Refining margins

Crude oil price rebound yet to spill over to Korean refiners

By Feb 19, 2021 (Gmt+09:00)

3

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

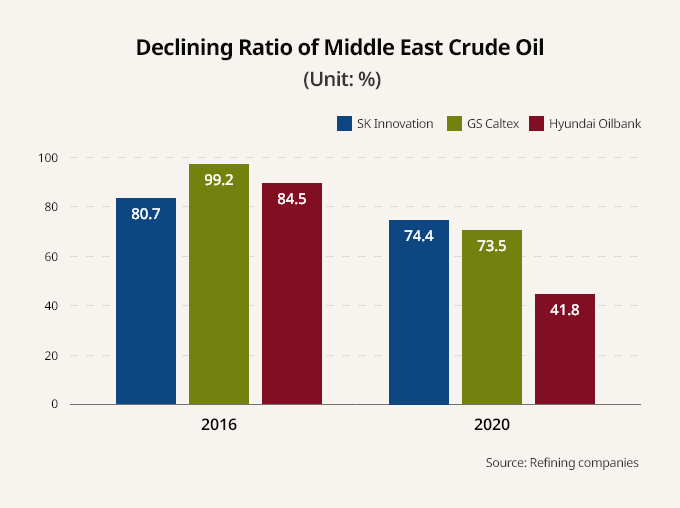

Battling the prolonged demand slump, Korean refiners, led by SK Innovation Co., are going all out to prop up their margins. They have been reducing their dependence on costly Middle East crude oil and switching to imports from Central and South America.

Further, they are opting to process lower-quality heavy crude oil to save import prices, while bolstering high-value products such as lube base oil.

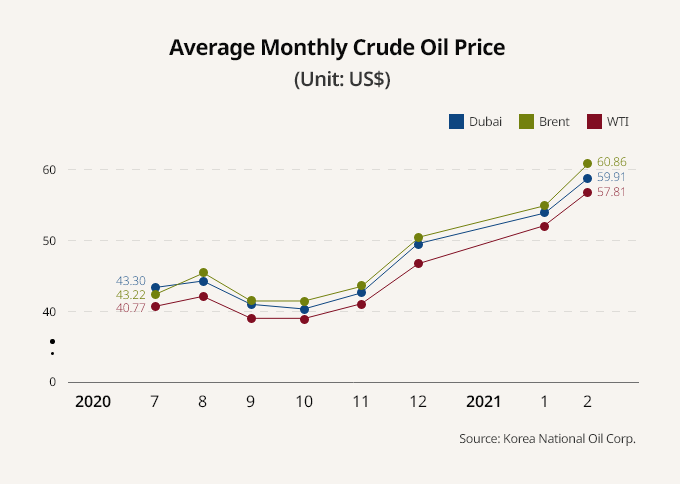

The price of Dubai crude oil, the benchmark price for South Korean refiners, have risen by 23.7% year to date, according to the Korea National Oil Corp. on Feb. 19. They are now quoted at $63.2 per barrel, compared with $51.1 at the end of last year. Brent crude increased by 23.4% during the same period, with the US West Texas Intermediate (WTI) crude up 24.7%.

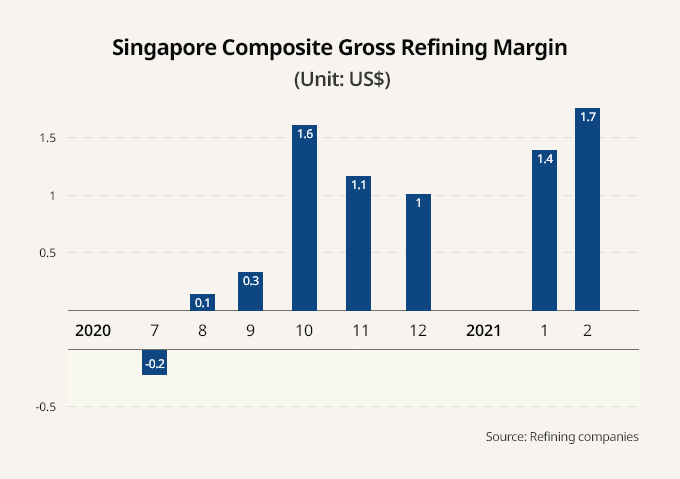

So far this month, the benchmark Singapore gross refining margin has edged up to $1.7 per barrel on average, versus $1.4 in January and $1 in December of last year. Despite the slight increase in the refining margin, it stayed far below the breakeven point for Korean refiners.

“We can make a profit only when the refining margin comes to $4-$5. But it has remained in the $1 range,” said a refining company official.

A crude production cut by Saudi Arabia further worsened the inventory shortages. In January, the world’s largest oil exporter announced a sharp cut in crude production for both February and March in an effort to raise prices. Now Saudi Arabia plans to increase its oil output in the coming months, the Wall Street Journal reported on Wednesday, citing advisers to the kingdom.

“Unless oil demand rebounds sharply to the level of 2019, Korean refiners will unlikely see a significant improvement in their refining margins,” said DB Financial Investment analyst Han Seung-jae.

DIVERSIFYING INTO CHEAPER CRUDE

In search of cheaper crude oil, Hyundai Oilbank Co. has recently imported Castilla Blend, Columbia’s main oil blend. Albeit lower quality, it is more than 10% less expensive than Middle East crude. The company also sharply raised the proportion of Mexico’s Maya crude, which it began importing from 2015.

“We used to sign long-term supply contracts with Middle East crude companies for stable supply, despite their higher prices,” said a Hyundai Oilbank official. “But now we are increasingly opting to sign spot market deals to secure cheaper crude.”

The refiner halved its dependence on Middle East crude to 41.8% last year, from 84.5% in 2016.

Last year, S-Oil Corp. earned 426.3 billion won ($386 million) from its lube base oil sales, although the company as a whole swung to a net loss of 1 trillion won.

The refining companies also chose to process the residues from distilled crude oil into petrochemical products to boost earnings.

“The refinery utilization rate tumbled to a historic low last year, but the heavy oil upgrading facilities were run at full capacity,” said another refinery company official.

Facilities for upgrading heavy oil resources account for 20% to 40% of Korean refiners' facilities.

Write to Jae-Kwang Ahn at ahnjk@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Corporate investmentLG Electronics breaks ground on $600 mn home appliance plant in India

Corporate investmentLG Electronics breaks ground on $600 mn home appliance plant in India10 HOURS AGO

-

-

E-commerceCoupang’s Q1 revenue up; quarterly dip signals rising competition

E-commerceCoupang’s Q1 revenue up; quarterly dip signals rising competitionMay 07, 2025 (Gmt+09:00)

-

Asset managementKorea Investment & Securities deepens global ties with 2nd IR in New York

Asset managementKorea Investment & Securities deepens global ties with 2nd IR in New YorkMay 07, 2025 (Gmt+09:00)

Comment 0

LOG IN