LG CNS gears up for 2025 IPO with $5.1 billion in enterprise value

If successful, the IPO will offer financial investor Macquarie PE a chance to exit from its LG investment

By Aug 01, 2024 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

LG CNS Co., the information technology service unit of South Korea’s LG Group, is gearing up for an initial public offering early next year, offering its financial investor Macquarie Group a chance to exit from its LG investment in 2019.

According to investment banking sources on Thursday, in late July LG’s IPO managers began paperwork to submit a preliminary share listing request to the Korea Exchange in September.

If all goes to plan, the company expects to obtain approval in November and debut its shares on the main Kospi market in January next year.

Seven local and foreign brokerages will manage its IPO, sources said.

KB Securities Co., Bank of America (BoA) and Morgan Stanley are the lead managers, with Mirae Asset Securities Co., Daishin Securities Co., Shinhan Securities Co. and J.P. Morgan working as co-managers.

LG CNS’ enterprise value is estimated at 7 trillion won ($5.1 billion), which would make it the largest company to go public on Korea’s main bourse since LG Energy Solution Ltd., whose corporate value stood at 70 trillion won when it debuted shares in January 2022.

PRIME TIME FOR AN IPO?

LG CNS was trying to go public in 2022 but gave up its bid as the IPO market cooled amid the COVID-19 pandemic.

But the company revived its IPO plan after the successful market debuts of APR Co., HD Hyundai Marine Solution Co. and Shift Up Corp. earlier this year.

LG CNS hopes to start trading its shares in January to benefit from the so-called “January effect," when retail investors are often willing to invest in new shares at the start of the year.

LG Energy, an affiliate of LG Chem Ltd., saw record-high bidding from institutional investors during the bookbuilding process in January 2022.

The battery maker also drew the highest number in bids from retail investors.

MACQUARIE’S EXIT

The planned IPO would allow Macquarie Group's private equity arm to exit from its investment in LG CNS.

Macquarie bought a 35% stake in LG CNS from LG’s holding company LG Corp. for 950 billion won in 2019, beating KKR & Co., the other shortlisted bidder.

With the stake, Macquarie PE is LG CNS’ second-largest shareholder after LG Corp., which owns 49.95%.

Other major individual shareholders include LG Chairman Koo Kwang-mo with a 1.12% stake; Heesung Group Chairman Koo Bon-neung with a 0.84% stake; LX Group Chairman Koo Bon-joon with a 0.28% stake; and LT Group Chairman Koo Bon-sik with a 0.14% stake.

When Macquarie purchased the stake in 2019, LG CNS’ corporate value was estimated at 2.9 trillion won, meaning the company’s value has more than doubled over the past five years.

At the time, LG promised Macquarie it would list its shares on the Kospi by April 2025.

DIGITAL TRANSITION TECH LEADER

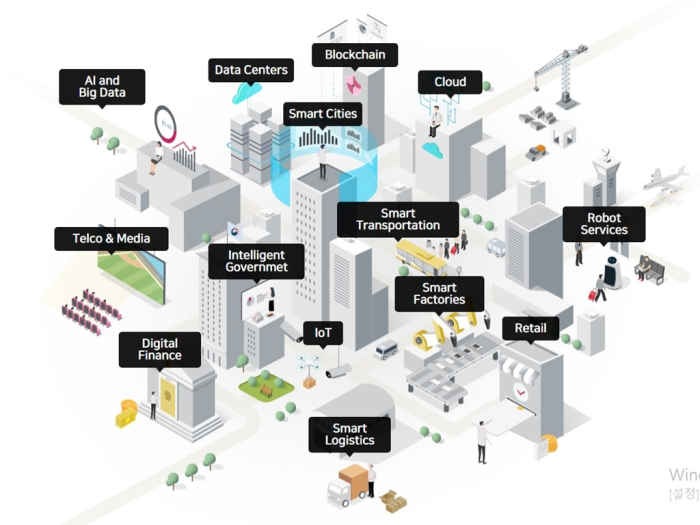

Founded in 1987, LG CNS is a major Korean IT service provider that's been spearheading LG Group’s digital transition (DX) drive.

LG CNS provides system integration (SI) and maintenance services to group affiliates.

Since 2020, it has expanded its business areas to include DX projects in the financial sector, cloud, smart factory and artificial intelligence (AI).

The company has posted strong sales and profit growth since 2019.

In 2021, its sales surpassed 4 trillion won for the first time and last year posted a record 5.6 trillion won in annual sales.

Its operating profit also reached an all-time high of 464 billion won in 2023.

In the first quarter of this year, its sales were 1.07 trillion won, up 2% from a year earlier. First-quarter operating profit fell 49% on-year to 32.3 billion won.

Analysts said LG CNS must reduce its heavy reliance on group affiliates for business growth if its corporate value is to be properly recognized during the IPO.

Its internal transactions with group affiliates account for some 60% of its total revenue.

LG said proceeds from its share sale will be used to finance new growth businesses.

Write to Seok-Cheol Choi at dolsoi@hankyung.com

In-Soo Nam edited this article.

-

Artificial intelligenceLG CNS to lead digital transformation at FPT in Vietnam

Artificial intelligenceLG CNS to lead digital transformation at FPT in VietnamMar 26, 2024 (Gmt+09:00)

2 Min read -

Artificial intelligenceLG CNS launches AI center for synergy of business, research

Artificial intelligenceLG CNS launches AI center for synergy of business, researchJan 21, 2024 (Gmt+09:00)

2 Min read -

Tech, Media & TelecomMetaverse-based virtual offices: New breadwinner for LG CNS

Tech, Media & TelecomMetaverse-based virtual offices: New breadwinner for LG CNSJan 20, 2023 (Gmt+09:00)

2 Min read -

Tech, Media & TelecomLG CNS hires new employees based on computer coding skills

Tech, Media & TelecomLG CNS hires new employees based on computer coding skillsNov 01, 2022 (Gmt+09:00)

1 Min read -

-

Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment center

Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment centerJul 05, 2021 (Gmt+09:00)

4 Min read