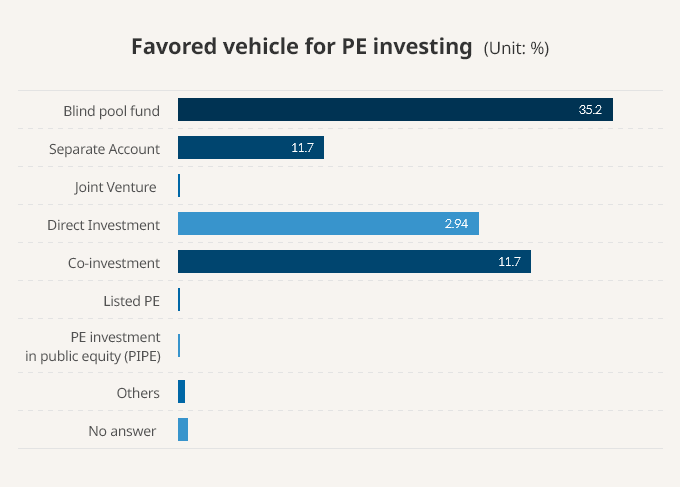

By sector, healthcare and technology were at the top of the list, with blind pool funds chosen as the preferred PE vehicle.

Among the respondents, overseas private equity investments by 11 institutions average 1.4 trillion won ($1.3 billion), compared to their average alternative asset investments of 16.7 trillion won. The other six respondents declined to give details of their portfolio breakdown.

Write to Seon-Pyo Hong at rickey@hankyung.com

Yeonhee Kim edited this article.

-

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout funds

Pension fundsS.Korea’s GEPS to commit $143 million to foreign mid-cap buyout fundsMay 08, 2025 (Gmt+09:00)

-

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Pension fundsNPS yet to schedule external manager selection; PE firms’ fundraising woes deepenMay 02, 2025 (Gmt+09:00)

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)