Korean chipmakers

US chipmakers announce 10% hike in NAND flash prices

Prices of NAND flash memory chips fluctuate due to production disruption in Japan

By Mar 02, 2022 (Gmt+09:00)

1

Min read

Most Read

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

K-pop stocks surge as China set to loosen cultural ban after 9 years

Earlier this year, another US chipmaker Micron Technology Inc. also announced a 10% price increase.

The string of price hikes follows production disruptions at NAND flash memory plants in Japan jointly owned by Western Digital and Japan's Kioxia Holdings Corp.

Western Digital announced on February 10 that contamination of certain materials used in its manufacturing processes has led to disruptions at NAND flash production facilities in the Japanese cities of Yokkaichi and Kitakami.

The disruption has affected some 14 exabytes, which accounts for 8% of the world’s total NAND flash supply. One exabyte is equal to 1,000 petabytes or one billion gigabytes.

According to Q3 2021 figures, Western Digital and Kioxia boast market shares of 19.3% and 13.2%, respectively.

BENEFIT TO KOREAN CHIPMAKERS

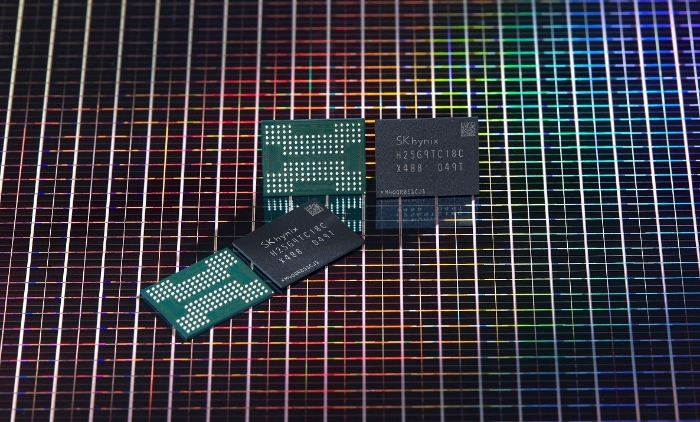

South Korea's Samsung Electronics Co. and SK Hynix Inc. have yet to announce such price adjustments.

Industry insiders expect the Korean juggernauts to be the main beneficiaries of the rise in the spot prices of 3D NAND flash memory chips.

Since the production disruption, the price of 512 gigabyte TLC NANDs increased 6% and that of 256 gigabyte TLC NANDs rose 7%. SATA SSD prices climbed 3%.

Market tracker TrendForce forecasts the two plants jointly owned by Western Digital and Kioxia will not be operating as normal until this autumn and thus expects the fixed transaction price of NAND chips to surge as much as 10%.

The fixed transaction price of NAND chips has been stable for the past eight months; after rising 5.5% last July.

The demand for memory chips is expected to increase around the globe on facilities expansion by tech giants.

Alphabet Inc., Meta Platforms Inc. (formerly Facebook Inc.,) and Amazon.com Inc. have all announced plans to increase facilities investments this year.

SK Hynix is expected to benefit significantly from its latest acquisition of Intel Corp’s NAND flash memory chip business and projects a two-fold jump in its 2022 shipments.

Write to Su-Bin Lee at lsb@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

Corporate investmentLG Electronics to spend $600 mn to build 3rd home appliance plant in India

Corporate investmentLG Electronics to spend $600 mn to build 3rd home appliance plant in India24 MINUTES AGO

-

-

-

Asset managementKorea Investment & Securities deepens global ties with 2nd IR in New York

Asset managementKorea Investment & Securities deepens global ties with 2nd IR in New York24 HOURS AGO

-

Comment 0

LOG IN