Foreign exchange

Korean won at 5-mth high; BOK may not lower interest rate

Stop-loss dollar selling may be behind the won’s jump; BOK is likely to keep the rate this month although the Fed is set for a cut

By Aug 19, 2024 (Gmt+09:00)

4

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

The South Korean won on Monday touched a five-month high as the central bank may not immediately cut its policy interest rate due to rising property prices although the US Federal Reserve is likely to lower borrowing costs.

The won advanced as much as 2.1% to 1,329.8 against the dollar, its strongest since March 21, according to the Bank of Korea.

That came as the greenback fell across the board as the Fed is expected to reduce its policy interest rates with inflation slowing amid growing signs of weakness in the world’s largest economy. Meanwhile, predictions of a BOK rate cut in the near term waned as real estate prices in South Korea jumped.

The US economy slowdown is not severe enough to spur recession concerns, boosting risk appetite and the won’s value, analysts said. The South Korean currency is likely to strengthen further, probably to 1,320, they added.

“The won may weaken again if worries about the ballooning fiscal deficit ahead of the US election, but that would be short-lived,” said Lee Joowon, an economist at Daishi Securities Co. “The won is expected to appreciate in the mid to long term as the foreign exchange market also focuses on the economy.”

BOK UNLIKELY TO CUT RATES THIS MONTH

The BOK is expected to keep its policy interest rate at 3.50% later this week, according to about 90% of participants in a survey by The Korea Economic Daily.

The Fed is widely predicted to cut its benchmark lending rate by 25 basis points (bps) in the upcoming meeting on Sept. 17-18, which will narrow the rate differentials between the two countries to as little as 1.75 percentage points from the current 2 percentage points.

The US rate cut forecast increased after data showing that privately owned housing starts fell 6.8%, adding to concerns over an economic slowdown, while producer and consumer price data already point to easing inflation.

The dismal data hurt the US currency. The dollar index, which measures the greenback’s value against six major currencies, headed to its lowest level this year, trading around a crucial support level of 102.

STOP-LOSS DOLLAR SELLING

The dollar’s weakness prompted some traders to rush to dump dollar holdings, which they had built up to bet on won depreciation, to cut their losses, currency market watchers in Seoul said.

The South Korean unit was still one of the worst-performing Asian currencies with a 3.4% loss against the US dollar so far this year.

“The won did not keep up enough with the recent strength in other Asian currencies,” said a South Korean foreign exchange authority official. “We were aware that stop-loss dollar selling by some investors with key support levels for the dollar/won rate broken added to the won’s appreciation.”

Stop-loss dollar selling has already boosted the Japanese yen.

The Bank of Japan raised its benchmark interest rate in late July, leading to the unwinding of the popular yen carry trade and boosting the currency. Carry trades refer to operations wherein an investor borrows money in a currency with low interest rates, such as the Japanese currency, and invests it in higher-yielding assets.

“The won’s appreciation was similar to the yen’s jump earlier this month when the yen’s short positions were massively unwound,” said Park Sang-hyun, an economist at iM Securities Co.

Some analysts said China’s policy to shore up the yuan to bolster domestic demand supported the won, which was the most correlated and liquid proxy for the Chinese currency.

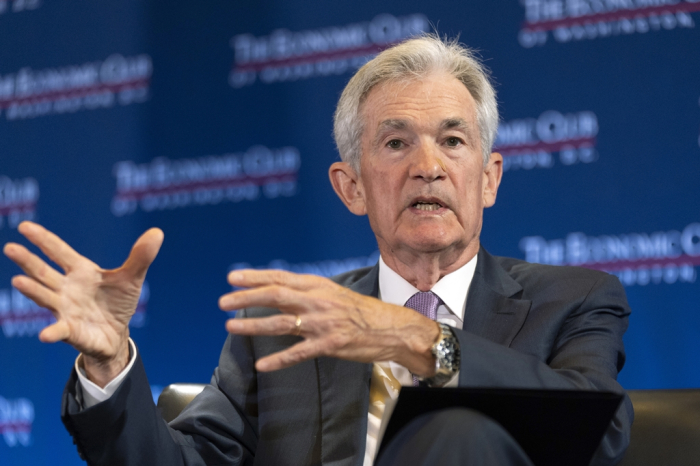

WATCHING POWELL, RHEE

Currency investors are keeping an eye on comments from Fed Chair Jerome Powell and BOK Governor Rhee Chang-yong for the won’s future direction.

The local currency is expected to appreciate further if Rhee takes a hawkish stance at the BOK policy meeting on Aug. 22 by emphasizing concerns over rising housing prices, analysts said.

The South Korean unit is likely to weaken again if monetary policy committee members see a need for a rate cut, they added.

Powell is scheduled to speak at the Fed’s annual economic symposium in Jackson Hole, Wyoming, Aug. 22-24.

Investors are closely watching if the chair will have his chance to provide clues on the path forward for monetary policy.

Given cooling inflation and a slowing economy, the question is not whether the US central bank will cut rates in September but by how much, they said.

Write to Jin-gyu Kang at josep@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Central bankBOK chief signals rate cut; warns of rising housing prices

Central bankBOK chief signals rate cut; warns of rising housing pricesJul 11, 2024 (Gmt+09:00)

3 Min read -

Foreign exchangeWon to soften past 1,400, BOK rate cut likely in Oct: poll

Foreign exchangeWon to soften past 1,400, BOK rate cut likely in Oct: pollJul 10, 2024 (Gmt+09:00)

4 Min read -

Foreign exchangeKorean won hits 15-year low in Q2 amid FX, economic uncertainty

Foreign exchangeKorean won hits 15-year low in Q2 amid FX, economic uncertaintyJul 07, 2024 (Gmt+09:00)

5 Min read -

Central bankBOK sees more uncertainty in rate cut timing, ups growth forecast

Central bankBOK sees more uncertainty in rate cut timing, ups growth forecastMay 23, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN