Online lender K Bank aims for IPO at $4 bn valuation in Q4

Its earnings vulnerability to cyrptocurrency prices could be a downside factor to its valuation

By Sep 06, 2024 (Gmt+09:00)

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Samsung steps up AR race with advanced microdisplay for smart glasses

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

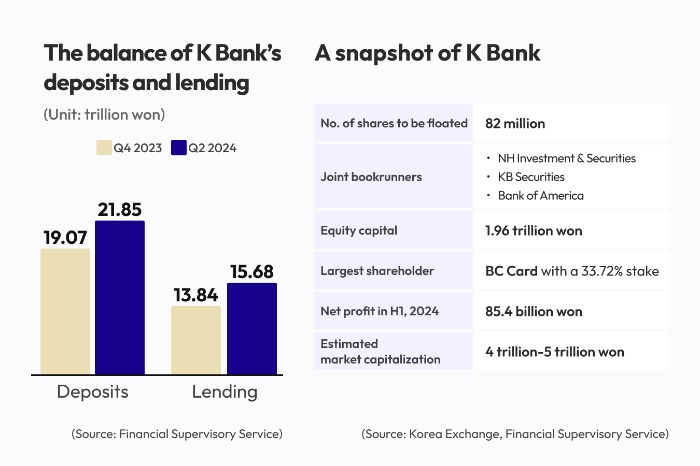

Kbank, a South Korean online bank, is preparing to list on the main bourse Kospi at an estimated value of up to 5 trillion won ($3.8 billion) in the fourth quarter of this year. If it goes forward, it would be the country’s largest initial public offering this year, according to securities industry sources.

Kbank is now assessing its valuation compared with bigger domestic peer KakaoBank Corp. and Brazilian fintech PagSeguro, the sources said on Thursday.

Some investment bankers say, however, that the timing might not be ideal as the domestic IPO market rally is running out of steam.

But Kbank aims to push through with its IPO this year after its first attempt to go public in June 2022 went awry due to high interest rates and a lethargic stock market, the sources added.

Kbank will submit an IPO prospectus to the Financial Supervisory Service this month.

Its largest shareholder is Korea’s card processing company BC Card with a 33.72% stake. Woori Bank, a part of Woori Financial Group, holds a 12.58% stake as of the end of June.

Kbank’s estimated valuation is around half of KakaoBank’s market capitalization of 10 trillion won and about 60% of its projection of 7 trillion to 8 trillion won back in June 2022.

Its enterprise value would be based on two to three times its book value of 2 trillion won and then applying a 20-30% discount as IPO companies normally do.

KakaoBank, a unit of Korea’s dominant mobile platform Kakao Corp., went public in 2021 at an estimated valuation of 15.7 trillion to 18.5 trillion won, or seven times its book value. It is the first Korean online bank to be listed on the Korean stock market.

But its share price has since plunged to about half of its IPO price of 39,000 won, or 1.6 times its book. The company is being investigated by financial regulators and government authorities in connection to its buying a majority stake in K-pop pioneer SM Entertainment Co.

In comparison, Brazilian mobile payment app PagSeguro is trading at 1.4 times its book.

If Kbank’s flotation goes as planned, it will mark the country’s biggest IPO since Kakao Pay Corp., a fintech platform, went pubic at a valuation of 8.2 trillion won in 2021.

High-profile IPOs that have taken place on the Korea Exchange this year include HD Hyundai Marine Solution Co. at an enterprise value of 3.7 trillion won and Sift Up Corp., a Tencent-backed video game developer, at a valuation of 3.5 trillion won.

Industry observers, however, point to Kbank’s heavy reliance on Upbit as a downside risk.

Nearly half of accounts at Kbank have been opened in tandem with Upbit, a cryptocurrency exchange operator. This means that half of its customers use the banking platform for cryptocurrency transactions. Thus, its operating profit is highly vulnerable to Bitcoin and other cryptos’ performance, they warned.

Write to Jeong-Cheol Bae at bjc@hankyung.com

Yeonhee Kim edited this article

-

IPOsLG CNS gears up for 2025 IPO with $5.1 billion in enterprise value

IPOsLG CNS gears up for 2025 IPO with $5.1 billion in enterprise valueAug 01, 2024 (Gmt+09:00)

3 Min read -

Investment bankingBofA eyes its 1st Korean IPO management with K Bank deal

Investment bankingBofA eyes its 1st Korean IPO management with K Bank dealJul 16, 2024 (Gmt+09:00)

1 Min read -

Korean stock marketKorean IPO boom sets record; bubbles burst post debut

Korean stock marketKorean IPO boom sets record; bubbles burst post debutJul 04, 2024 (Gmt+09:00)

2 Min read -

Korean gamesTencent-backed Shift Up to raise up to $313 mn in IPO

Korean gamesTencent-backed Shift Up to raise up to $313 mn in IPOJun 26, 2024 (Gmt+09:00)

3 Min read -

-

-

Upcoming IPOsOverhang concerns loom over HD Hyundai Marine IPO shares

Upcoming IPOsOverhang concerns loom over HD Hyundai Marine IPO sharesMay 03, 2024 (Gmt+09:00)

3 Min read -

IPOsHD Hyundai Marine IPO sees strong demand from retail investors

IPOsHD Hyundai Marine IPO sees strong demand from retail investorsApr 26, 2024 (Gmt+09:00)

2 Min read -

Upcoming IPOsKorea’s IPO market heats up with HD Hyundai Marine, K Bank

Upcoming IPOsKorea’s IPO market heats up with HD Hyundai Marine, K BankMar 25, 2024 (Gmt+09:00)

2 Min read -

-