Korean food

S.Korea’s premium kimchi war escalated by luxury hotels

The country’s luxury hotel and casino operator Paradise has jumped into the premium kimchi retail business

By Oct 16, 2024 (Gmt+09:00)

3

Min read

Most Read

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

Samsung steps up AR race with advanced microdisplay for smart glasses

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

Kimchi, Koreans’ staple food throughout millennia, has become a new, lucrative revenue source for the country’s luxury hotel chain operators with the hospitality industry’s household names flocking to the premium kimchi market.

Paradise Co., South Korea’s resort and casino operating conglomerate, last week rolled out kimchi products under its hotel brand.

The 1,500 bags of 4-kilogram kimchi were sold out on the first day of its sale, and an additional 1,200 bags were also snatched immediately on the second day, according to sources in the country’s hospitality industry on Tuesday.

Paradise kimchi enjoyed high demand thanks to its premium image on top of the country’s overall strong demand for premade kimchi due to a recent surge in its main ingredient napa cabbage's price.

However, Paradise is a latecomer in the premium kimchi market in Korea, going after the market’s frontrunners Walkerhill Resorts & Hotels and Josun Hotels & Resorts Co.

Walkerhill Resorts was the country’s first hotel chain to introduce its own branded kimchi in 1997, followed by Josun Hotels in 2004.

WALKERHILL AND JOSUN ON THE FRONT LINE

The leaders first offered their kimchi products made by themselves. But as their premium kimchi sold like hotcakes, they have recently started sourcing kimchi from their contractors and selling them under their private brands (PBs).

In response to the high demand, they also have diversified their sales channel, including TV shopping channels, online marketplaces, department stores and big-box hypermarkets. In the past, they sold their spicy fermented cabbage dishes through their hotel stores.

Paradise has decided to jump into the country’s premium kimchi market as luxury hotel kimchi sales have rapidly grown in recent years despite their high price tags.

Josun Hotels’ kimchi sales in 2023 zoomed 42% from the prior year, outpacing the hotel operator’s entire sales growth of about 15%.

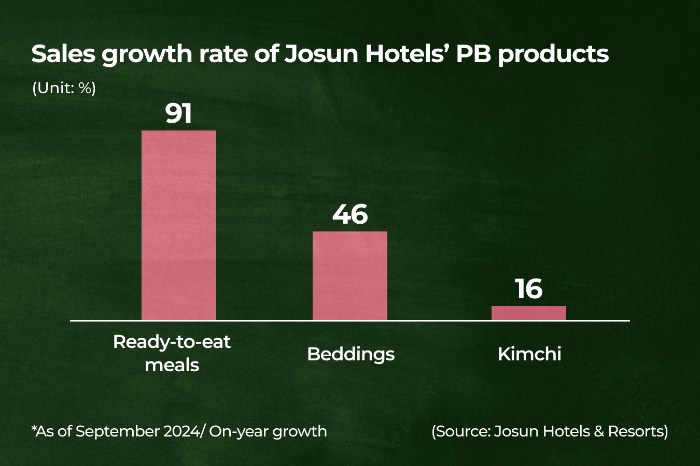

In the first nine months of this year, Josun Hotels’ kimchi sales increased 16% on-year, while Walkerhill Resorts’ kimchi sales soared 140% for the year to date.

To seize the kimchi opportunity, Korea’s largest hotel group Lotte Hotels & Resorts resumed its kimchi business last year, four years after its exit from the market.

PB PRODUCTS AS EXTRA REVENUE SOURCES

The lucrative kimchi business has led Korean luxury hotels to release other PB ready-to-eat meals.

Josun Hotels introduced its PB-labeled prepared fried rice meal kits in 2018 and has added 50 more meal kit products, ranging from Chinese, Korean and Western cuisines to bakery products.

The Josun Hotel, Josun Hotels’ bedding brand, currently operates six offline stores and is now Korea’s No. 1 bedding brand in terms of sales.

Josun Hotels’ PB products account for about 15% of the hotel’s entire revenue, according to the hotel.

For decades, selling in-room items has been a popular way for high-end hotels to earn extra revenue.

Luxury hotel chains also do it to boost hotel guests’ loyalty by keeping their hotel brand top on guests' minds and encouraging them to return for future stays.

Global high-end hotel operators including Westin Hotels & Resort owned by Marriott International actively sell in-room items such as bedding, towels and bathrobes.

Write to Jae-Kwang Ahn at ahnjk@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean foodSouth Korea enjoys record-high kimchi exports in first half

Korean foodSouth Korea enjoys record-high kimchi exports in first halfAug 05, 2024 (Gmt+09:00)

1 Min read -

Food & BeverageLotte Hotels & Resorts ups ante in kimchi business

Food & BeverageLotte Hotels & Resorts ups ante in kimchi businessNov 21, 2023 (Gmt+09:00)

2 Min read -

Korean foodLotte Hotels & Resorts to launch premium kimchi product

Korean foodLotte Hotels & Resorts to launch premium kimchi productAug 10, 2023 (Gmt+09:00)

1 Min read -

-

Food & BeverageCJ CheilJedang launches new Bibigo kimchi in Europe

Food & BeverageCJ CheilJedang launches new Bibigo kimchi in EuropeDec 05, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN