Insurance

Woori to buy Dajia’s insurers in Korea for up to $2.2 bn

Woori to buy Tongyang, ABL, not to bid on Lotte Insurance, dampening other insurers’ hopes to sell their stakes to the group

By Jun 26, 2024 (Gmt+09:00)

3

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

Woori Financial Group Inc., South Korea’s fourth-largest financial services holding company, is set to acquire China’s Dajia Insurance Group Co.'s insurers in Korea for up to an estimated $2.2 billion to strengthen its non-banking businesses.

Woori has recently signed a memorandum of understanding to take over Tongyang Life Insurance Co. and ABL Life Insurance Co. from Dajia, the revamped entity of China’s embattled Anbang Insurance Group, according to financial industry sources in Seoul on Wednesday.

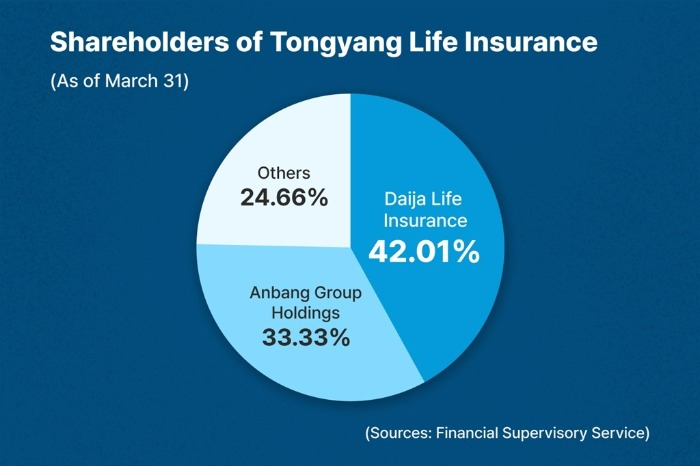

Dajia is the largest shareholder of Tongyang with a 42.01% stake, followed by Anbang Group Holdings Co. with 33.33%. Anbang also has a 100% in ABL, formerly Allianz Life Insurance Korea.

Woori and Dajia plan to ink a share purchase agreement in the third quarter after evaluating the deal’s value. The total corporate value, including control premium, was estimated at up to 3 trillion won ($2.2 billion), according to the sources.

Tongyang’s stock price ended up 5.42% at 7,000 won in the South Korean stock market after the news, far outperforming a 0.64% gain in the benchmark Kospi. The insurer’s market capitalization increased to 1.1 trillion won. ABL is not listed in the country.

Dajia had sought to sell ABL with an estimated value of 300 billion won-400 billion won in 2022.

DIVERSIFICATION

Woori has sought to acquire insurers and securities firms to diversify its business portfolios as it is the only financial conglomerate without an insurer among the country’s five largest players.

The group sold Woori Aviva Life Insurance, its joint venture life insurer with Aviva plc., to DGB Financial Group in 2014.

Woori was touted as the top potential buyer when other insurers such as Tongyang, Lotte Insurance Co. and KDB Life Insurance were put up for sale.

The group selected Tongyang as it secured the most stable profitability after reviewing other insurers, according to the sources.

Tongyang logged a net profit of 88.5 billion won in the first quarter after enjoying the largest profit of 295.7 billion won last year. ABL also reported 80.4 billion won in net profit in 2023.

Woori is expected to compete with other financial groups in the local insurance market with the takeover.

The assets of Tongyang and ABL totaled 49.9 trillion won as of end-March, the sixth-largest after those of Samsung Life Insurance Co., Kyobo Life Insurance Co., Hanwha Life Insurance Co., Shinhan Life Insurance Co. and NongHyup Life Insurance Co.

TO DAMPEN OTHER INSURANCE M&A DEALS

Woori’s acquisition is expected to dampen other insurers’ hopes to sell their stakes to the group.

The conglomerate reportedly decided not to participate in the final bidding for Lotte Insurance scheduled on June 28, which was seen as the most attractive among the insurers on sale, according to the sources.

“We have yet to make a final decision, although we are considering various measures,” said a Woori official.

As Woori has been seeking to strengthen non-banking businesses through acquisitions, many insurers asked the group to buy their stakes, hoping to sell them at higher prices to a financial holding company.

Lotte Insurance and MG Non-Life Insurance Co. have already been on sale, while KDB Life Insurance, BNP Paribas Cardif Life Insurance, AIA Life Insurance Co., MetLife Insurance Co. of Korea and AXA General Insurance Co. are likely to be put on the market, industry sources said.

Those insurers are expected to seek new buyers including other financial holding companies or global private equity firms.

The seller of Lotte Insurance was known to have told other financial holding companies that they could participate in the final bidding although they did not join the preliminary biddings. Woori’s larger rival Hana Financial Group submitted a bid in the final round to acquire KDB Life last year, skipping the preliminary biddings.

Woori may still seek to take over a non-life insurer for long-term growth since it does not have a unit for the business, industry sources said.

Write to Jun-Ho Cha, Seok-Cheol Choi and Jae-Won Park at chacha@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Mergers & AcquisitionsWoori Financial acquires Korea Foss Securities to offer brokerage services

Mergers & AcquisitionsWoori Financial acquires Korea Foss Securities to offer brokerage servicesMay 03, 2024 (Gmt+09:00)

2 Min read -

InsuranceKorea's Lotte Insurance put on market for around $1.5 bn

InsuranceKorea's Lotte Insurance put on market for around $1.5 bnApr 23, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsKDB halts KDB Life sale process to take full control

Mergers & AcquisitionsKDB halts KDB Life sale process to take full controlMar 27, 2024 (Gmt+09:00)

2 Min read -

InsuranceDajia Insurance likely to put Korea's ABL Life up for sale again

InsuranceDajia Insurance likely to put Korea's ABL Life up for sale againDec 09, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN