SK Hynix, Samsung to cut legacy DRAM output as Chinese firms catch up

SK vows to cut its DDR4 output to 20% of its total DRAM by the end of the year while increasing HBM, eSSD production

By Nov 01, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

South Korea’s two leading memory chipmakers – Samsung Electronics Co. and SK Hynix Inc. – are moving to significantly reduce their production of legacy memory chips, particularly DRAM, amid falling prices caused by greater volumes from Chinese companies.

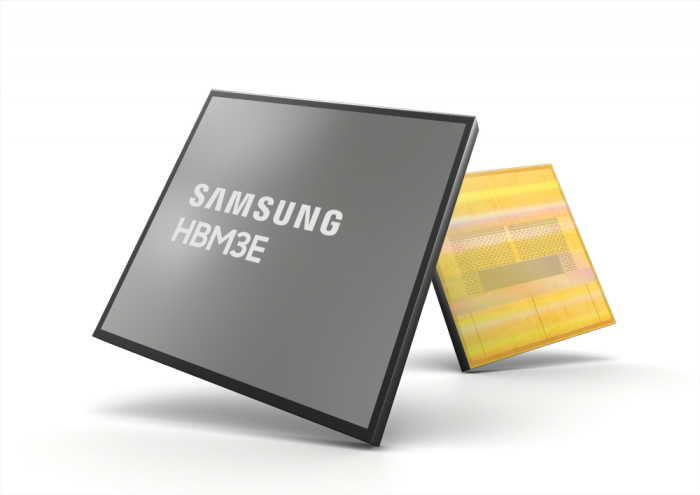

Samsung and SK Hynix, the world’s No. 1 and No. 2 memory chipmakers, respectively, instead plan to steadily ramp up production volumes of cutting-edge products such as high-bandwidth memory (HBM) and enterprise solid-state drives (eSSDs).

During an earnings conference call with analysts on Thursday, Samsung executives said the company plans to slash its production of legacy DRAM and NAND flash chips, confirming market talk that chipmakers are cutting down on conventional memory chips.

“We are adjusting production volumes downward for general-purpose DRAM and NAND flash in line with falling market demand,” said Kim Jae-joon, executive vice president of Samsung’s device solutions (DS) division, during the call.

According to industry sources on Friday, SK Hynix said in a recent investor relations session with Goldman Sachs that it plans to lower its DDR4 DRAM chip production to 20% of its DRAM output by year's end from 30% at the end of September and 40% at the end of June.

Samsung and SK’s moves come as major tech companies such as Google Inc. and China’s Baidu continue to invest in servers, leading to steady server DRAM demand, while sales of PC DRAM chips have stalled.

The global semiconductor market has been recovering from last year’s downturn, driven by chips used in AI devices and servers. Meanwhile, demand recovery for conventional chips used in smartphones and PCs is slowing.

Market research firm TrendForce recently revised down its forecast for PC DRAM price increases in the fourth quarter to flat, from the 3%-8% hike it projected in September.

Industry data show that while server DRAM is booming, with its prices rising due to strong demand for AI-powered devices, the prices of DRAMs for PCs and smartphones have been steadily dropping.

The price gap between traditional DRAMs and cutting-edge new products such as HBM is also widening.

CHINA’S CXMT RAMPS UP LEGACY CHIPS

The widened price gap was owed largely to increased production of older chips such as DDR4 and LPDDR4X by China’s ChangXin Memory Technologies (CXMT), according to industry officials.

According to TrendForce, Chinese memory chipmakers are expected to control a combined 11.8% market share of the DRAM segment by year's end, up from 10.1% in the first quarter.

Now the world’s No. 4 DRAM maker, CXMT's monthly DRAM production capacity has expanded to 160,000 sheets in terms of wafers, from 40,000 sheets in 2020. Its monthly production capacity is forecast to rise to 200,000 sheets by the end of this year and to 300,000 sheets by the end of 2025.

In a recent research note, Morgan Stanley said it expects CXMT’s DRAM output to surpass 10% of the global total by year-end.

SK HYNIX TO BOOST ADVANCED MEMORY OUTPUT

SK Hynix expects the global HBM market to reach $40 billion next year — a more aggressive forecast than rival Micron Technology Inc.’s $25 billion estimate.

SK executives said the company aims to double its HBM supplies in 2025 to keep its market share above 50%. The company is the top HMB supplier with a 52.5% market share.

In terms of production of next-generation HBM4, SK plans to prioritize standard chips over customized ones, which it is working on with its HBM4 partner TSMC, sources said.

Judging that a global supply glut will be protracted, SK plans to speed up the conversion of its older DRAM lines in Wuxi, China, to more advanced lines to make products such as the fourth-generation 10-nanometer 1a DRAM.

While keeping its NAND flash production pace at the current level, SK is upping the operation rate of its eSSD facility in Dalian, China, to nearly 100%, sources said.

China’s Yangtze Memory Technologies Co. (YMTC) recently developed SSDs for data storage after mass-producing its latest 232-layer NAND flash.

SAMSUNG TO UP AI CHIP INVESTMENT

Samsung’s recent chip business strategy is to increase investment in high-end products such as HBM, eSSD and LPDDR5.

For HBM4, Samsung is leveraging its strengths in design and production to develop customized products for its clients.

Samsung has also forged a tie-up with its foundry rival TSMC for HBM4 chips.

Samsung plans to allocate the majority of its 48 trillion won ($34.8 billion) in 2025 chip investment to AI memory facilities and related R&D projects.

Samsung has been scrambling to catch up with smaller crosstown rival SK Hynix in a race to supply advanced HBM chips to Nvidia Corp., the world’s top AI chip designer.

While more than half of SK Hynix’s sales revenue comes from HBM and other high-value server DRAMs, Samsung has a relatively higher proportion of smartphone and PC DRAMs.

Write to Jeong-Soo Hwang and Eui-Myung Park at hjs@hankyung.com

In-Soo Nam edited this article.

-

EarningsSamsung’s memory business fares better in Q3; more HBM sales ahead

EarningsSamsung’s memory business fares better in Q3; more HBM sales aheadOct 31, 2024 (Gmt+09:00)

5 Min read -

EarningsSK Hynix’s Q3 profit soars to record high, beats Samsung’s memory profit

EarningsSK Hynix’s Q3 profit soars to record high, beats Samsung’s memory profitOct 24, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soars

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soarsOct 23, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip development

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip developmentSep 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boom

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boomSep 04, 2024 (Gmt+09:00)

3 Min read -

EarningsSK Hynix to supply 12-layer HBM3E to Nvidia in Q4; profit soars in Q2

EarningsSK Hynix to supply 12-layer HBM3E to Nvidia in Q4; profit soars in Q2Jul 25, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersHBM chip war intensifies as SK Hynix hunts for Samsung talent

Korean chipmakersHBM chip war intensifies as SK Hynix hunts for Samsung talentJul 08, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025May 30, 2024 (Gmt+09:00)

3 Min read