Korean ramen makers set sights beyond US to Latin America

In Central and South America, Japanese food companies dominate the instant noodle market

By Sep 18, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

Nongshim Co. and Samyang Foods Co., South Korea’s two largest ramen makers, are ramping up production to create and meet demand for their spicy instant noodles in new markets such as Latin America, heralding an intensifying competition with their Japanese peers.

Nongshim, better known for its instant noodle brand Shin Ramyun, is likely to open a sales branch in Mexico within the year. That would mark its first branch established in Latin America.

“We’re actively considering expanding our operation in Central and South America, including Mexico, where the demand for ramen is expected to grow rapidly,” said a Nongshim official.

SAMYANG

Samyang Foods has been increasing exports to Latin America, led by its flagship brand Buldak Bokkeum Myeon, a hot chicken stir-fried ramen.

Ramen sales in Mexico, the largest economy in Central America, have jumped by 18% to 1.2 trillion won ($900 million) over the past three years as of the end of 2023, according to Kyobo Securities.

In comparison, the ramen market in Brazil, the largest economy in South America, has expanded by 14% to 1.6 trillion won over the same period.

Nissin Foods, Japan’s No. 1 ramen company, has solidified its presence in Brazil since its entrance into the country in 1965. It commands 67% of Brazil’s ramen market as of 2023.

Toyo Suisan, another Japanese ramen brand, has introduced cup noodles to Mexico since its foray into the country in 1990. It boasts a 77% share of Mexico’s instant ramen market.

The two Japanese food companies rely heavily on the Americas for overseas sales.

Toyo Suisan reported a rise of 61.0% and 27.2% in operating profit and sales in overseas ramen sales, respectively, in the second quarter of this year, compared with the same period last year.

Its second-quarter operating profit and sales came in at 14.8 billion yen and 60.4 billion yen, respectively.

Its operating profit margin from overseas sales reached 24.5% in the quarter, 8.5 percentage points higher than the 16.0% average for its domestic and global sales.

Nissin Foods notched up an operating profit margin of 14.5% from the Americas in the second quarter, compared with the average of 11.8%, including those from other foreign countries and domestic operations.

The lack of pricing regulations and little consumer resistance to price changes in Latin America appeal to foreign food makers.

Toyo Suisan hiked its product prices in Mexico in April this year, followed by Nissin Foods, which raised its food prices in Brazil in July.

Nongshim began ramen exports in 1971 with the shipment to Los Angeles. Since establishing the US subsidiary Nongshim America in 1994, it has been operating two ramen factories in Los Angeles, built in 2005 and 2022, respectively.

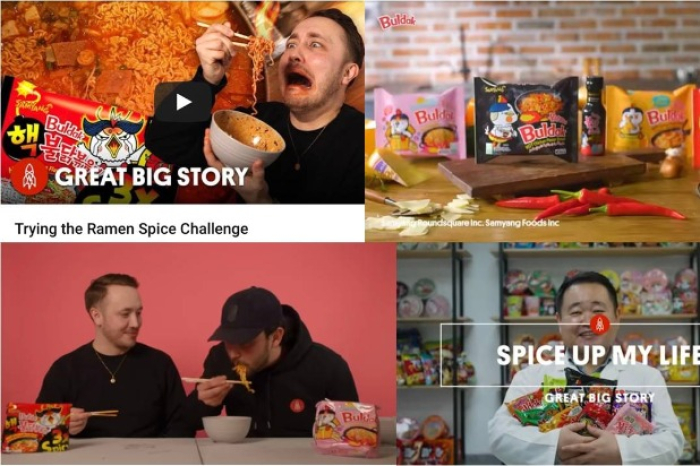

Samyang Foods is stepping up exports to the US. Its Buldak Bokkeum Myeon, or Buldak Ramen, fueled a craze for spicy Korean noodles in the US thanks to spicy eating challenges posted by social media influencers.

In the US, Korean ramen, also called ramyun, has built its presence through sales at big retailers such as Walmart and Costco.

In 2017, Nongshim overtook Nissin Foods to rise to the second spot after Toyo Suisan in the US ramen market in terms of market share. Nongshim controlled 25.4% of the US ramen market as of 2023, with Toyo Suisan holding a 45.0% market share, according to Euromonitor and IBK Investment & Securities.

CAPACITY INCREASE

Nongshim is scheduled to build an exports-only factory that can produce 500 million ramen packs annually in Busan, South Korea’s largest port city, by the end of the first half of 2026.

It will become its first new factory to be constructed at home in 17 years. Next month, it is expected to add new production lines to its second US plant.

Samyang Foods broke ground on its second factory in Miryang, South Gyeongsang Province, in March this year after the completion of its first facility there in 2022.

The new plant will be dedicated to exports of Buldak Ramen to the US and Latin America.

Write to Hyung-Joo Oh at ohj@hankyung.com

Yeonhee Kim edited this article.

-

Food & BeverageNongshim to build export-only ramen factory in Korea

Food & BeverageNongshim to build export-only ramen factory in KoreaAug 30, 2024 (Gmt+09:00)

3 Min read -

-

Korean stock marketSamyang tops Korean ramen makers by market cap, beating Nongshim

Korean stock marketSamyang tops Korean ramen makers by market cap, beating NongshimMay 17, 2024 (Gmt+09:00)

2 Min read -

Food & BeverageNongshim to open stores in Leclerc, Carrefour; expands plant in US

Food & BeverageNongshim to open stores in Leclerc, Carrefour; expands plant in USMay 14, 2024 (Gmt+09:00)

2 Min read -

Food & BeverageNongshim to build instant noodle plant in Korea for exports

Food & BeverageNongshim to build instant noodle plant in Korea for exportsMar 22, 2024 (Gmt+09:00)

3 Min read -

Korean foodKorea’s ramen exports on course to reach $1 bn in 2024

Korean foodKorea’s ramen exports on course to reach $1 bn in 2024Mar 21, 2024 (Gmt+09:00)

1 Min read -

EarningsSamyang’s power: Hot Chicken Flavor Ramen by daughter-in-law

EarningsSamyang’s power: Hot Chicken Flavor Ramen by daughter-in-lawFeb 01, 2024 (Gmt+09:00)

2 Min read -

-

-

Korean foodInstant noodles, rice, kimchi buoy Korean food exports

Korean foodInstant noodles, rice, kimchi buoy Korean food exportsSep 25, 2023 (Gmt+09:00)

2 Min read -

-

Food & BeverageS.Korea urges ramen makers to cut prices to ease inflation

Food & BeverageS.Korea urges ramen makers to cut prices to ease inflationJun 19, 2023 (Gmt+09:00)

3 Min read -

Food & BeverageS.Korean ramen's exports reach new heights amid K-content boom

Food & BeverageS.Korean ramen's exports reach new heights amid K-content boomApr 10, 2023 (Gmt+09:00)

1 Min read