SK Hynix shares nosedive after Morgan Stanley downgrade

The brokerage house's view on the memory chip market contrasts SK Hynix's upbeat outlook

By Sep 19, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

The share price of SK Hynix Inc. plummeted as much as 11% at one point on Thursday after Morgan Stanley sharply cut its target price in an about-turn on its view on the world’s No. 2 memory chipmaker in just three months.

Morgan Stanley on Sept. 15 slashed the target price for SK Hynix to 120,000 won ($90) from 260,000, suggesting the stock has room to drop 26% from its closing price on Sept. 13.

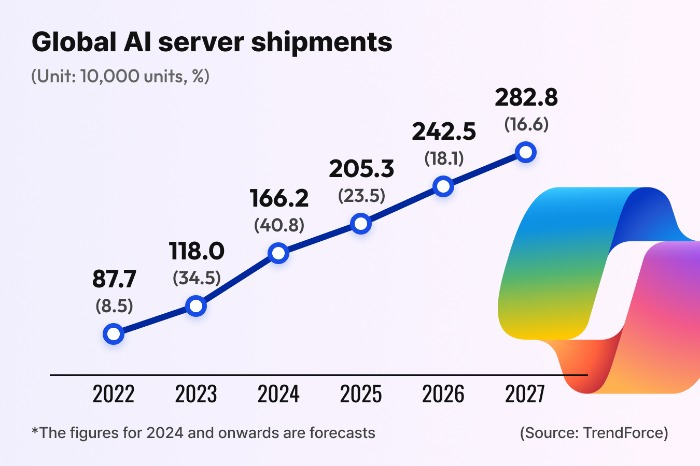

It forecasts that the DRAM and high-bandwidth memory (HBM) market will enter a downturn next year due to softening demand and oversupply. The US brokerage house downgraded the second-largest stock on South Korea’s main bourse Kospi to “underweight” from a “top pick."

On Thursday, SK Hynix shares briefly skidded to as low as 144,700 won, their lowest intra-day level since hitting 137,900 on Feb. 8 of this year.

Shares pared back some early losses to close at 152,800 won, down 6.14%, against the steady Kospi market.

Thursday is the first trading day in South Korea after the Morgan Stanley report's publication on Sept. 15. The domestic stock market was closed during the Korean Thanksgiving Chuseok holiday Sept. 14-18.

“We believe the fourth quarter (of 2024) marks the peak of the (memory chip) cycle in terms of the year-on-year rate of change,” Morgan Stanley said in the research note.

“Memory conditions are beginning to deteriorate. It will get tougher for revenue growth and margins from here as we move past late-cycle conditions,” noted.

The downgrade and target price cut marked a flip-flop on its SK Hynix forecast in three months and contrasted SK Hynix’s bullish outlook for the memory chip market.

The negative comments rattled investors betting big on a surge in AI-driven memory chips.

Some market analysts argued against the report, titled “Winter looms – double downgrade to underweight,” saying it exaggerates the risk to the semiconductor industry and fails to reflect the growing demand for chips tailor-made to customers.

They also pointed out its negative outlook on SK Hynix contradicts its positive comments about Nvidia and the world’s largest chip contract manufacturer TSMC. Morgan Stanley has picked Nvidia and TSMC as beneficiaries of the AI data center demand.

Morgan Stanley forecast that HBM supply would more than double in 2025, factoring in Samsung Electronics’ production ramp-up as Nvidia’s new HBM supplier after SK Hynix and Micron Technology.

It added that cyclical DRAM shortages are coming to an end and Samsung’s foray into the HBM market will likely challenge sustainable long-term margins of the high-performance chips.

SK Hynix’s operating margins will likely peak in early 2025, with the memory chip sector forecast to enter a downturn later in 2025, according to Morgan Stanley. SK Hynix is the world’s No. 1 HBM supplier.

The research note was issued about one month after SK Hynix CEO Kwak Noh-jung told employees at a company town hall meeting that the memory chip market was expected to remain buoyant until the first half of next year, powered by AI boom-triggered demand for high-value-added memory chips.

But the brokerage house said SK Hynix will unlikely meet its future guidance in the coming quarters, saying “Hynix is now the least preferred among our global memory stock coverage.”

Morgan Stanley also cut the target price for Samsung Electronics by 27.6% to 76,000 won, compared with its stock price of 64,400 won as of the market close on Sept. 13.

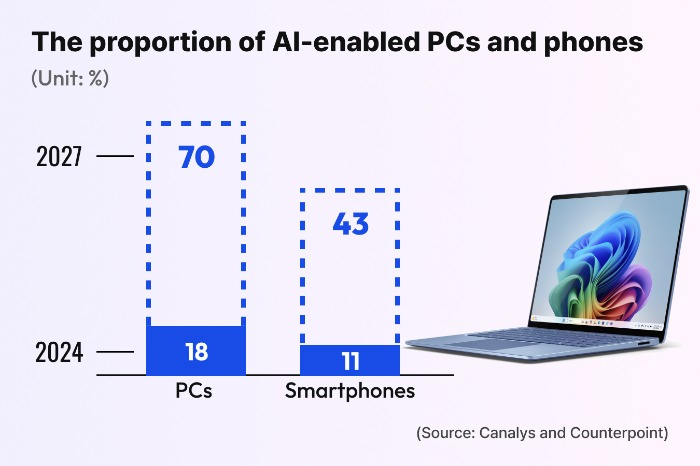

Some semiconductor observers argued that the Korean chipmakers’ pivot toward high-performance chips HBMs and solid-state drives for use in data centers will result in supply constraints in commodity DRAMs and NAND memory, in growing demand for AI PCs and AI phones.

But Morgan Stanley played down such arguments as "just statements of likelihood."

In response, Samsung Electronics and SK Hynix said “DRAM demand from smartphone and PC manufacturers have neither declined nor increased."

HBM is a high-capacity, high-performance semiconductor chip, stacking multiple DRAM chips on top of one another. It is used to power generative AI devices like ChatGPT, high-performance data centers and machine learning platforms.

SK Hynix shares have gained 7.3% year to date, outperforming the Kospi's 2.8% decline.

(Updated with SK Hynix's closing price and the Kospi index at market close.)

Write to Jung-Soo Hwang at hjs@hankyung.com

Yeonhee Kim edited this article.

-

-

Corporate investmentLG Electronics breaks ground on $600 mn home appliance plant in India

Corporate investmentLG Electronics breaks ground on $600 mn home appliance plant in India7 HOURS AGO

-

-

E-commerceCoupang’s Q1 revenue up; quarterly dip signals rising competition

E-commerceCoupang’s Q1 revenue up; quarterly dip signals rising competitionMay 07, 2025 (Gmt+09:00)

-

Asset managementKorea Investment & Securities deepens global ties with 2nd IR in New York

Asset managementKorea Investment & Securities deepens global ties with 2nd IR in New YorkMay 07, 2025 (Gmt+09:00)