[Survey] Transport remains top pick for Korean LPs’ 2020 infra investment

By Oct 28, 2019 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

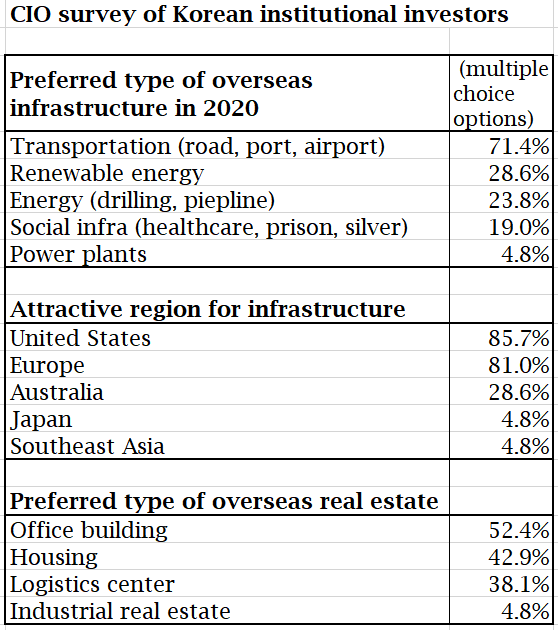

South Korean institutional investors will continue to increase their allocations to overseas infrastructure next year, and transport facilities such as roads and airports remain their top pick within the sector, a survey of 21 chief investment officers of Korean pension funds and insurance firms shows.

Of the respondents, 85.7% saw an increase in their overseas infrastructure investment next year, while the remaining 14.3% chose “no change,” or “undecided.”

“Compared to the global real estate market where disputes are arising over high valuations on core assets, infrastructure looks more attractive,” said a Korean pension fund CIO.

In a similar poll conducted in the same period last year, 78.3% of 23 respondents expected an increase in their overseas infrastructure investment in 2019, whereas the other 21.7% saw no change.

The surveys were undertaken on the occasion of the ASK Real Estate & Infrastructure Summit in 2018 and 2019, respectively.

By region, Australia won more votes than last year, reflecting growing interest in renewable energy facilities in the country.

For real estate, 52.4% of the respondents plan to boost investment in 2020, outnumbering those (42.9%) saying no change.

Overall, 71.4% of the 21 CIOs said they would increase allocations to alternatives next year.

Participants in the survey are as follows:

1. National Pension Service

2. Government Employees Pension Service

3. Korean Teachers’ Credit Union

4. Teachers’ Pension

5. Public Officials Benefit Association

6. Military Mutual Aid Association

7. Korea Scientists and Engineers Mutual-aid Association

8. Construction Workers Mutual Aid Association

9. Police Mutual Aid Association

10. Yellow Umbrella Mutual Aid Fund

11. Korea Fire Officials Credit Union

12. DB Insurance

13. Hanwha Life Insurance

14. Hyundai Marine & Fire Insurance

15. KB Insurance

16. Kyobo Life Insurance

17. Meritz Fire & Marine Insurance

18. Nonghyup Life Insurance

19. Samsung Fire & Marine Insurance

20. Samsung Life Insurance

21. Shinhan Life Insurance

Write to Sang-yeol Lee and Hyun-il Lee at mustafa@hankyung.com

Yeonhee Kim edited this article

-

Private equityKorean LPs seek private equity secondaries amid liquidity crunch

Private equityKorean LPs seek private equity secondaries amid liquidity crunchFeb 01, 2024 (Gmt+09:00)

-

-

-

InfrastructureDigital assets emerge as Korean LPs' No. 1 infrastructure target

InfrastructureDigital assets emerge as Korean LPs' No. 1 infrastructure targetJan 31, 2024 (Gmt+09:00)

-

Asset Owners ReportPrivate debt, infrastructure remain top picks for Korean LPs in 2024

Asset Owners ReportPrivate debt, infrastructure remain top picks for Korean LPs in 2024Jan 29, 2024 (Gmt+09:00)